- 要聞

- 每日跳空排名 星期三:CVS、SAN、COF等

Top Gap Ups and Downs on Wednesday: COIN, CVS, ENPH and More

Top Gap Ups and Downs on Wednesday: COIN, CVS, ENPH and More

Welcome to the Daily Gap column!

In the realm of technical analysis, gaps are often viewed as critical indicators of potential price movements. Particularly those that emerge at market open, these gaps can signify dramatic shifts in market sentiment. The directionality of these gaps provides traders with insights into short-term trends, allowing them to develop corresponding trading strategies.

Here is the showcase of the top 10 stocks with the largest gap sizes as of yesterday's close. The "Gap %chg" metric indicates the magnitude of these gaps, with all included stocks reaching a market capitalization of $5 billion.

Additionally, we highlight stocks that have exhibited the longest streak of consecutive gaps in either up or down direction over the past 250 trading days. These stocks are also filtered with the same market capitalization criterion.

Additionally, we highlight stocks that have exhibited the longest streak of consecutive gaps in either up or down direction over the past 250 trading days. These stocks are also filtered with the same market capitalization criterion.

Technical traders believe that gaps can provide directional clues, but the accuracy of a single indicator is not sufficient to predict stock movements. Investors still need to incorporate various factors, including board market sentiment, company fundamental factors, technical indicators, and so on.

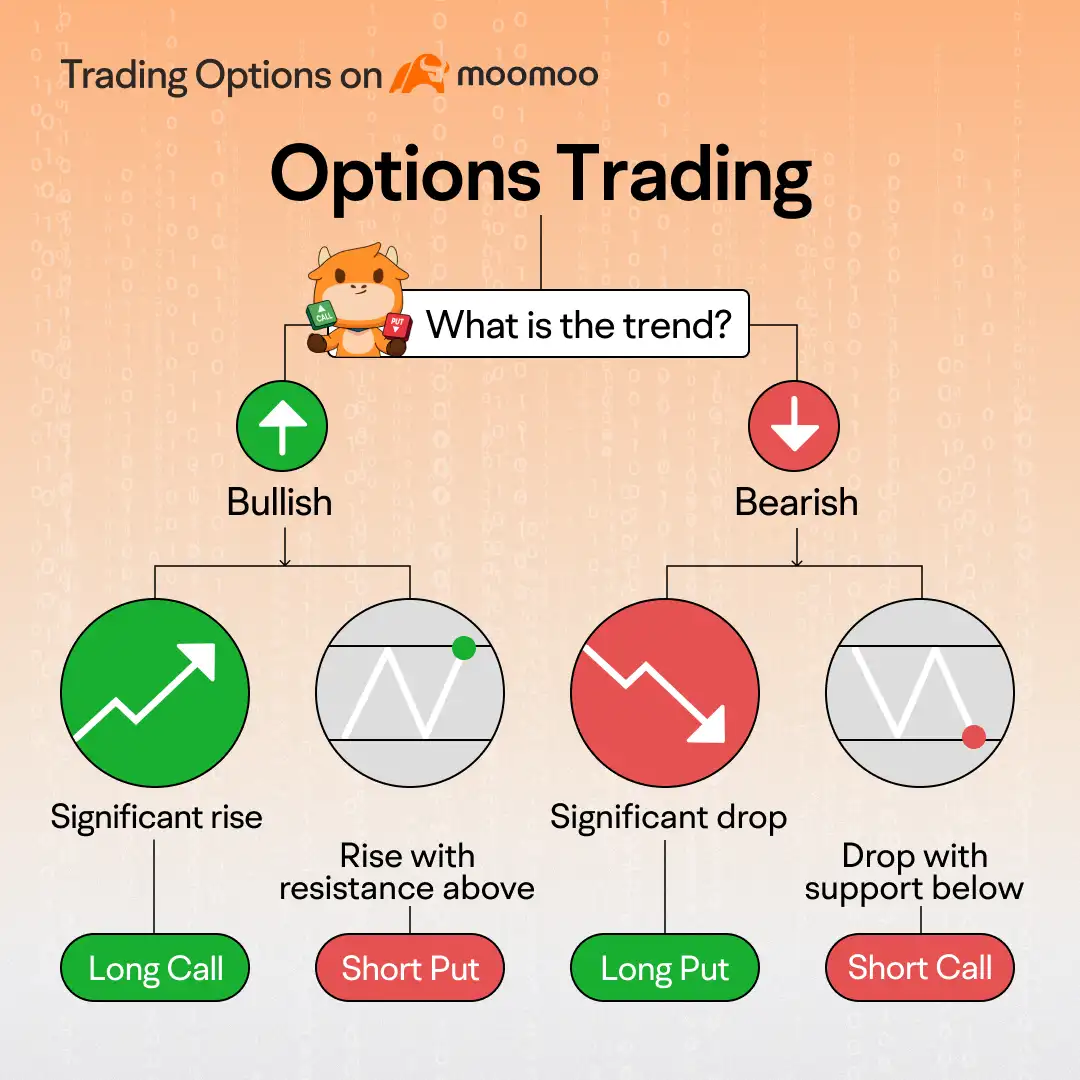

Options strategies can be an effective way to capitalize on anticipated price movements in different trending scenarios.

For investors optimistic about a stock's upward trajectory, some commonly utilized options strategies include the Long Call, the Bull Call Spread, and the Cash-Secured Put, each with different risk levels.

The Long Call involves purchasing a call option, limiting risk to the premium paid while offering potentially unlimited profit if the stock rises. The Bull Call Spread is a more conservative approach, where investors buy a call at a lower strike and sell another at a higher strike, reducing costs and capping both gains and losses. Alternatively, the Cash-Secured Put involves selling a put option while holding enough cash to buy the stock at the strike price if assigned, allowing investors to potentially acquire the stock at a discount while generating premium income.

For investors anticipating a downward trend in a stock, several options strategies can be employed, each with varying risk levels.

The Long Put strategy involves purchasing a put option, granting the right to sell the stock at a specified strike price before expiration. This strategy offers significant profit potential if the stock price declines, with risk limited to the premium paid for the option. The Bull Put Spread combines selling a put option at a higher strike price while simultaneously buying another put option at a lower strike price, allowing traders to collect premium income while capping potential losses, thus providing a more balanced risk-reward profile. Another strategy is the Short Call, where an investor sells a call option, obligating them to sell the stock at the strike price if the option is exercised. While this can yield profits if the stock price falls, it carries unlimited risk if the stock rises sharply, making it more suitable for experienced traders who can manage the associated risks effectively.

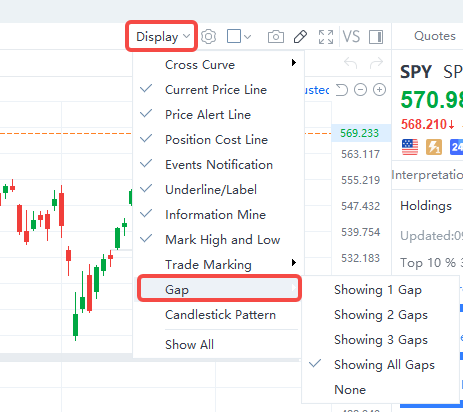

What are gaps?

Price charts sometimes have blank spaces known as gaps (up gaps and down gaps), where the price of a stock moves sharply up or down, with little or no shares traded in between. This is why the asset's chart shows a gap in the normal price pattern. Normally this occurs between the close of the market on one day and the next day's open.

For an up gap, the low price of the day must be higher than the high price of the previous day. A down gap is just the opposite of an up gap.

Gaps can show signals that something important has happened to the fundamental or the psychology of traders that accompanies this market movement.

For example, if an unexpectedly high earnings report comes out after the market has closed for the day, a lot of buying interest could be generated overnight, leading to an imbalance between supply and demand. When the market opens the next morning, the stock price will likely rise in response to the increased demand from buyers. If the stock price remains above the previous day's high throughout the day, then an up gap is formed.

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.moomoo.com/017y9J) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

什麽是缺口?

缺口是指股價在快速大幅變動中有一段價格沒有任何交易,顯示在股價趨勢圖上是一個真空區域,這個區域稱之「缺口」,通常又稱為跳空。K線圖中的缺口是指由於受到利好或者利空消息的影響,股價大幅上漲或者大幅下跌,導致日K線圖出現當日最低價超過前一交易日最高價或者當日最高價低於前一交易日最低價的圖形形態的一種現象。

缺口是指股價在快速大幅變動中有一段價格沒有任何交易,顯示在股價趨勢圖上是一個真空區域,這個區域稱之「缺口」,通常又稱為跳空。K線圖中的缺口是指由於受到利好或者利空消息的影響,股價大幅上漲或者大幅下跌,導致日K線圖出現當日最低價超過前一交易日最高價或者當日最高價低於前一交易日最低價的圖形形態的一種現象。

對於上漲缺口,當天的最低價必須高於前一天的最高價;向下的缺口正好與向上的缺口相反。

隨著市場的走勢,缺口的產生在一定程度上表明了交易員對基本面或消息面的一致性看法。

例如,如果在當天市場收盤後,一份出乎意料的亮眼報告出爐,一夜之間就會產生大量的購買興趣,導致供需失衡;當第二天早上市場開盤時,股票價格會隨著買家需求的增加而上漲;如果股票價格一整天都高於前一天的高點,那麽就形成了一個向上的缺口。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧