On Nov 08, major Wall Street analysts update their ratings for $Qualcomm (QCOM.US)$, with price targets ranging from $185 to $245.

Morgan Stanley analyst Joseph Moore maintains with a hold rating, and adjusts the target price from $207 to $204.

BofA Securities analyst Tal Liani maintains with a buy rating, and maintains the target price at $245.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Barclays analyst Thomas O'Malley maintains with a buy rating, and maintains the target price at $200.

UBS analyst Timothy Arcuri maintains with a hold rating, and adjusts the target price from $175 to $190.

Furthermore, according to the comprehensive report, the opinions of $Qualcomm (QCOM.US)$'s main analysts recently are as follows:

In the September quarter, Qualcomm experienced benefits from augmented content, a steady and expanding high-end handset market, along with normalized inventory dynamics. Post-report analysis indicates that forecasts remain relatively stable. Revenue expectations for the March quarter are set at $10.3 billion with EPS projections at $2.66, and for the year 2025, anticipated revenues and EPS stand at $42.6 billion and $11.32 respectively.

Qualcomm has projected strong guidance and presents a positive outlook for the flagship segment of the China market, attributed to the introduction of new models and an increase in selling prices stemming from its new Snapdragon 8 Elite. Despite a relatively stable overall unit market, Qualcomm's mobile business is experiencing growth, particularly due to its significant presence in the premium tier.

The analyst notes an improvement in revenue and margins which led to earnings surpassing consensus forecasts. Expectations for revenue and earnings have been raised for the company, with particular attention on the IOT and Autos sectors. These sectors are anticipated to shift investor focus towards long-term prospects concerning market diversification, which Qualcomm is expected to detail at the forthcoming investor day.

The firm acknowledges Qualcomm's delivery of Q4 results that surpassed expectations, along with a favorable Q1 2025 guidance. Nonetheless, the firm maintains a cautious perspective due to several factors: the anticipated increase in competition in the AI PC market, concerns over Apple's foray into the 5G modem space, and the ongoing licensing disagreements with Arm.

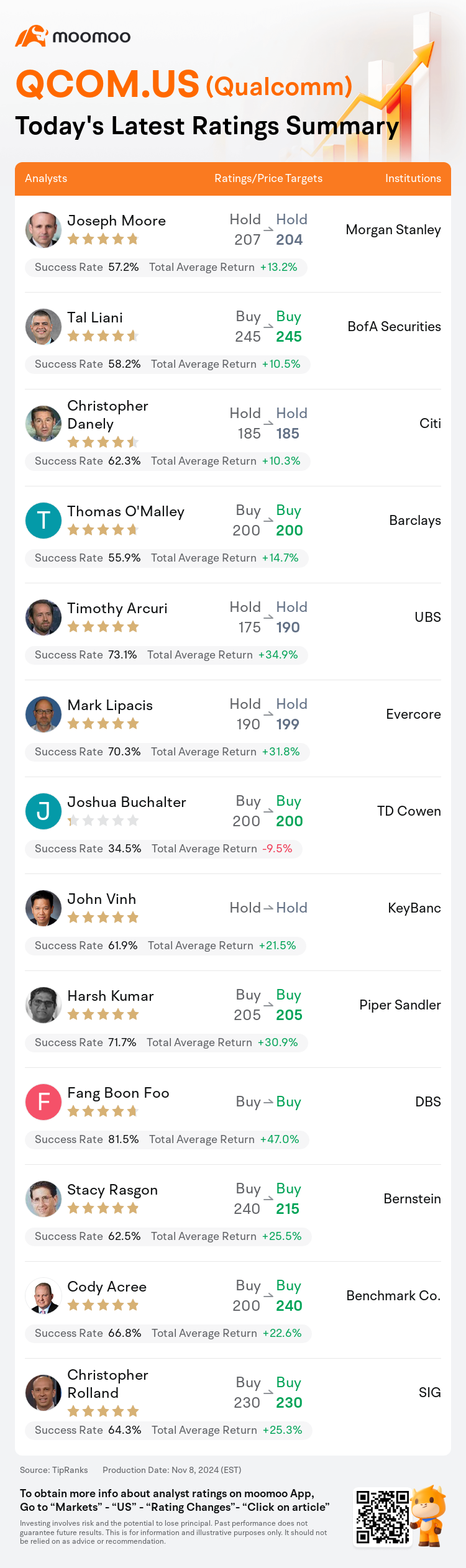

Here are the latest investment ratings and price targets for $Qualcomm (QCOM.US)$ from 13 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月8日,多家華爾街大行更新了$高通 (QCOM.US)$的評級,目標價介於185美元至245美元。

摩根士丹利分析師Joseph Moore維持持有評級,並將目標價從207美元下調至204美元。

美銀證券分析師Tal Liani維持買入評級,維持目標價245美元。

花旗分析師Christopher Danely維持持有評級,維持目標價185美元。

花旗分析師Christopher Danely維持持有評級,維持目標價185美元。

巴克萊銀行分析師Thomas O'Malley維持買入評級,維持目標價200美元。

瑞士銀行分析師Timothy Arcuri維持持有評級,並將目標價從175美元上調至190美元。

此外,綜合報道,$高通 (QCOM.US)$近期主要分析師觀點如下:

在九月季度,高通受益於增強內容、穩定且不斷擴大的高端手機市場,以及庫存動態的正常化。報告後分析表明,預測仍然相對穩定。三月季度的營業收入預期設定爲103億美元,每股收益預測爲2.66美元,而到2025年,預期營業收入和每股收益分別爲426億美元和11.32美元。

高通預測旗艦手機市場的強勁業績,並呈現積極的展望,這要歸功於引入新機型以及銷售價格的增加,這些來自其全新的驍龍8 Elite。儘管整體手機市場相對穩定,但高通的手機業務正在增長,特別是由於它在高端市場的重要地位。

分析師指出,收入和利潤率的改善導致盈利超過共識預測。該公司的收入和盈利預期已經提高,特別關注物聯網和汽車行業。預計這些行業將引起投資者對市場多元化長期前景的關注,高通預計將在即將到來的投資者日詳細介紹。

公司承認高通交付超出預期的第四季度業績,以及有利的2025年第一季度展望。然而,公司持謹慎態度,這是由於幾個因素:預計人工智能PC市場競爭加劇,對蘋果進軍5g概念調制解調器領域的擔憂以及與Arm之間持續的許可協議分歧。

以下爲今日13位分析師對$高通 (QCOM.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Christopher Danely維持持有評級,維持目標價185美元。

花旗分析師Christopher Danely維持持有評級,維持目標價185美元。

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.

Citi analyst Christopher Danely maintains with a hold rating, and maintains the target price at $185.