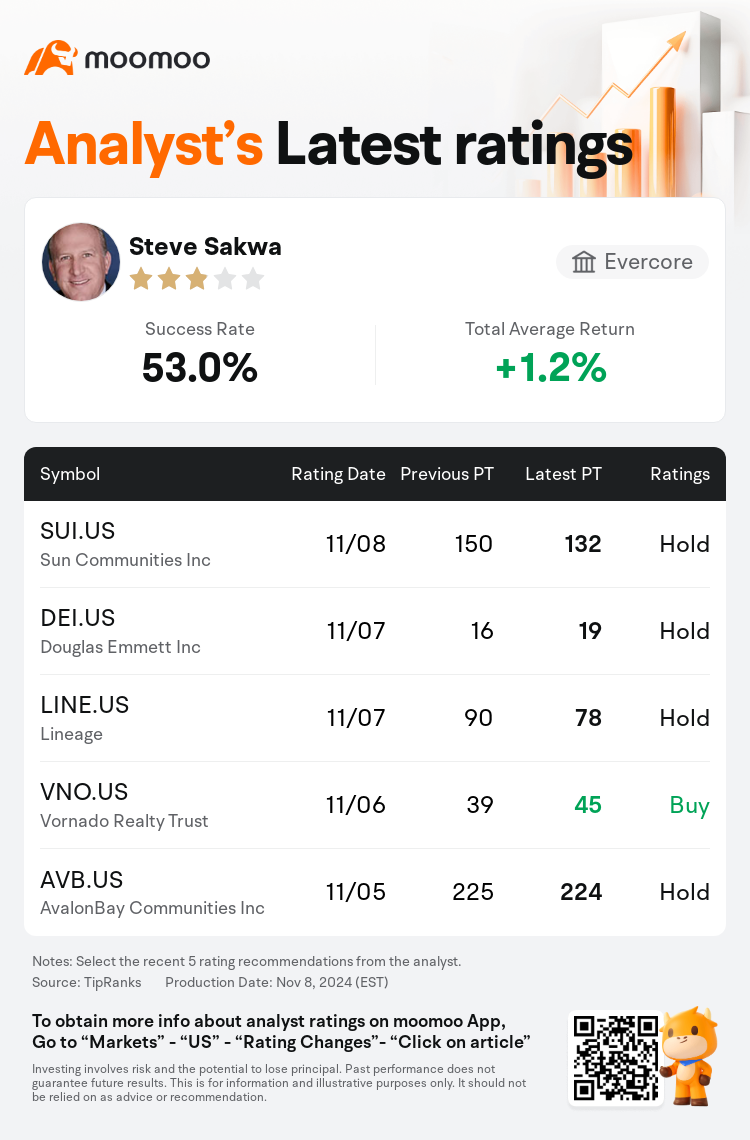

Evercore analyst Steve Sakwa maintains $Sun Communities Inc (SUI.US)$ with a hold rating, and adjusts the target price from $150 to $132.

According to TipRanks data, the analyst has a success rate of 53.0% and a total average return of 1.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Sun Communities Inc (SUI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Sun Communities Inc (SUI.US)$'s main analysts recently are as follows:

Sun Communities experienced one of the most challenging quarters in recent memory, marked by significant misses and guidance reductions. This was primarily due to a combination of increased expenses, diminished demand in transient and marina operations, hurricane effects, and the challenge in swiftly adjusting expenses. Consequently, this has led to a 5% reduction in the outlook for 2024.

Sun Communities' third-quarter outcomes were below expectations, showcasing a shortfall in core FFO per share and a downward revision in guidance. This coincided with a pivotal announcement regarding leadership changes, including the retirements of the CEO and a board member. It is anticipated that these developments could lead to more substantial transformations, potentially involving the divestiture or disposition of Park Holidays or Safe Harbor.

Although the business model of Sun Communities is appreciated for its relative resilience, recent quarterly reports have not exhibited the same sturdiness. The company has revised its guidance downward for North America same-store NOI growth by 2.25%, with reductions across all segments. A cautious stance is being adopted until the company demonstrates a series of consistent and clear quarterly performances.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Evercore分析師Steve Sakwa維持$Sun Communities (SUI.US)$持有評級,並將目標價從150美元下調至132美元。

根據TipRanks數據顯示,該分析師近一年總勝率為53.0%,總平均回報率為1.2%。

此外,綜合報道,$Sun Communities (SUI.US)$近期主要分析師觀點如下:

此外,綜合報道,$Sun Communities (SUI.US)$近期主要分析師觀點如下:

Sun Communities經歷了近代記憶中最具挑戰性的季度之一,其特點是重大失誤和指導下調。這主要是由於支出增加、臨時和碼頭運營需求減少、颶風影響以及快速調整開支面臨的挑戰等綜合因素。因此,這導致2024年的前景下降了5%。

Sun Communities第三季度的業績低於預期,顯示每股核心FFO不足,預期向下修正。這恰逢有關領導層變動(包括首席執行官和董事會成員的退休)的重要公告。預計這些發展可能會導致更實質性的轉型,可能涉及Park Holidays或Safe Harbor的剝離或處置。

儘管Sun Communities的商業模式因其相對的彈性而受到讚賞,但最近的季度報告並未表現出同樣的穩健性。該公司已將其對北美同店淨收入增長的預期下調了2.25%,所有細分市場均有所下調。在公司表現出一系列持續而明確的季度業績之前,將採取謹慎的立場。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Sun Communities (SUI.US)$近期主要分析師觀點如下:

此外,綜合報道,$Sun Communities (SUI.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of