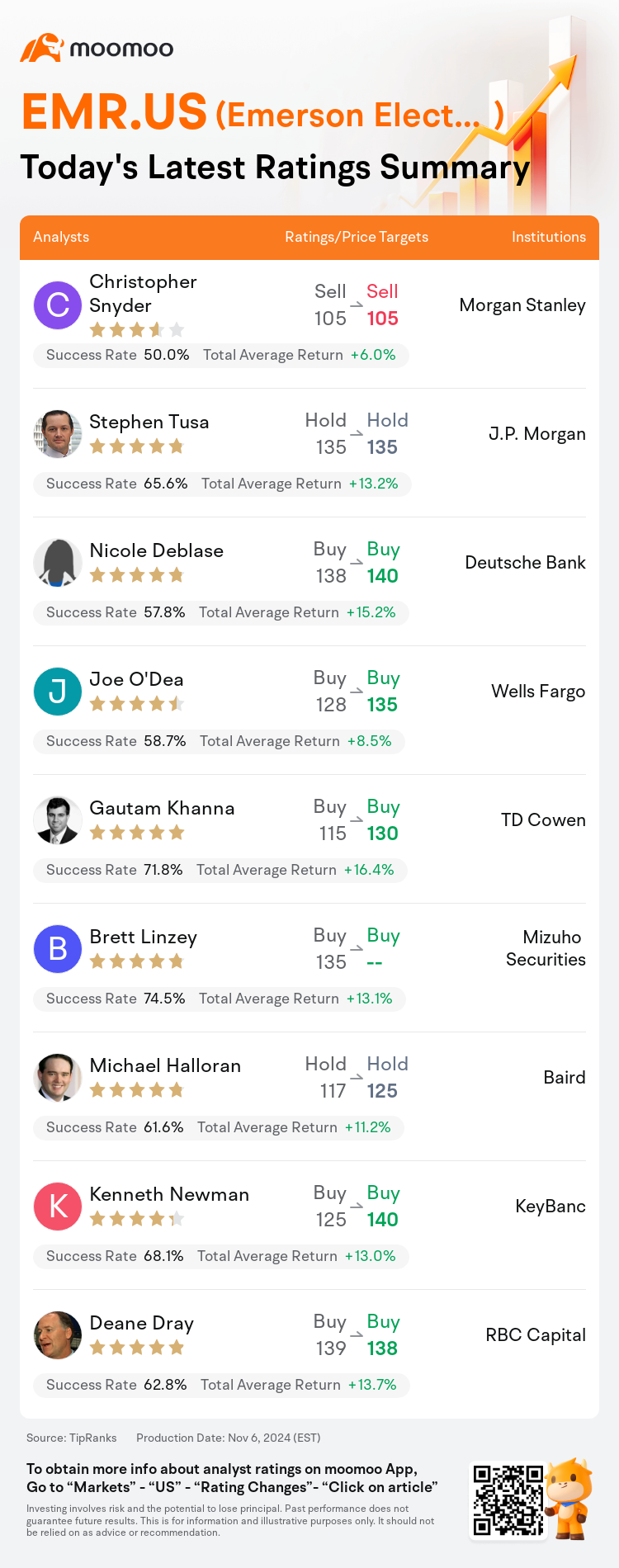

On Nov 06, major Wall Street analysts update their ratings for $Emerson Electric (EMR.US)$, with price targets ranging from $105 to $140.

Morgan Stanley analyst Christopher Snyder maintains with a sell rating, and maintains the target price at $105.

J.P. Morgan analyst Stephen Tusa maintains with a hold rating, and maintains the target price at $135.

Deutsche Bank analyst Nicole Deblase maintains with a buy rating, and adjusts the target price from $138 to $140.

Deutsche Bank analyst Nicole Deblase maintains with a buy rating, and adjusts the target price from $138 to $140.

Wells Fargo analyst Joe O'Dea maintains with a buy rating, and adjusts the target price from $128 to $135.

TD Cowen analyst Gautam Khanna maintains with a buy rating, and adjusts the target price from $115 to $130.

Furthermore, according to the comprehensive report, the opinions of $Emerson Electric (EMR.US)$'s main analysts recently are as follows:

The expectation for Emerson's stock to experience a favorable response is in part due to the completion of the Aspen Technology deal, combined with guidance for Q1 that aligns with forecasts, and current investor sentiment which appears to be skewed negatively.

The observed uptick in Emerson's shares can largely be credited to strategic announcements rather than the modest 3% quarter four core adjusted segment EBITA beat and fiscal 2025 guidance, which was only slightly ahead of consensus. The company has declared three pivotal strategic actions that underscore its evolution into an industrial technology frontrunner with a focus on delivering advanced automation solutions. It is opined that the current stock valuation does not yet mirror the redefined image of Emerson.

The firm has observed that shares outperformed subsequent to the company's Q4 results and the announcement of portfolio transformation initiatives. It has been highlighted by management that growth in FY24 is anticipated to be propelled by Process and Hybrid businesses, despite continued challenges in Discrete end markets. Nevertheless, a positive inflection in Discrete orders during Q4 was noted, and comments from management have suggested optimism that these end markets may have reached a turning point.

The firm noted that Emerson's results slightly surpassed forecasts, showing robust margins accompanied by revenues that were higher than anticipated.

The reorganization of Emerson into a pure-play automation entity is seen as a decisive move towards completing a multi-year transformation, which could lead to a reassessment of the company's value. Solid operational performance in the fourth quarter and a promising outlook for 2025 are also noted.

Here are the latest investment ratings and price targets for $Emerson Electric (EMR.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

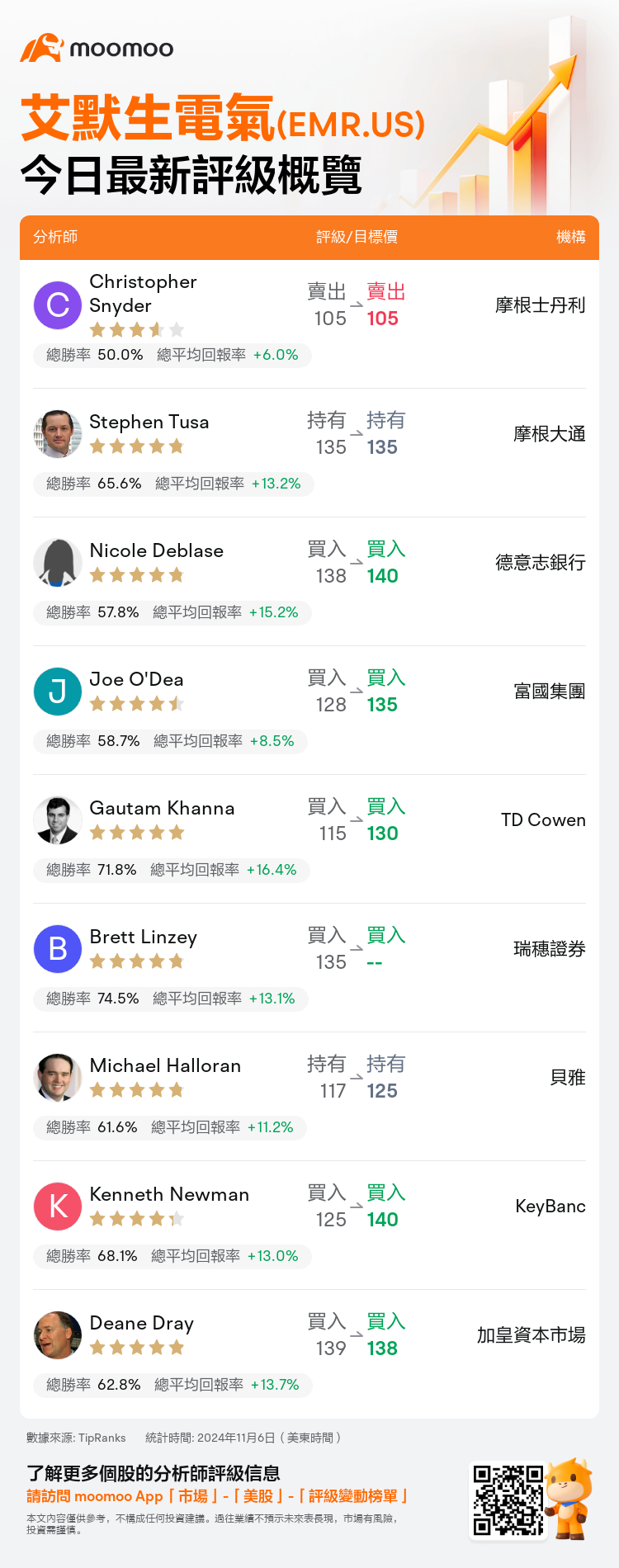

美東時間11月6日,多家華爾街大行更新了$艾默生電氣 (EMR.US)$的評級,目標價介於105美元至140美元。

摩根士丹利分析師Christopher Snyder維持賣出評級,維持目標價105美元。

摩根大通分析師Stephen Tusa維持持有評級,維持目標價135美元。

德意志銀行分析師Nicole Deblase維持買入評級,並將目標價從138美元上調至140美元。

德意志銀行分析師Nicole Deblase維持買入評級,並將目標價從138美元上調至140美元。

富國集團分析師Joe O'Dea維持買入評級,並將目標價從128美元上調至135美元。

TD Cowen分析師Gautam Khanna維持買入評級,並將目標價從115美元上調至130美元。

此外,綜合報道,$艾默生電氣 (EMR.US)$近期主要分析師觀點如下:

對愛文思控股股票預期獲得有利回應的部分原因是與Q1的指引相一致,與預測一致,以及當前投資者情緒似乎出現了負面偏差。

艾默生股票的觀察到的上漲很大程度上要歸功於戰略公告,而不僅僅是季度四核心調整段EBITA增長了3%,和2025財年指引略超出共識。公司宣佈了三項重要的戰略行動,突顯了其發展成爲工業技術領跑者,並專注於提供先進的自動化解決方案。一般認爲當前股價估值尚未反映出艾默生業務轉型爲工業技術的重要形象。

公司注意到股票在Q4業績和組合轉型計劃公告後表現優異。管理層強調,儘管離散終端市場持續面對挑戰,但FY24的增長預計將由過程和混合業務推動。然而,Q4期間離散訂單的積極變化值得注意,並且管理層的評論表明,這些終端市場可能已經觸達拐點。

公司注意到艾默生的業績略超出預期,表現出強勁的利潤率,並伴隨着高於預期的收入。

將艾默生重新組織爲一家純自動化實體被視爲向完成多年轉型邁出的決定性舉措,這可能導致公司價值的重新評估。四季度的良好運營表現和2025年的有希望前景也受到關注。

以下爲今日9位分析師對$艾默生電氣 (EMR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

德意志銀行分析師Nicole Deblase維持買入評級,並將目標價從138美元上調至140美元。

德意志銀行分析師Nicole Deblase維持買入評級,並將目標價從138美元上調至140美元。

Deutsche Bank analyst Nicole Deblase maintains with a buy rating, and adjusts the target price from $138 to $140.

Deutsche Bank analyst Nicole Deblase maintains with a buy rating, and adjusts the target price from $138 to $140.