Market Mover | Qualcomm Shares Jump More than 7% Post-Market as Profits Surge by Over 30% Last Quarter

Market Mover | Qualcomm Shares Jump More than 7% Post-Market as Profits Surge by Over 30% Last Quarter

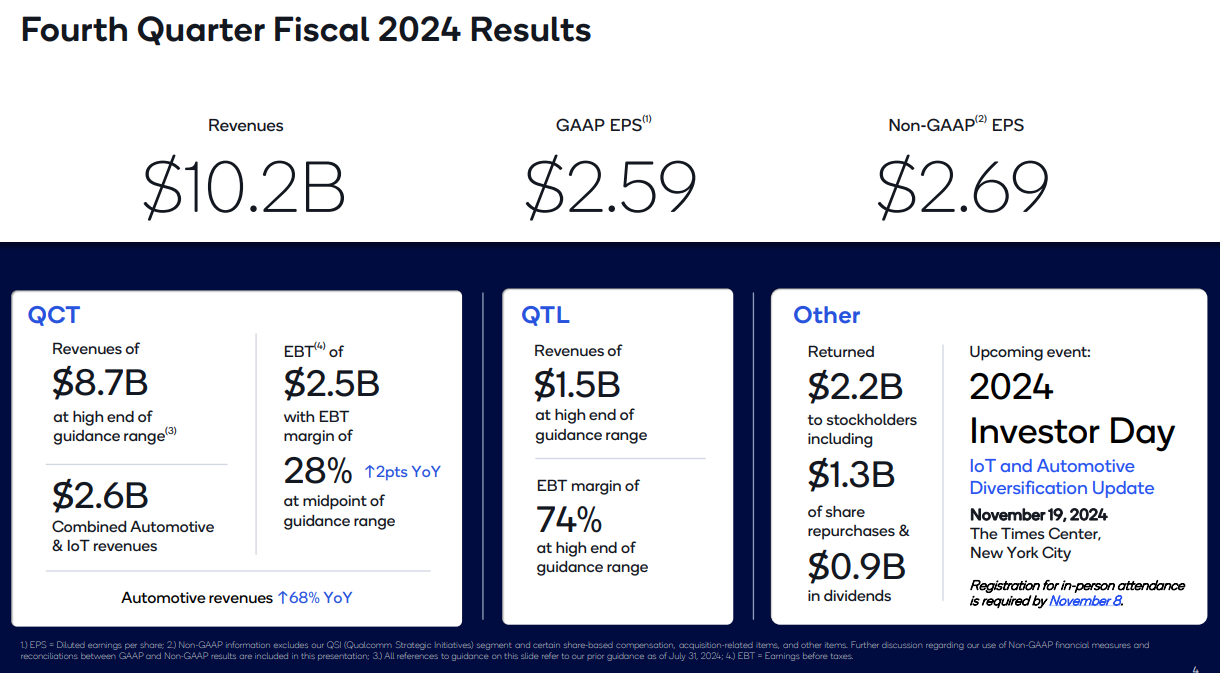

November 6, 2024 - $Qualcomm (QCOM.US)$ shares surged 7.10% to $185.27 in post-market trading on Wednesday. It announced results for its fiscal fourth quarter and year ended September 29, 2024. “We are pleased to conclude the fiscal year with strong results in the fourth quarter, delivering greater than 30% year-over-year growth in EPS,” said Cristiano Amon, President and CEO of Qualcomm Incorporated. “We are excited about our recent product announcements at Snapdragon Summit and Embedded World, as they continue to extend our technology leadership and position us well across Handsets, PC, Automotive and Industrial IoT. ”

2024年11月6日 - $高通 (QCOM.US)$ 高通股價在週三的美股盤後交易中大漲7.10%,至185.27美元。它宣佈截至2024年9月29日的財政第四季度和全年業績。高通公司總裁兼首席執行官Cristiano Amon表示:「我們很高興以第四季度強勁業績收官,每股收益同比增長超過30%。」「我們對在驍龍峯會和嵌入式世界上近期的產品發佈感到興奮,因爲它們繼續擴展了我們的科技領先地位,並使我們在手持設備、個人電腦、汽車和工業物聯網領域處於更有利的位置。」

Highlight

突出

Fiscal 2024 GAAP Revenues: $39.0 billion

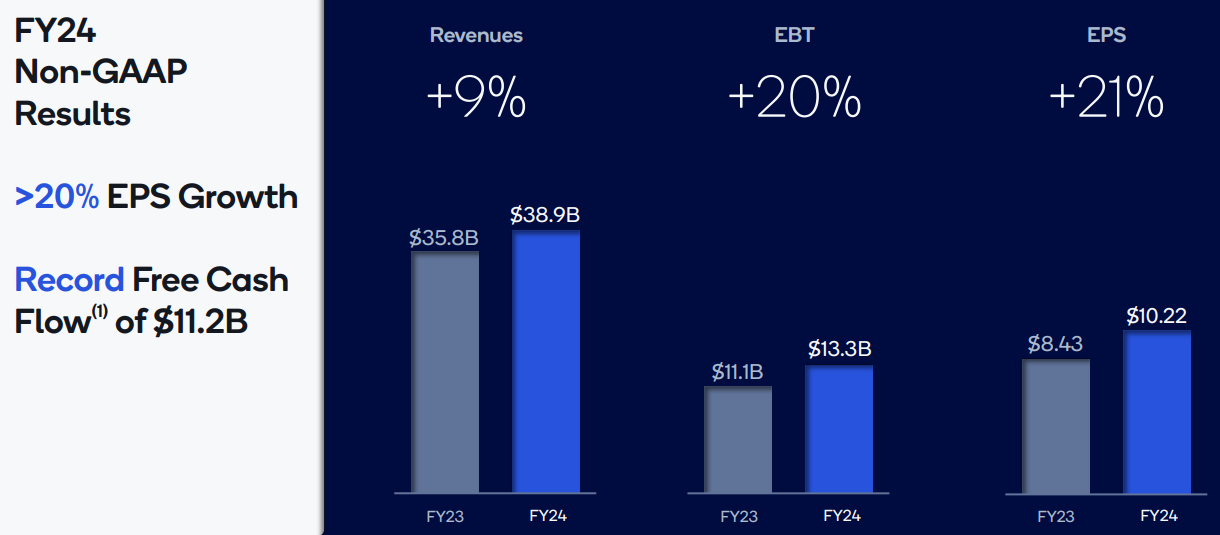

Fiscal 2024 GAAP EPS: $8.97, Non-GAAP EPS: $10.22

Greater Than 20% Growth in Fiscal Year EPS

Record Fiscal Year Operating Cash Flow

QCT Automotive: 5th Consecutive Record Quarterly Revenues

2024財年GAAP營業收入:390億美元

2024財年GAAP每股收益:8.97美元,非GAAP每股收益:10.22美元

財年每股收益增長超過20%

創紀錄的財年經營現金流

駿途汽車:第五個連續創紀錄季度營收

Buyback

回購

Building on the stock buyback plan announced in October 2021, the board has approved a new $15 billion stock buyback authorization with no expiration date. As of the end of fiscal year 2024, there remains $1 billion of unused authorization from the previous buyback plan.

繼2021年10月宣佈的股票回購計劃之後,董事會批准了一項新的150億美元的股票回購授權,並且沒有到期日期。截至2024財年結束時,之前回購計劃中剩餘10億美元未使用的授權金額。

Strong Growth Across Qualcomm's Divisions

高通各板塊均實現強勁增長

Qualcomm's third-quarter financials exceeded expectations with a 19% increase in overall revenue and a 33% rise in EPS, surpassing analyst predictions of 14.4% and 27.2% growth rates, respectively. The mobile chip sector, a primary revenue driver, posted $6.1 billion, up 12% from last year and ahead of the $6 billion forecast. For fiscal 2024, total revenue hit $33.19 billion, up 9%, fueled by a 40% surge in Android phone sales in China. The automotive chip sector saw a significant 68% increase to $899 million, markedly above the $816 million expected, marking five consecutive quarters of growth. IoT chip revenue also outperformed, reaching $1.68 billion, a 22% increase.

高通第三季度的財務數據超出預期,整體營業收入增長19%,每股收益增長33%,分別超過分析師對應的14.4%和27.2%的增長率預測。移動芯片板塊作爲主要營收驅動因素,收入達到61億美元,比去年增長12%,超出了預測的60億美元。2024財年,總收入達到331.9億美元,增長了9%,得益於中國Android手機銷量增長40%。汽車芯片板塊的收入大幅增長了68%,達到了89900萬美元,明顯高於預期的81600萬美元,標誌着連續五個季度的增長。物聯網芯片收入也表現出色,達到了16.8億美元,增長22%。

Revenue and EPS Guidance Surpasses Expectations

營收和每股收益的展望超出預期

Qualcomm's outlook for the fourth quarter suggests continued robust performance, projecting revenue growth between 5.8% and 13.9%, well above analyst forecasts. EPS growth is expected to range from 3.6% to 10.9%, significantly higher than the anticipated 2.2% increase. The recent launch of the Snapdragon 8 Elite, described as the most powerful SoC to date, features triple the performance of its predecessors and has been well received in the market, with major releases from Chinese brands and anticipation for new products from Samsung and Asus.

高通對第四季度的展望顯示持續強勁的表現,預計營業收入增長區間爲5.8%至13.9%,遠高於分析師的預測。每股收益增長預計在3.6%至10.9%之間,顯著高於預期的2.2%增長。最近推出的Snapdragon 8 Elite被描述爲迄今爲止最強大的SoC,性能是其前任的三倍,市場上受到了熱烈歡迎,中國品牌發佈了重大產品,同時關注三星和華碩等公司的新產品。

Greater Than 20% Growth in Fiscal Year EPS

Greater Than 20% Growth in Fiscal Year EPS