Decoding NIO's Options Activity: What's the Big Picture?

Decoding NIO's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on NIO (NYSE:NIO), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in NIO often signals that someone has privileged information.

高額投資者已將自己定位爲看好蔚來(紐約證券交易所代碼:NIO),散戶交易者注意這一點很重要。\ 這項活動今天通過Benzinga對公開期權數據的追蹤引起了我們的注意。這些投資者的身份尚不確定,但是蔚來汽車的如此重大舉動通常表明有人擁有特權信息。

Today, Benzinga's options scanner spotted 19 options trades for NIO. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現了NIO的19筆期權交易。這不是典型的模式。

The sentiment among these major traders is split, with 89% bullish and 5% bearish. Among all the options we identified, there was one put, amounting to $56,202, and 18 calls, totaling $1,532,034.

這些主要交易者的情緒分歧,89%看漲,5%看跌。在我們確定的所有期權中,有一個看跌期權,金額爲56,202美元,還有18個看漲期權,總額爲1,532,034美元。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將NIO的價格定在3.0美元至17.0美元之間。

Volume & Open Interest Development

交易量和未平倉合約的發展

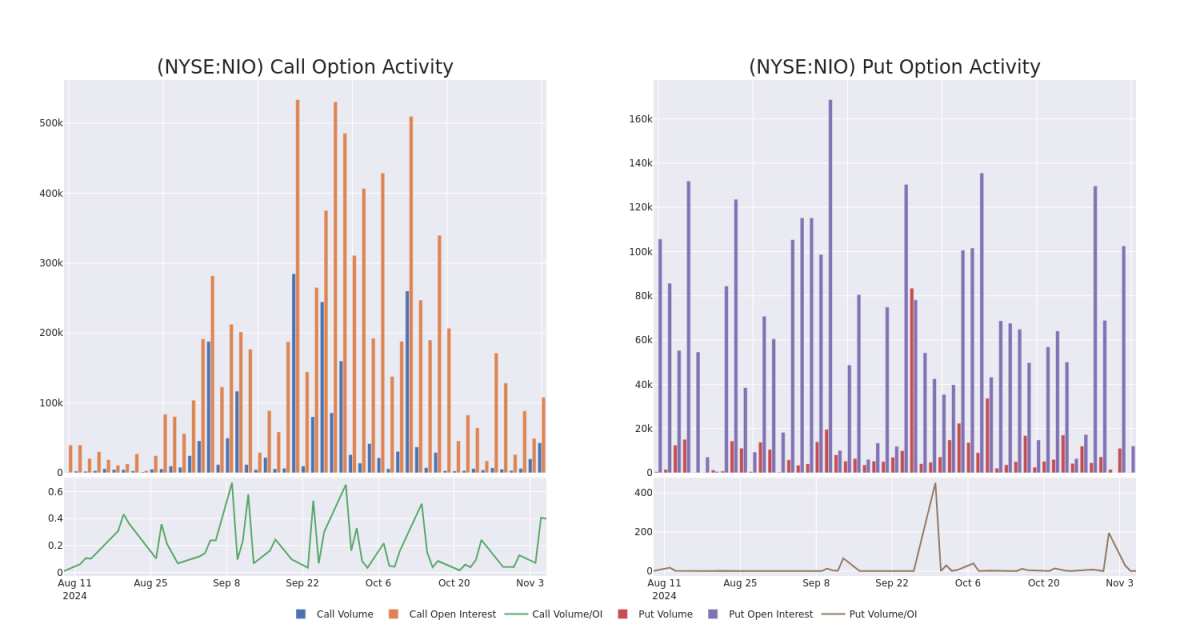

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for NIO's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NIO's whale trades within a strike price range from $3.0 to $17.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤NIO期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內蔚來所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在3.0美元至17.0美元之間。

NIO Option Volume And Open Interest Over Last 30 Days

過去 30 天的 NIO 期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $2.33 | $1.85 | $2.33 | $5.00 | $233.4K | 45.6K | 1.1K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $0.43 | $0.43 | $0.43 | $17.00 | $225.7K | 13.1K | 5.2K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.78 | $1.75 | $1.78 | $5.00 | $151.1K | 45.6K | 6.3K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.78 | $1.75 | $1.77 | $5.00 | $146.9K | 45.6K | 5.3K |

| NIO | CALL | SWEEP | BULLISH | 01/16/26 | $1.77 | $1.77 | $1.77 | $5.00 | $107.5K | 45.6K | 3.2K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 不是 | 打電話 | 掃 | 看漲 | 01/16/26 | 2.33 美元 | 1.85 | 2.33 美元 | 5.00 美元 | 233.4 萬美元 | 45.6K | 1.1K |

| 沒有 | 打電話 | 掃 | 看漲 | 01/16/26 | 0.43 美元 | 0.43 美元 | 0.43 美元 | 17.00 美元 | 225.7 萬美元 | 13.1K | 5.2K |

| 沒有 | 打電話 | 掃 | 看漲 | 01/16/26 | 1.78 美元 | 1.75 美元 | 1.78 美元 | 5.00 美元 | 151.1 萬美元 | 45.6K | 6.3K |

| 沒有 | 打電話 | 掃 | 看漲 | 01/16/26 | 1.78 美元 | 1.75 美元 | 1.77 | 5.00 美元 | 146.9 萬美元 | 45.6K | 5.3K |

| 沒有 | 打電話 | 掃 | 看漲 | 01/16/26 | 1.77 美元 | 1.77 美元 | 1.77 美元 | 5.00 美元 | 107.5 萬美元 | 45.6K | 3.2K |

About NIO

關於蔚來

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

Nio是領先的電動汽車製造商,目標是高端市場。Nio 成立於 2014 年 11 月,設計、開發、聯合制造和銷售優質智能電動汽車。該公司通過持續的技術突破和創新(例如電池交換和自動駕駛技術)脫穎而出。蔚來於2017年12月推出了其首款車型,即ES8七座電動SUV,並於2018年6月開始交付。其目前的車型組合包括中型到大型轎車和越野車。它在2023年售出了超過16萬輛電動汽車,約佔中國乘用新能源汽車市場的2%。

Having examined the options trading patterns of NIO, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了蔚來的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Where Is NIO Standing Right Now?

NIO 現在的立場在哪裏?

- Trading volume stands at 64,729,005, with NIO's price down by -5.11%, positioned at $5.01.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 27 days.

- 交易量爲64,729,005美元,蔚來汽車的價格下跌了-5.11%,至5.01美元。

- RSI指標顯示該股可能接近超賣。

- 預計將在27天內公佈業績。

What The Experts Say On NIO

專家對蔚來汽車的看法

1 market experts have recently issued ratings for this stock, with a consensus target price of $6.6.

1位市場專家最近發佈了該股的評級,共識目標價爲6.6美元。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Macquarie upgraded its action to Outperform with a price target of $6.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處查看。* 麥格理的一位分析師將其行動上調至跑贏大盤,目標股價爲6美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $17.0 for NIO over the last 3 months.