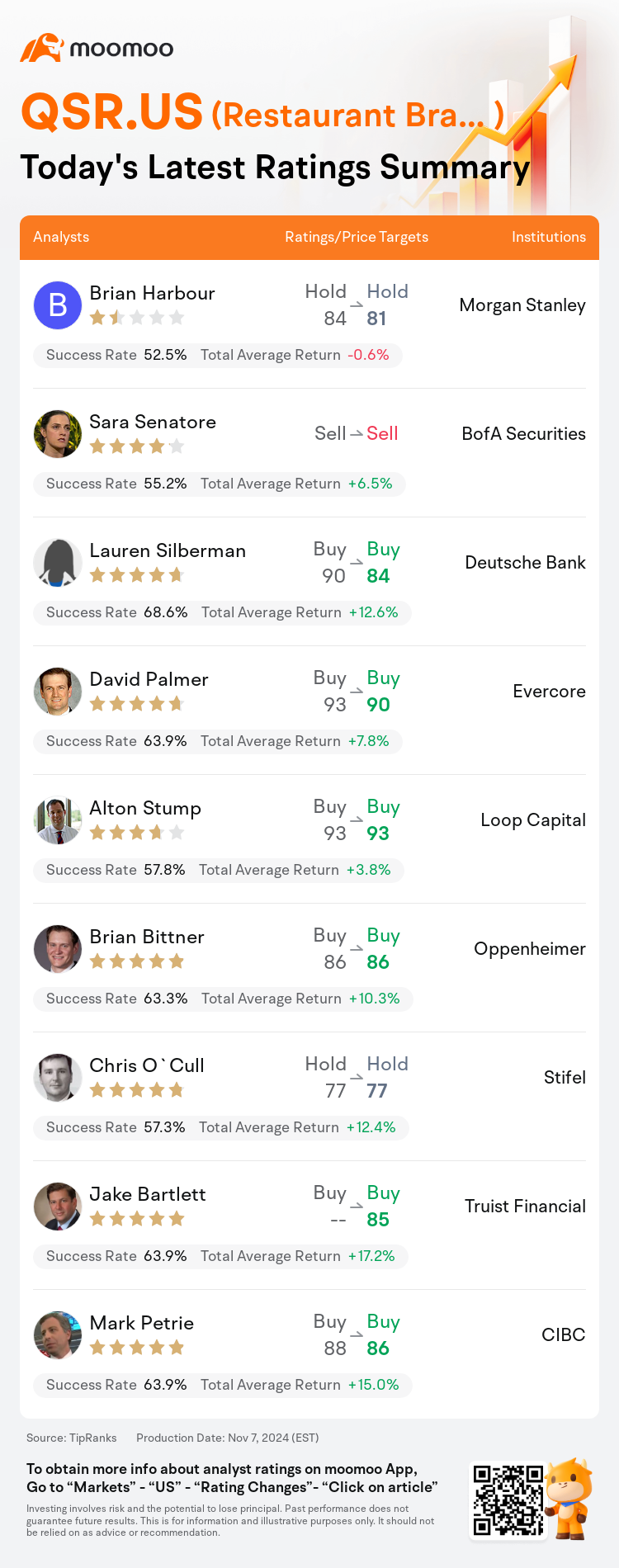

On Nov 07, major Wall Street analysts update their ratings for $Restaurant Brands International (QSR.US)$, with price targets ranging from $77 to $93.

Morgan Stanley analyst Brian Harbour maintains with a hold rating, and adjusts the target price from $84 to $81.

BofA Securities analyst Sara Senatore maintains with a sell rating.

Deutsche Bank analyst Lauren Silberman maintains with a buy rating, and adjusts the target price from $90 to $84.

Deutsche Bank analyst Lauren Silberman maintains with a buy rating, and adjusts the target price from $90 to $84.

Evercore analyst David Palmer maintains with a buy rating, and adjusts the target price from $93 to $90.

Loop Capital analyst Alton Stump maintains with a buy rating, and maintains the target price at $93.

Furthermore, according to the comprehensive report, the opinions of $Restaurant Brands International (QSR.US)$'s main analysts recently are as follows:

Restaurant Brands' third quarter performance was underwhelming, with comparables trailing behind consensus in all segments. Nonetheless, there was a noticeable acceleration in comparables during October.

The company exhibited a mixed performance recently, with a notable uptick in business during October as consolidated comparable sales figures rose to low-single-digit levels. Despite the third quarter falling short of expectations with weaker-than-anticipated comps across the board, leading to a 2.5% shortfall in revenue, the company has shown a consistent capacity for expense management amidst a tough macroeconomic landscape. This adeptness could bolster investor confidence in the potential for some earnings stability in the coming year.

The company's Q3 results broadly missed consensus forecasts due to macro and competitive challenges throughout the period. Following a Q3 shortfall against expectations, the company revised its full-year projections for systemwide sales to 5%-5.5% and unit growth to 3.5%. Nonetheless, it maintains its anticipation of over 8% adjusted operating income growth and has reasserted its five-year forecast, which includes over 8% systemwide sales growth and an average of 5% unit growth through 2028.

The firm has observed that Restaurant Brands' Q3 outcomes did not meet expectations. There was a notable deceleration in comparable sales across the company's various concepts, and the projections for unit growth by 2024 have been adjusted downward once more.

Here are the latest investment ratings and price targets for $Restaurant Brands International (QSR.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

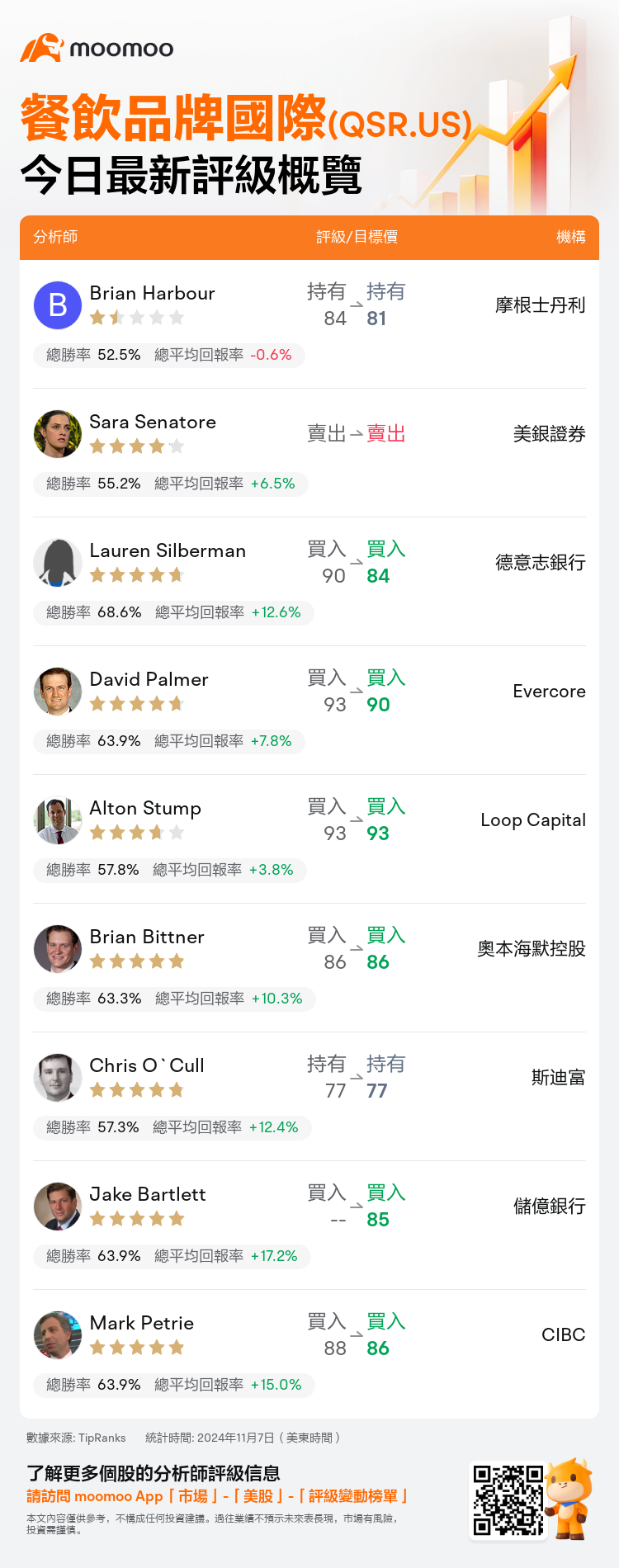

美東時間11月7日,多家華爾街大行更新了$餐飲品牌國際 (QSR.US)$的評級,目標價介於77美元至93美元。

摩根士丹利分析師Brian Harbour維持持有評級,並將目標價從84美元下調至81美元。

美銀證券分析師Sara Senatore維持賣出評級。

德意志銀行分析師Lauren Silberman維持買入評級,並將目標價從90美元下調至84美元。

德意志銀行分析師Lauren Silberman維持買入評級,並將目標價從90美元下調至84美元。

Evercore分析師David Palmer維持買入評級,並將目標價從93美元下調至90美元。

Loop Capital分析師Alton Stump維持買入評級,維持目標價93美元。

此外,綜合報道,$餐飲品牌國際 (QSR.US)$近期主要分析師觀點如下:

餐飲品牌的第三季表現令人失望,在所有板塊方面比較落後共識。儘管如此,在十月份的比較板塊中有明顯的加速。

最近公司表現不一,尤其是十月份業務明顯增長,整體比較銷售數據升至微個位數水平。儘管第三季未達預期,各方面比較營收偏弱,導致營收出現2.5%的虧損,公司在面對複雜的宏觀經濟形勢中展現了有力的費用管理能力。這種能力有助於增強投資者對未來一年中盈利穩定性的信心。

由於整個季度宏觀和競爭挑戰,公司第三季整體未達共識預測。在與預期不符的第三季之後,公司將全年對系統範圍內銷售的預測調整爲5%-5.5%,單位增長率爲3.5%。儘管如此,公司仍預計調整後的營業收入增長超過8%,並重申其五年預測,其中包括超過8%的系統範圍內銷售增長和2028年以來5%的單位增長的平均水平。

該公司認爲餐飲品牌的第三季業績未達預期。在公司的不同概念中,比較銷售出現了明顯減速,並且2024年單位增長的預測再次下調。

以下爲今日9位分析師對$餐飲品牌國際 (QSR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

德意志銀行分析師Lauren Silberman維持買入評級,並將目標價從90美元下調至84美元。

德意志銀行分析師Lauren Silberman維持買入評級,並將目標價從90美元下調至84美元。

Deutsche Bank analyst Lauren Silberman maintains with a buy rating, and adjusts the target price from $90 to $84.

Deutsche Bank analyst Lauren Silberman maintains with a buy rating, and adjusts the target price from $90 to $84.