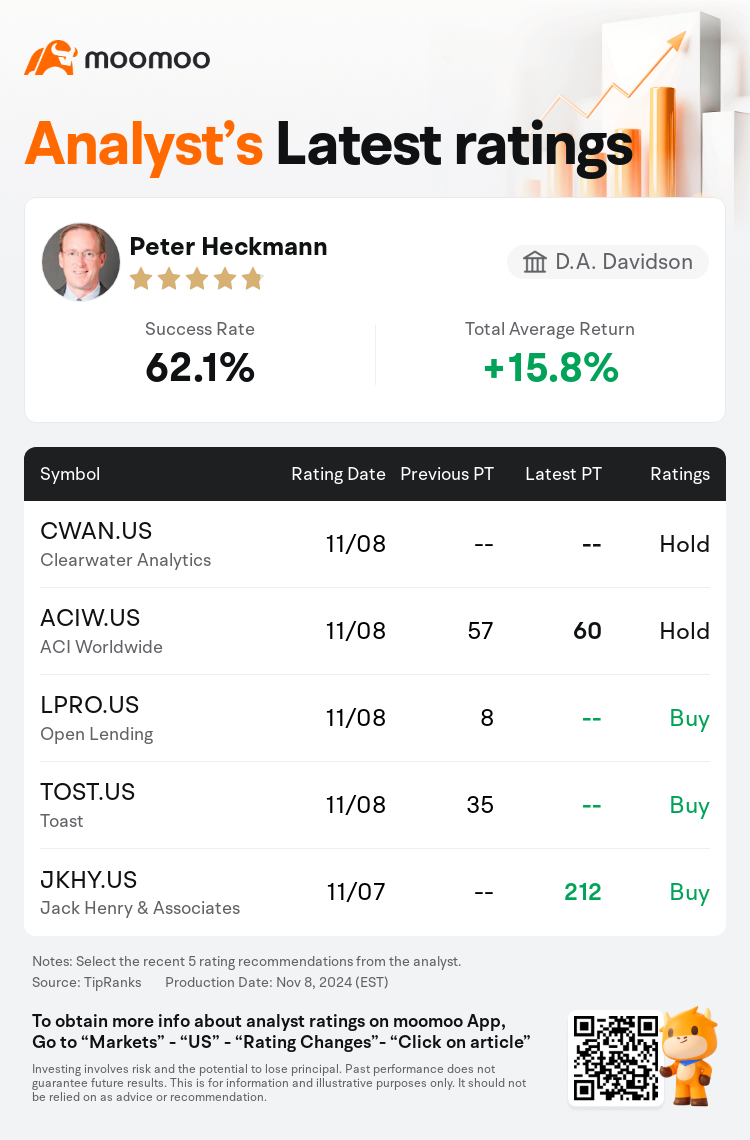

D.A. Davidson analyst Peter Heckmann downgrades $Clearwater Analytics (CWAN.US)$ to a hold rating.

According to TipRanks data, the analyst has a success rate of 62.1% and a total average return of 15.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Clearwater Analytics (CWAN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Clearwater Analytics (CWAN.US)$'s main analysts recently are as follows:

After a 'strong' Q3 report, there was an unexpected surge in recurring revenue to 114%, spurred by new product contributions and minimal customer turnover. The demand at the top of the funnel seems increasingly robust and was unanticipatedly widespread across various customer types and regions. It's believed that the 'significant valuation premium to peers' is warranted due to a compelling mix of high sales growth, enhanced profitability, and market share expansion.

Clearwater Analytics exhibited a remarkable third quarter, characterized by substantial bookings, a significant beat on EBITDA projections, the highest free cash flow to date, and a resurgence in business expansion. The positive stance on Clearwater is underpinned by the expectation of sustained strong bookings, both from new customers and expansion of existing accounts, which is attributed to effective sales productivity and the success of several new product cycles, as evidenced by the Q3 outcomes, along with continued operational leverage.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

戴維森信託分析師Peter Heckmann下調$Clearwater Analytics (CWAN.US)$至持有評級。

根據TipRanks數據顯示,該分析師近一年總勝率為62.1%,總平均回報率為15.8%。

此外,綜合報道,$Clearwater Analytics (CWAN.US)$近期主要分析師觀點如下:

此外,綜合報道,$Clearwater Analytics (CWAN.US)$近期主要分析師觀點如下:

在發佈了 「強勁」 的第三季度報告之後,在新產品貢獻和最低客戶流失率的推動下,經常性收入出人意料地激增至114%。渠道頂端的需求似乎越來越強勁,並且在各種客戶類型和地區的需求出人意料地廣泛存在。據信,由於高銷售增長、盈利能力提高和市場份額擴張等令人信服的組合,「對同行大幅估值溢價」 是有道理的。

Clearwater Analytics的第三季度表現出色,其特點是預訂量巨大,息稅折舊攤銷前利潤大幅超出預期,自由現金流達到迄今爲止最高水平,業務擴張復甦。Clearwater的積極立場是由新客戶和現有客戶的持續強勁預訂的預期支撐的,這要歸因於有效的銷售生產率和多個新產品週期的成功,第三季度業績以及持續的運營槓桿作用也證明了這一點。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Clearwater Analytics (CWAN.US)$近期主要分析師觀點如下:

此外,綜合報道,$Clearwater Analytics (CWAN.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of