Top 3 Industrials Stocks That Could Blast Off In Q4

Top 3 Industrials Stocks That Could Blast Off In Q4

第四季度可能起飛的前三家工業股票

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

工業板塊中超賣次數最多的股票爲買入被低估的公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI是一個動量指標,它比較股票在價格上漲的日子裏的走強與價格下跌的日子的走強。與股票的價格走勢相比,它可以讓交易者更好地了解股票在短期內的表現。根據Benzinga Pro的數據,當相對強弱指數低於30時,資產通常被視爲超賣。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該行業主要超賣參與者的最新名單,RSI接近或低於30。

Verra Mobility Corp (NASDAQ:VRRM)

Verra Mobility Corp(納斯達克股票代碼:VRRM)

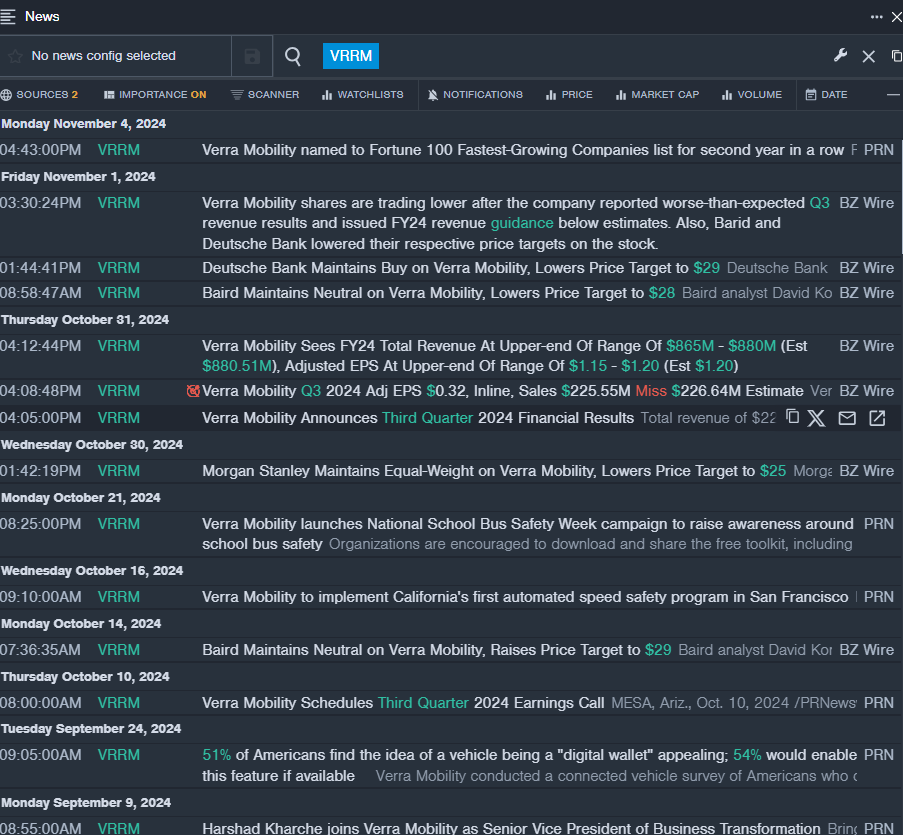

- On Oct. 31, Verra Mobility reported worse-than-expected third-quarter revenue results and issued FY24 revenue guidance below estimates. "We delivered a solid third quarter, highlighted by strong revenue, earnings, and cash flow generation," said David Roberts, President and CEO, Verra Mobility. The company's stock fell around 12% over the past five days and has a 52-week low of $18.76.

- RSI Value: 27.83

- VRRM Price Action: Shares of Verra Mobility gained 1.4% to close at $23.12 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest VRRM news.

- 10月31日,Verra Mobility公佈的第三季度收入業績低於預期,併發布的24財年收入指引低於預期。Verra Mobility總裁兼首席執行官戴維·羅伯茨表示:“我們實現了穩健的第三季度業績,這體現在強勁的收入、收益和現金流創造上。該公司的股票在過去五天中下跌了約12%,跌至52周低點18.76美元。

- RSI 值:27.83

- vRRM價格走勢:週二,Verra Mobility的股價上漲1.4%,收於23.12美元。

- Benzinga Pro 的實時新聞提醒注意最新的 vRRM 新聞。

Huntington Ingalls Industries Inc (NYSE:HII)

亨廷頓英格爾斯工業公司(紐約證券交易所代碼:HII)

- On Oct. 31, Huntington Ingalls Industries reported worse-than-expected third-quarter financial results. It also revised FY24 revenue outlook and withdrew 5-year free cash flow outlook. The company's stock fell around 24% over the past five days and has a 52-week low of $184.29.

- RSI Value: 20.66

- HII Price Action: Shares of Huntington Ingalls rose 1.2% to close at $193.24 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in HII stock.

- 10月31日,亨廷頓英格爾斯工業公司公佈的第三季度財務業績低於預期。它還修訂了24財年的收入展望,並撤回了5年自由現金流展望。該公司的股票在過去五天中下跌了約24%,跌至52周低點184.29美元。

- RSI 值:20.66

- HII價格走勢:亨廷頓英格爾斯股價週二上漲1.2%,收於193.24美元。

- Benzinga Pro的圖表工具幫助確定了HII股票的走勢。

Janus International Group Inc (NYSE:JBI)

駿利國際集團公司(紐約證券交易所代碼:JBI)

- On Oct. 29, Janus International Group reported worse-than-expected third-quarter financial results and cut its FY24 sales guidance below estimates. "We saw continued pressure in the third quarter as headwinds from macroeconomic factors, interest rate uncertainty and project delays persisted," said Ramey Jackson, Chief Executive Officer. The company's stock fell around 28% over the past month and has a 52-week low of $6.68.

- RSI Value: 20.90

- JBI Price Action: Shares of Janus International Group fell 0.3% to close at $7.02 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in JBI shares.

- 10月29日,駿利國際集團公佈的第三季度財務業績低於預期,並將24財年的銷售預期下調至低於預期。首席執行官拉米·傑克遜表示:「由於宏觀經濟因素、利率不確定性和項目延誤的不利因素持續存在,我們在第三季度看到了持續的壓力。」該公司的股票在過去一個月中下跌了約28%,跌至52周低點6.68美元。

- RSI 值:20.90

- JBI價格走勢:週二,駿利國際集團股價下跌0.3%,收於7.02美元。

- Benzinga Pro的信號功能被告知JBI股票可能出現突破。

Read More:

閱讀更多:

- Jim Cramer Says He Can't Recommend This Major Automaker, Ceva Is 'Way Too High'

- 吉姆·克萊默說他不能推薦這家大型汽車製造商,Ceva 「太高了」