Brokers Are Upgrading Their Views On Shengda Resources Co.,Ltd. (SZSE:000603) With These New Forecasts

Brokers Are Upgrading Their Views On Shengda Resources Co.,Ltd. (SZSE:000603) With These New Forecasts

Shengda Resources Co.,Ltd. (SZSE:000603) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The stock price has risen 7.7% to CN¥14.63 over the past week, suggesting investors are becoming more optimistic. Could this big upgrade push the stock even higher?

盛達資源股份有限公司(SZSE:000603)的股東們今天將有理由微笑,分析師們對今年的預測進行了實質性的升級。分析師們大幅提高了他們的營業收入預期,表明業務基本面有顯著改善。上週股價上漲了7.7%,達到了人民幣14.63元,暗示投資者變得更加樂觀。這次大幅升級能將股票推高嗎?

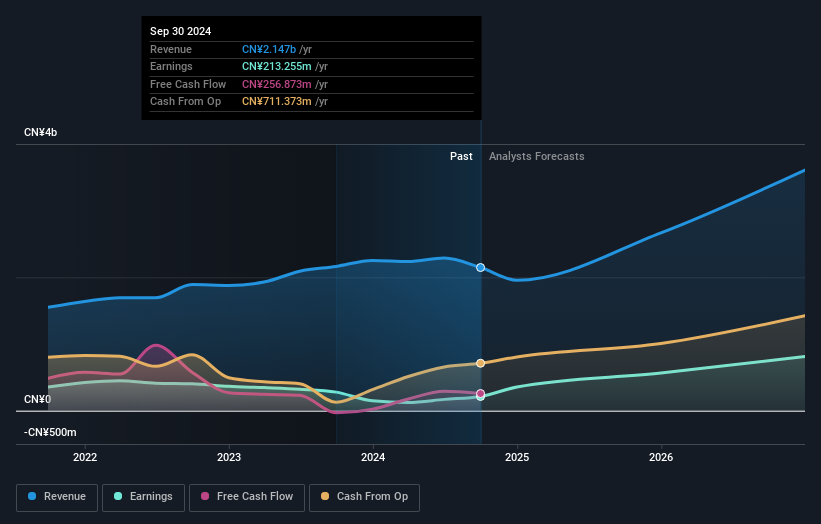

Following the latest upgrade, the current consensus, from the three analysts covering Shengda ResourcesLtd, is for revenues of CN¥2.0b in 2024, which would reflect a definite 8.9% reduction in Shengda ResourcesLtd's sales over the past 12 months. Statutory earnings per share are presumed to soar 86% to CN¥0.58. Before this latest update, the analysts had been forecasting revenues of CN¥1.7b and earnings per share (EPS) of CN¥0.52 in 2024. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

在最新的升級之後,覆蓋盛達資源有限公司的三名分析師目前達成共識,預計2024年的營業收入爲20億人民幣,這將反映盛達資源有限公司過去12個月銷售額明顯減少了8.9%。法定每股收益被預計將飆升86%至0.58元人民幣。在此最新更新之前,分析師們預測2024年的營業收入爲17億人民幣,每股收益(EPS)爲0.52元人民幣。因此,我們可以看到最近一段時間分析師情緒明顯上升,最新預測顯示營業收入和每股收益都得到了可觀的提升。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One more thing stood out to us about these estimates, and it's the idea that Shengda ResourcesLtd's decline is expected to accelerate, with revenues forecast to fall at an annualised rate of 8.9% to the end of 2024. This tops off a historical decline of 1.2% a year over the past five years. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 10% annually. So it's pretty clear that, while it does have declining revenues, the analysts also expect Shengda ResourcesLtd to suffer worse than the wider industry.

現在從宏觀角度來看,我們理解這些預測的一種方式是將它們與過去的表現和行業增長預期進行對比。關於這些預測,我們還注意到一個問題,即盛達資源有限公司的下滑預計將加速,市場預測營業收入將以每年8.9%的年增長率下降至2024年底。這是五年來每年曆史性下滑1.2%的最新數據。將這與更廣泛行業公司的分析師預測進行比較,這些預測表明,預計(總體上)行業收入每年將增長10%。因此,顯然,雖然營業收入在下降,但分析師們也預期盛達資源有限公司的狀況將比整個行業差。

The Bottom Line

最重要的事情是分析師增加了它對下一年每股虧損的估計。令人欣慰的是,營收預測未發生重大變化,業務仍有望比整個行業增長更快。共識價格目標穩定在28.50美元,最新估計不足以對價格目標產生影響。

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. With a serious upgrade to expectations, it might be time to take another look at Shengda ResourcesLtd.

從這些新預測中,我們最大的收穫是分析師們升級了他們的每股收益預期,預計今年的盈利能力將有所改善。令人愉悅的是,分析師還提高了他們的營業收入預期,他們的預測表明該業務預計增速將低於更廣泛市場。隨着預期的嚴重升級,現在或許是再次審視盛達資源有限公司的時候了。

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Shengda ResourcesLtd analysts - going out to 2026, and you can see them free on our platform here.

然而,業務的長期前景比明年的收益更爲重要。我們有來自多位盛達資源有限公司分析師的預測數據,一直延伸到2026年,您可以在我們的平台上免費查看。

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies backed by insiders.

跟蹤管理層是購買還是銷售,是尋找可能達到關鍵點的有趣公司的另一種方法,我們的免費公司列表由內部支持的增長公司組成。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. With a serious upgrade to expectations, it might be time to take another look at Shengda ResourcesLtd.

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. With a serious upgrade to expectations, it might be time to take another look at Shengda ResourcesLtd.