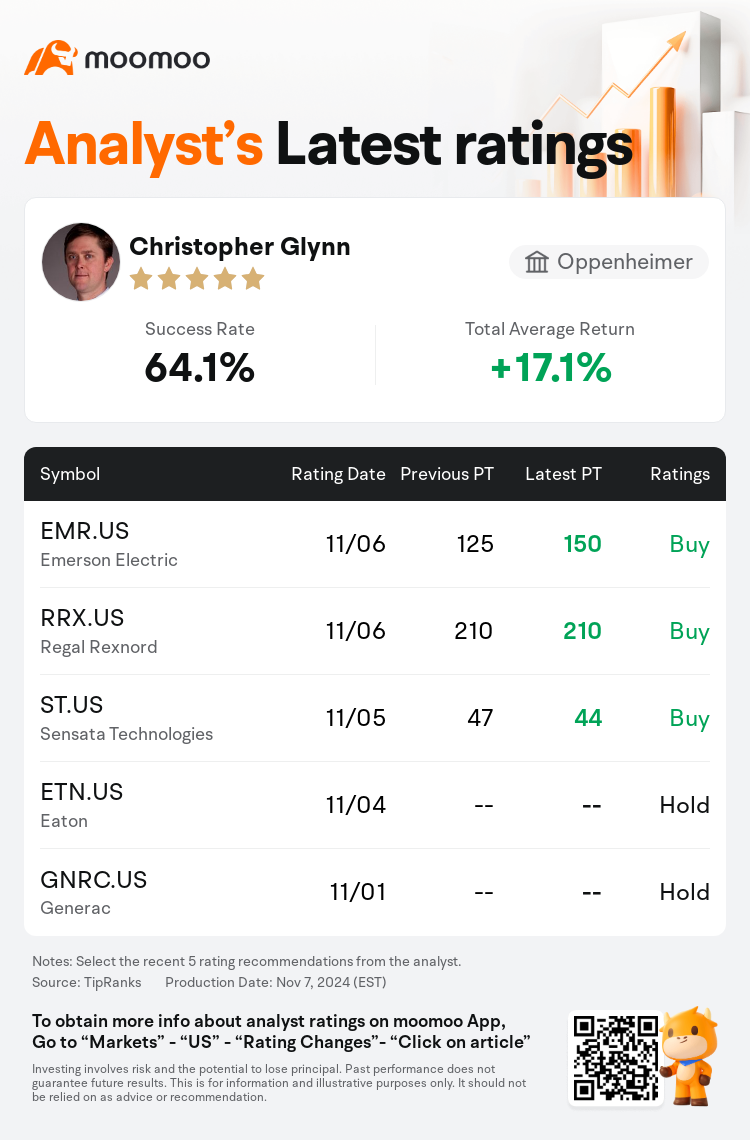

Oppenheimer analyst Christopher Glynn maintains $Emerson Electric (EMR.US)$ with a buy rating, and adjusts the target price from $125 to $150.

According to TipRanks data, the analyst has a success rate of 64.1% and a total average return of 17.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Emerson Electric (EMR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Emerson Electric (EMR.US)$'s main analysts recently are as follows:

Post-fiscal Q4 reporting, expectations are for a favorable market response as the completion of the Aspen Technology transaction is imminent. This, coupled with guidance for Q1 that aligns with current projections and prevailing bearish investor sentiment, could sway share performance positively.

Emerson's fourth quarter core adjusted segment EBITA outperformance and fiscal 2025 guidance, which was slightly above the consensus, played a role in the positive market response. The primary driver for the rally in shares, however, is attributed to strategic announcements made by the company. Emerson revealed three critical strategic actions that finalizes its transformation into a leading industrial technology company with a focus on advanced automation solutions. The market has yet to fully recognize the value of the revamped Emerson in its current stock valuation.

The performance of shares was noted to have improved following the announcement of Q4 results and portfolio transformation actions. Management indicated that FY24 growth is expected to be propelled by Process and Hybrid businesses, although this is somewhat counterbalanced by the continuing softness in Discrete end markets. Nevertheless, a positive inflection in Discrete orders was observed in Q4, and the outlook is cautiously optimistic based on management's suggestion that these markets may have reached their lowest point.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奧本海默控股分析師Christopher Glynn維持$艾默生電氣 (EMR.US)$買入評級,並將目標價從125美元上調至150美元。

根據TipRanks數據顯示,該分析師近一年總勝率為64.1%,總平均回報率為17.1%。

此外,綜合報道,$艾默生電氣 (EMR.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾默生電氣 (EMR.US)$近期主要分析師觀點如下:

發帖季度Q4報告後,預計艾斯本科技交易的完成即將到來,市場對此有利的反應。這與Q1的指引相一致,符合當前的預期和普遍的看淡投資者情緒,可能會積極影響股票表現。

在埃默森第四季度核心調整部門EBITA表現優異以及2025財年的指引略高於共識的情況下,市場做出了積極的反應。然而,推動股價上漲的主要動力是該公司所做的戰略公告。埃默森透露了三項重要的戰略舉措,最終完成了向以先進自動化解決方案爲重點的領先工業技術公司的轉型。市場尚未完全認識到埃默森改頭換面後在當前股票估值中的價值。

股票表現的改善是在公佈Q4業績和組合變革舉措後引起關注的。管理層表示,FY24的增長預計將由流程和混合業務推動,儘管離散端市場持續疲軟,但Q4觀察到離散訂單的積極轉折,根據管理層的建議,這些市場可能已觸底,前景謹慎樂觀。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$艾默生電氣 (EMR.US)$近期主要分析師觀點如下:

此外,綜合報道,$艾默生電氣 (EMR.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of