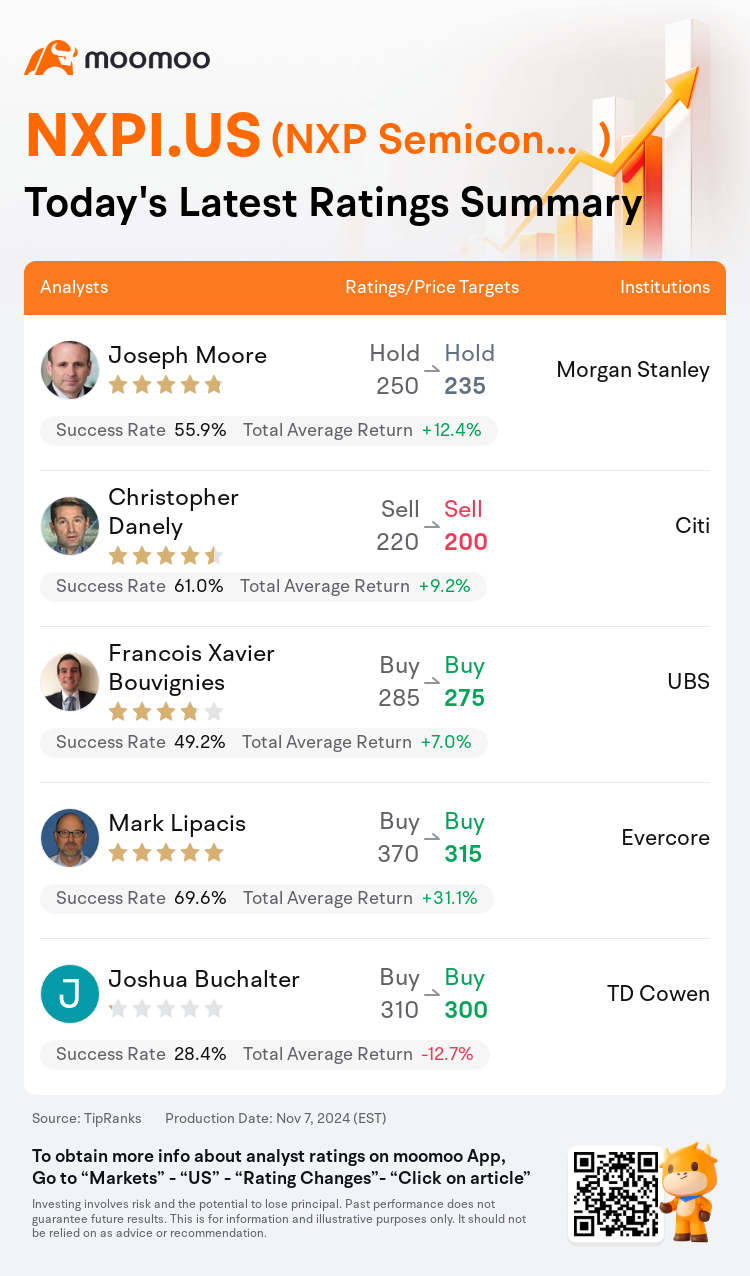

On Nov 07, major Wall Street analysts update their ratings for $NXP Semiconductors (NXPI.US)$, with price targets ranging from $200 to $315.

Morgan Stanley analyst Joseph Moore maintains with a hold rating, and adjusts the target price from $250 to $235.

Citi analyst Christopher Danely maintains with a sell rating, and adjusts the target price from $220 to $200.

UBS analyst Francois Xavier Bouvignies maintains with a buy rating, and adjusts the target price from $285 to $275.

UBS analyst Francois Xavier Bouvignies maintains with a buy rating, and adjusts the target price from $285 to $275.

Evercore analyst Mark Lipacis maintains with a buy rating, and adjusts the target price from $370 to $315.

TD Cowen analyst Joshua Buchalter maintains with a buy rating, and adjusts the target price from $310 to $300.

Furthermore, according to the comprehensive report, the opinions of $NXP Semiconductors (NXPI.US)$'s main analysts recently are as follows:

NXP Semiconductors is expected to navigate through challenges in the automotive and industrial as well as IoT sectors, with anticipated declines in the high-single digit percentage range for the end of March quarter. This comes following a guidance that fell short of earlier estimates. Despite facing these market pressures, it's noted that the company is not impervious to the broader difficulties impacting the auto industry, leading to a revision of projections post the earnings announcement.

The management's commentary echoed similar sentiments to a peer company, highlighting China as the singular area of strength within the automotive sector and indicating a continually sluggish industrial segment. It also suggested a softer outlook for the upcoming December and March quarters. It was noted that the protracted weakness in the industrial sector might comparatively benefit the company due to its lower exposure in contrast to its competitors. However, projections suggest that the automotive sector may experience a mid-single-digit decline on a quarter-over-quarter basis for the subsequent few quarters, marking the onset of 2025 with a foundation that is significantly weaker than anticipated.

The analyst noted that NXP Semiconductors posted Q3 results that aligned with expectations but projected a subdued Q4 and a similarly soft outlook for Q1, mirroring the trends observed outside of China within the auto/industrial sector. They maintained a positive stance on the stock, citing NXP's anticipated sales growth for 2024, which appears to outpace its competitors significantly. Additionally, there's an expectation that Q1 might represent the cyclical low point, and that the auto production sector is unlikely to remain in a slump indefinitely. The possibility of an uptick in growth could lead to a revival of the stock, which is not overly populated with investors and has limited association with the AI theme.

NXP Semiconductors met its guidance, yet provided a softer forecast for a second consecutive quarter. The weakening macroeconomic conditions and cautious forward-looking statements have been common themes this earnings season within the broad-based semiconductor sector. While it was anticipated that NXP's previous cautious stance might offer some protection, the outlook for Q4 and the implications for Q1 were seen as underwhelming. Nevertheless, it is believed that the company is addressing the situation appropriately and transparently. The challenges faced are considered to be systematic, not particular to NXP, and there is an expectation that the company's financial performance will improve with the eventual betterment of macroeconomic conditions.

NXP Semiconductors' Q3 results aligned with expectations, yet the Q4 forecast for sales and EPS presented by the company fell short of the Street consensus by 8% and 14%, respectively. With inventories approaching low points, there is anticipation of a significant recovery for NXP. The revised valuation takes into account the broader multiple compression within the group.

Here are the latest investment ratings and price targets for $NXP Semiconductors (NXPI.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

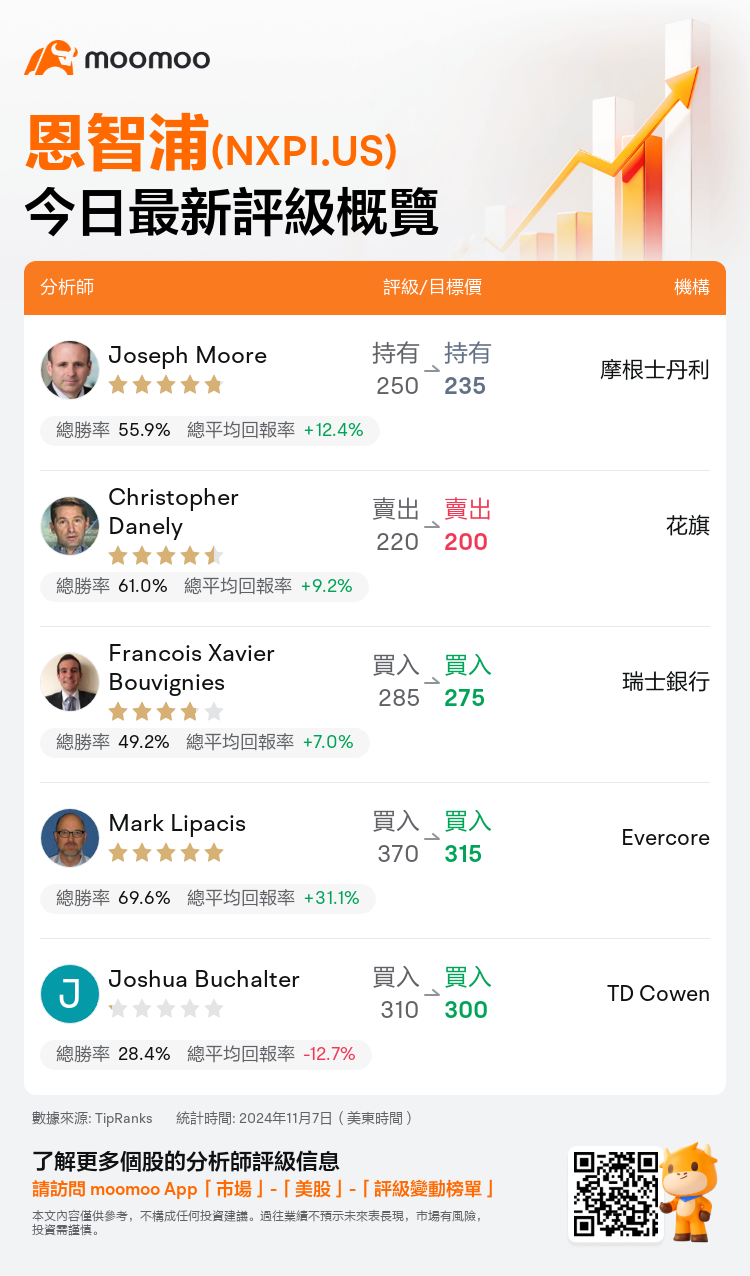

美東時間11月7日,多家華爾街大行更新了$恩智浦 (NXPI.US)$的評級,目標價介於200美元至315美元。

摩根士丹利分析師Joseph Moore維持持有評級,並將目標價從250美元下調至235美元。

花旗分析師Christopher Danely維持賣出評級,並將目標價從220美元下調至200美元。

瑞士銀行分析師Francois Xavier Bouvignies維持買入評級,並將目標價從285美元下調至275美元。

瑞士銀行分析師Francois Xavier Bouvignies維持買入評級,並將目標價從285美元下調至275美元。

Evercore分析師Mark Lipacis維持買入評級,並將目標價從370美元下調至315美元。

TD Cowen分析師Joshua Buchalter維持買入評級,並將目標價從310美元下調至300美元。

此外,綜合報道,$恩智浦 (NXPI.US)$近期主要分析師觀點如下:

恩智浦預計將在汽車、工業以及物聯網行業板塊遇到挑戰,在3月底季度末,高位數位百分比區間預計會出現下滑。此前發佈的指導預期未能達到較早的估計。儘管面臨這些市場壓力,但有消息指出公司並非對汽車行業持不可透的態度,導致在盈利公告後修正了預測。

管理層的評論與同行公司表達了類似觀點,強調中國作爲汽車領域的唯一實力區域,並指出持續疲軟的工業板塊。還建議未來12月和3月季度的前景較爲溫和。有指出,工業板塊長期的疲軟可能相對有利於該公司,因爲其較少與競爭對手接觸。然而,預測顯示未來幾個季度汽車板塊可能會以季度爲基礎經歷中位數位數的下降,這將在2025年伊始打下明顯弱於預期的基礎。

分析師指出,恩智浦發布的Q3結果符合預期,但預計Q4和同樣對Q1持謹慎態度,與中國以外的汽車/工業行業板塊觀察到的趨勢相一致。他們對該股保持積極立場,主要是因爲預計恩智浦2024年的銷售增長將顯著超過競爭對手。此外,有預期表明,Q1可能代表週期性最低點,並且汽車生產行業不太可能無限期陷入低迷。增長可能性的提升可能會帶動股價的復甦,該公司的投資者並不多,並且與人工智能主題的關聯有限。

恩智浦完成了預期指導,但連續第二個季度提供了較爲溫和的預測。普遍半導體行業本報季度的弱化的宏觀經濟環境和謹慎的前瞻性聲明這是共同的主題。雖然預期恩智浦先前的謹慎立場可能會提供一些保護,但Q4的前景以及對Q1的影響被視爲令人失望。儘管如此,人們認爲公司正在適當和透明地應對這種情況。所面臨的挑戰被認爲是系統性的,而非特定於恩智浦,有預期隨着宏觀經濟狀況的改善,公司的財務表現也將得到提升。

恩智浦第三季度的業績符合預期,但公司對第四季度銷售和每股收益的預測均比街頭共識低8%和14%。隨着庫存接近低點,人們期待恩智浦有着顯著的復甦。修訂後的估值考慮到集團內部更廣泛的多元壓縮。

以下爲今日5位分析師對$恩智浦 (NXPI.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Francois Xavier Bouvignies維持買入評級,並將目標價從285美元下調至275美元。

瑞士銀行分析師Francois Xavier Bouvignies維持買入評級,並將目標價從285美元下調至275美元。

UBS analyst Francois Xavier Bouvignies maintains with a buy rating, and adjusts the target price from $285 to $275.

UBS analyst Francois Xavier Bouvignies maintains with a buy rating, and adjusts the target price from $285 to $275.