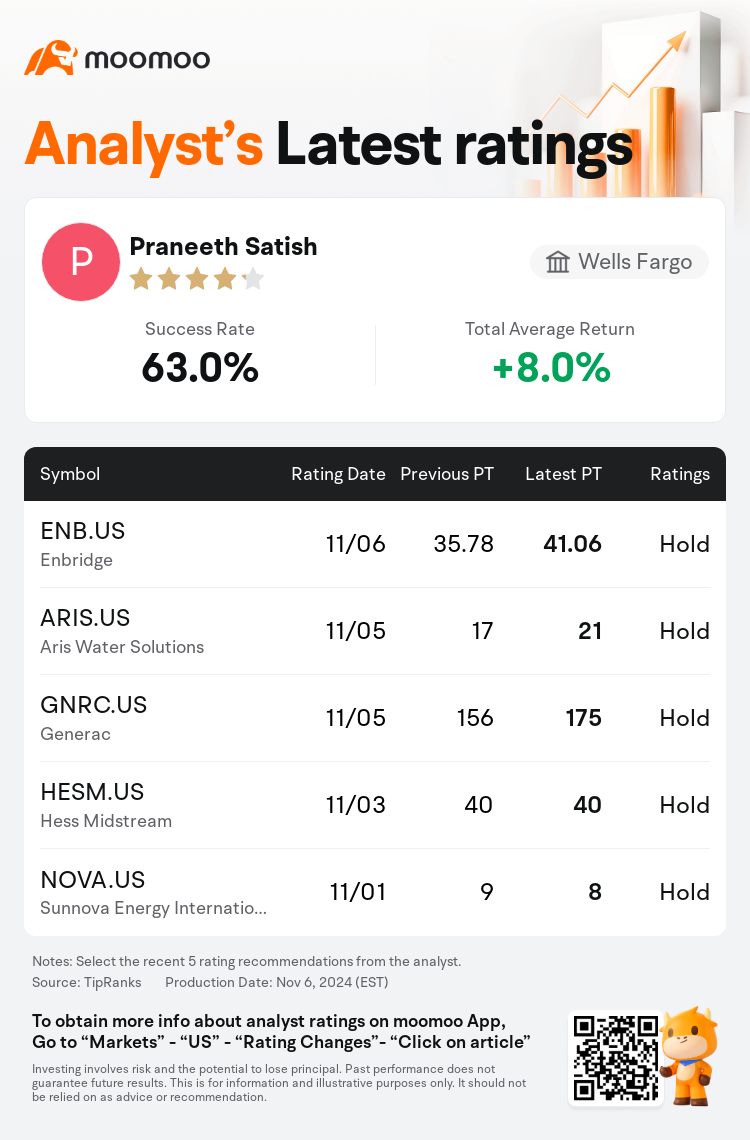

Wells Fargo analyst Praneeth Satish maintains $Aris Water Solutions (ARIS.US)$ with a hold rating, and adjusts the target price from $17 to $21.

According to TipRanks data, the analyst has a success rate of 63.0% and a total average return of 8.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Aris Water Solutions (ARIS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Aris Water Solutions (ARIS.US)$'s main analysts recently are as follows:

Aris Water Solutions' robust Q3 results were underlined by strategic reductions in structural operating expenses and prudent capital expenditure management. These initiatives have bolstered the company's free cash flow and expanded its capital allocation flexibility. The commendable performance in the third quarter, which exceeded expectations and forecasts, reflects the company's positive trajectory. Nonetheless, the stock's significant year-to-date returns, which have greatly surpassed the AMNA Index benchmark, might limit further investor engagement.

Aris Water Solutions' Q3 results surpassed expectations, prompting a more optimistic view of its 2024 EBITDA. The company is seen to remain in a robust position to generate considerable free cash flow and to continue its practice of returning additional capital to its shareholders.

Aris Water Solutions delivered a robust quarter with Q3 results and Q4 projections surpassing the consensus. While acknowledging the company's improved growth outlook reflected in its significant post-quarter share price advancement, the stance remains neutral.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

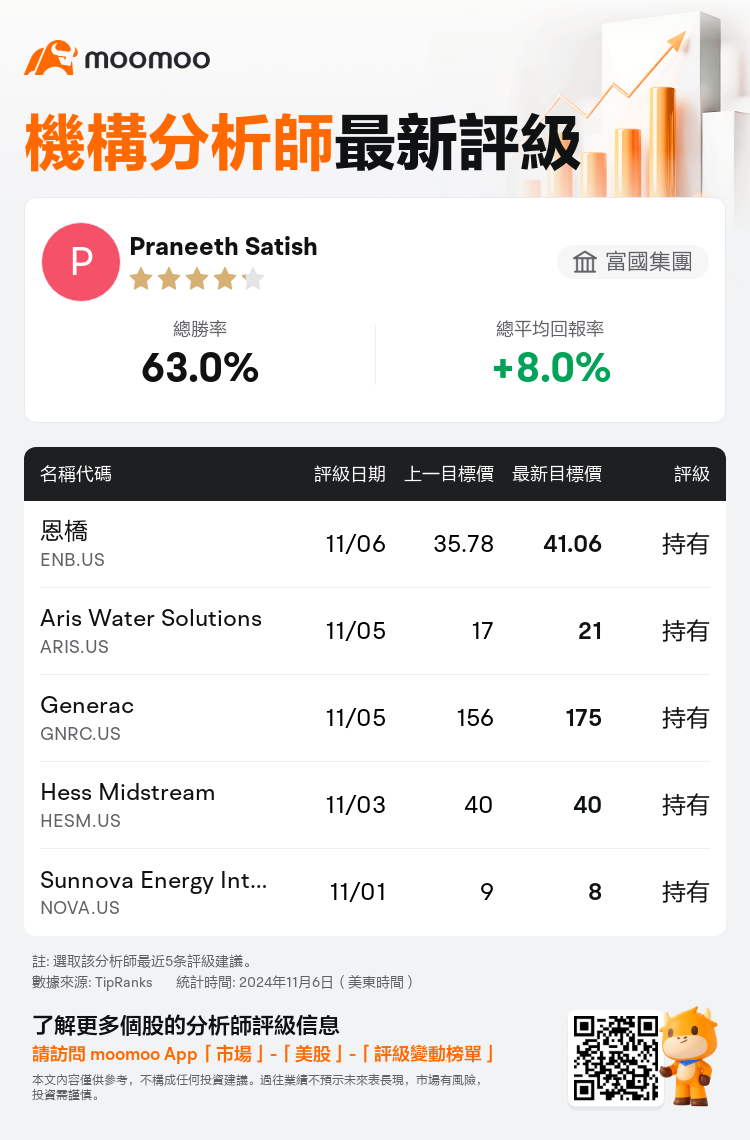

富國集團分析師Praneeth Satish維持$Aris Water Solutions (ARIS.US)$持有評級,並將目標價從17美元上調至21美元。

根據TipRanks數據顯示,該分析師近一年總勝率為63.0%,總平均回報率為8.0%。

此外,綜合報道,$Aris Water Solutions (ARIS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Aris Water Solutions (ARIS.US)$近期主要分析師觀點如下:

Aris Water Solutions強勁的第三季度業績得益於對結構性營業費用的戰略性削減和審慎的資本支出管理。這些舉措增強了公司的自由現金流,擴大了資本配置的靈活性。第三季度表現可圈可點,超出了預期和預測,反映了公司的積極發展軌跡。然而,股票今年以來顯著的回報,大大超過了AMNA指數基準,可能會限制投資者進一步參與。

Aris Water Solutions的第三季度業績超出預期,促使更樂觀地看待公司2024年EBITDA。公司被視爲保持強勁地位,能夠產生可觀的自由現金流,並繼續向股東返還額外資本。

Aris Water Solutions在第三季度業績和第四季度預測方面表現強勁,超出共識。儘管承認公司在業績後股價上漲方面表現良好,仍保持中立立場。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Aris Water Solutions (ARIS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Aris Water Solutions (ARIS.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of