We Think You Should Be Aware Of Some Concerning Factors In Huafu Fashion's (SZSE:002042) Earnings

We Think You Should Be Aware Of Some Concerning Factors In Huafu Fashion's (SZSE:002042) Earnings

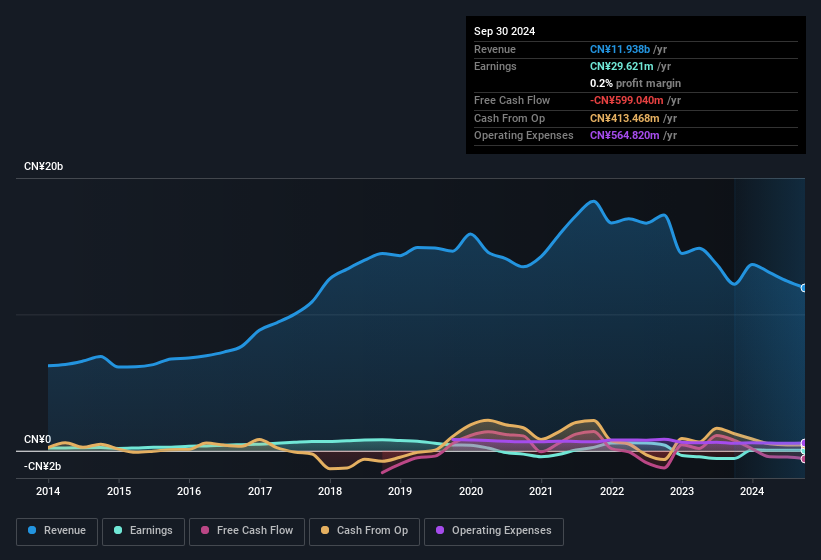

The market for Huafu Fashion Co., Ltd.'s (SZSE:002042) stock was strong after it released a healthy earnings report last week. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

華孚時尚股份有限公司(SZSE:002042)的股票市場在上週發佈健康收益報告後表現強勁。然而,我們認爲股東們應該保持謹慎,因爲我們發現了一些潛在利潤下的令人擔憂的因素。

How Do Unusual Items Influence Profit?

非常規項目如何影響利潤?

Importantly, our data indicates that Huafu Fashion's profit received a boost of CN¥370m in unusual items, over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. Huafu Fashion had a rather significant contribution from unusual items relative to its profit to September 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

重要的是,我們的數據顯示,華孚時尚的利潤在過去一年中由飛凡項目獲得了37000萬元人民幣的提振。雖然我們喜歡看到利潤增加,但我們在飛凡項目大幅貢獻時往往更爲謹慎。我們對全球大多數上市公司進行了統計,發現飛凡項目很常見且一次性。而且,歸根結底,這正是會計術語的意思。相對於其2024年9月的利潤,華孚時尚從飛凡項目中獲得了相當大的貢獻。因此,我們可以推斷出飛凡項目使其法定利潤比其本來更爲強勁。

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

這可能會讓您想知道分析師對未來盈利能力的預測。幸運的是,您可以單擊此處查看基於其估計的未來盈利能力的互動圖表。

Our Take On Huafu Fashion's Profit Performance

我們對華孚時尚的利潤表現的看法

As we discussed above, we think the significant positive unusual item makes Huafu Fashion's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Huafu Fashion's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Huafu Fashion has 2 warning signs (1 shouldn't be ignored!) that deserve your attention before going any further with your analysis.

正如我們之前討論的那樣,我們認爲顯著的正面飛凡項對華孚時尚的收入並不是其潛在盈利能力的良好指標。因此,我們認爲華孚時尚的潛在盈利能力很可能比其法定利潤低。好消息是,儘管之前虧損,但它在過去十二個月實現了盈利。本文的目標是評估我們可以依靠法定收益如何反映公司潛力,但還有很多要考慮的因素。請記住,在分析股票時,值得注意涉及的風險。例如,我們發現華孚時尚有2個警示信號(1個不容忽視!)在進行進一步分析之前,這值得您關注。

Today we've zoomed in on a single data point to better understand the nature of Huafu Fashion's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

今天,我們已經仔細研究了一個數據點,以更好地了解華孚時尚盈利的性質。但還有很多其他方法可以幫助您了解一家公司。有些人認爲股東權益回報率高是優質公司的一個良好跡象。因此,您可能希望查看這個免費收集的公司,這些公司具有高股東權益回報率,或者這個高內部持股的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

As we discussed above, we think the significant positive unusual item makes Huafu Fashion's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Huafu Fashion's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Huafu Fashion has

As we discussed above, we think the significant positive unusual item makes Huafu Fashion's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that Huafu Fashion's underlying earnings power is lower than its statutory profit. The good news is that it earned a profit in the last twelve months, despite its previous loss. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've found that Huafu Fashion has