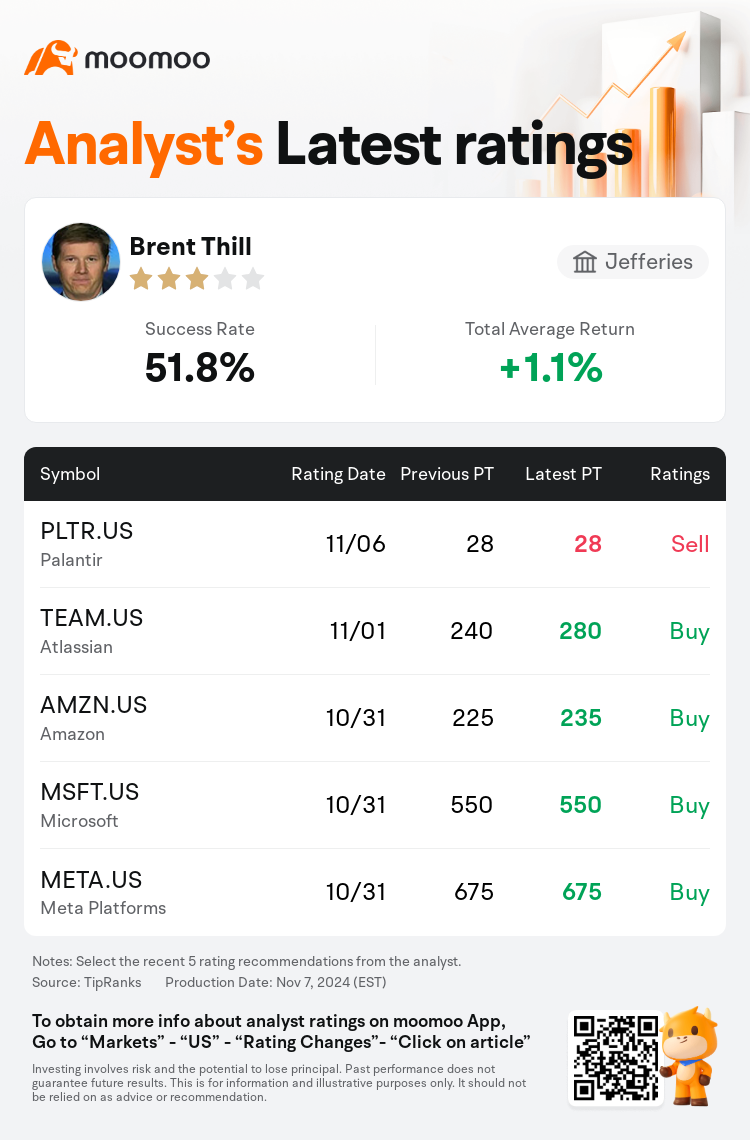

Jefferies analyst Brent Thill downgrades $Palantir (PLTR.US)$ to a sell rating, and maintains the target price at $28.

According to TipRanks data, the analyst has a success rate of 51.8% and a total average return of 1.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Palantir (PLTR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Palantir (PLTR.US)$'s main analysts recently are as follows:

The firm acknowledged having previously undervalued the substantial progress Palantir is expected to make in 2024 through the application of its foundational technological strengths in data integration and ontology creation to address bespoke AI software challenges among enterprise clients. However, the firm's neutral position is informed by the belief that the market has already factored in considerable accomplishments with the company's AIP, and further analysis is required to gauge the long-term sustainability of Palantir's competitive edge.

It's noted that Palantir's current valuation is steep, with the stock trading at a multiple of 38 times the projected revenue for 2025, positioning it as the priciest within the software sector. Additionally, there is an uptick in insider stock disposals through prearranged trading plans. While the company's core business remains robust, achieving the necessary growth rate of 40% annually over the next four years to merely maintain the stock price, and reaching a future revenue multiple of 12 times by 2028, is considered improbable.

The firm acknowledges that Palantir demonstrated a strong performance in Q3, deserving of a premium valuation. However, it is emphasized that valuation should still hold significance.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

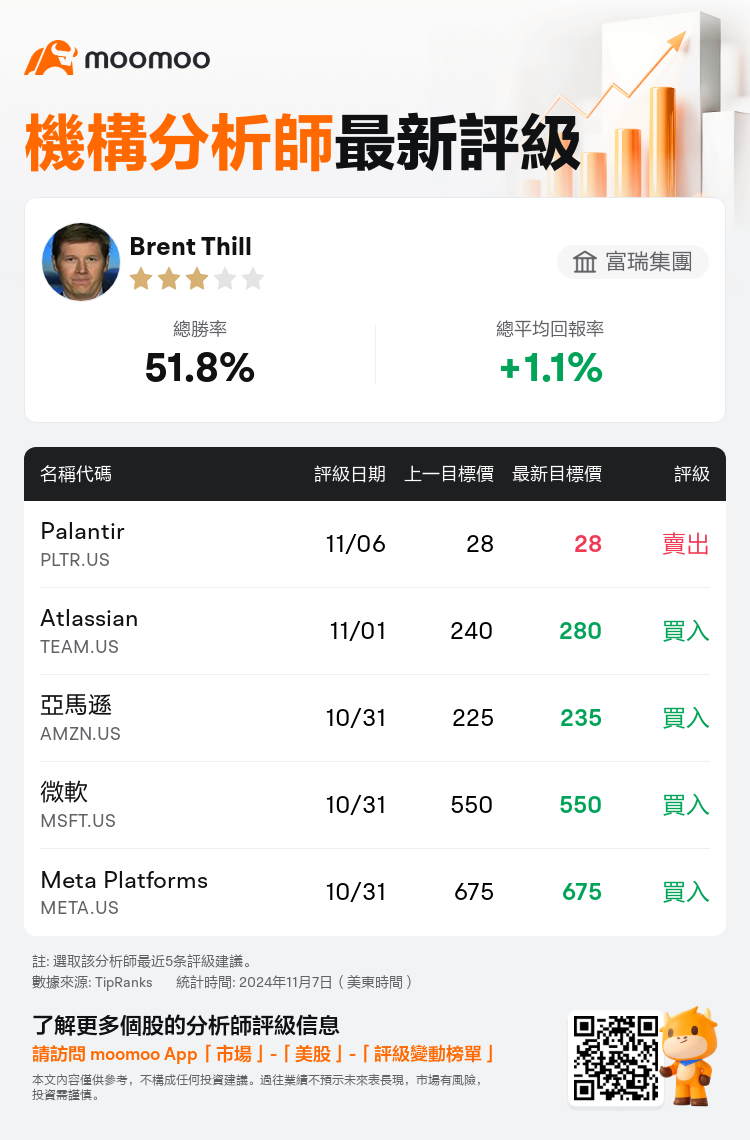

富瑞集團分析師Brent Thill下調$Palantir (PLTR.US)$至賣出評級,維持目標價28美元。

根據TipRanks數據顯示,該分析師近一年總勝率為51.8%,總平均回報率為1.1%。

此外,綜合報道,$Palantir (PLTR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Palantir (PLTR.US)$近期主要分析師觀點如下:

該公司承認,此前曾低估了Palantir通過應用其在數據集成和本體創建方面的基礎技術優勢來應對企業客戶面臨的定製人工智能軟件挑戰,預計將在2024年取得的實質性進展。但是,該公司的中立立場是基於這樣的信念,即市場已經將公司AIP的顯著成就考慮在內,因此需要進一步的分析來評估Palantir競爭優勢的長期可持續性。

值得注意的是,Palantir目前的估值很高,該股的交易價格是2025年預計收入的38倍,使其成爲軟件行業中最昂貴的股票。此外,通過預先安排的交易計劃,內幕股票的處置量有所增加。儘管該公司的核心業務仍然強勁,但僅僅爲了維持股價而在未來四年內實現每年40%的必要增長率,到2028年將未來收入倍數達到12倍被認爲是不可能的。

該公司承認,Palantir在第三季度表現強勁,值得進行溢價估值。但是,有人強調,估值仍應具有重要意義。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Palantir (PLTR.US)$近期主要分析師觀點如下:

此外,綜合報道,$Palantir (PLTR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of