Market Mover | Sigma shares surge 23% as the ACCC approves the continuation of the Sigma and CW merger

Market Mover | Sigma shares surge 23% as the ACCC approves the continuation of the Sigma and CW merger

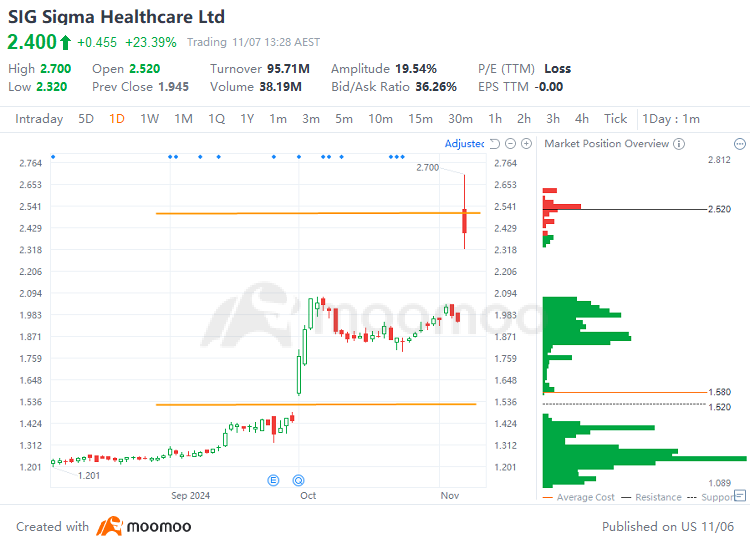

$Sigma Healthcare Ltd (SIG.AU)$ shares rose 23.39% on Thursday, with trading volume expanding to A$95.71 million. The stock price has reached a new record high. Sigma has risen 24.68% over the past week, with a cumulative gain of 139.57% year-to-date.

$Sigma Healthcare Ltd (SIG.AU)$ 週四股價上漲23.39%,成交量擴大至A$9571萬。股價已達到新的歷史高位。西格瑪在過去一週上漲24.68%,年初以來累計漲幅高達139.57%。

Sigma's technical analysis chart:

西格瑪的技術面分析圖表:

Technical Analysis:

技術面分析:

Support: A$1.52

Resistance: A$2.52

Price range A$1.52 to A$2.52: The trading range indicates a heavy concentration of buy orders, with the stock price on an upward trend. The stock repeatedly touched the level near A$1.52, where it found significant support and broke upward. There is a strong presence of buy orders around A$1.52, suggesting a robust foundation for the price. There is considerable upward pressure near the resistance level of A$2.52, with a lot of profit-taking positions, which suggests strong selling pressure. Going forward, it will be crucial to monitor whether the stock can effectively break through the resistance level at A$2.52.

支撐位:A$1.52

支撐位:A$2.52

價格區間爲A$1.52至A$2.52:交易區間表明有大量買單集中,股價呈上升趨勢。股價多次觸及A$1.52附近水平,找到重要支撐並向上突破。在A$1.52附近存在大量買單,表明價格有堅實基礎。在A$2.52的支撐位附近有相當大的上行壓力,伴有大量盈利平倉倉位,顯示有強烈的賣出壓力。未來關鍵在於觀察股價能否有效突破A$2.52的支撐位。

Market News :

市場資訊:

The ACCC decided not to oppose the merger of Sigma Healthcare Limited and CW Group Holdings Limited, following Sigma's acceptance of a court-enforceable undertaking. On December 11, 2023, the two companies entered into an agreement for Sigma to acquire all Chemist Warehouse shares in a deal valued at A$700 million, comprising Sigma shares and cash. Upon completion, Chemist Warehouse shareholders will own 85.75% of the combined ASX-listed entity, with Sigma shareholders holding the remaining 14.25%. This transaction effectively represents a reverse acquisition of Sigma by Chemist Warehouse.

澳大利亞競爭與消費者委員會決定不反對Sigma Healthcare Limited和CW Group Holdings Limited的合併,因爲Sigma接受了一項可由法院強制執行的承諾。2023年12月11日,兩家公司達成協議,Sigma將以70000萬澳元的價格收購所有Chemist Warehouse股票,其中包括Sigma股票和現金。交易完成後,Chemist Warehouse股東將擁有合併後澳交所上市實體的85.75%,而Sigma股東持有剩下的14.25%。該交易實際上代表了Chemist Warehouse對Sigma的反向收購。

Overall Analysis:

總體分析:

Fundamentally, focus on the company's performance and operational status. Technically, it is necessary to monitor whether the support at the support level remains valid, and whether the resistance level can be effectively broken through.

從基本角度來看,專注於公司的業績和運營狀況。從技術角度來看,有必要監督支撐位的支撐是否仍然有效,以及是否能有效突破壓力位。

In this scenario, investors should adopt a cautious strategy, setting stop-loss points to manage risk and maintaining ongoing vigilance regarding company developments and market conditions.

在這種情況下,投資者應採取謹慎的策略,設置止損點來管理風險,並對公司發展和市場情況保持持續警惕。

Resistance: A$2.52

Resistance: A$2.52