KARS ETF Hits Golden Cross Powered By Tesla, Geely, Xpeng, Li

KARS ETF Hits Golden Cross Powered By Tesla, Geely, Xpeng, Li

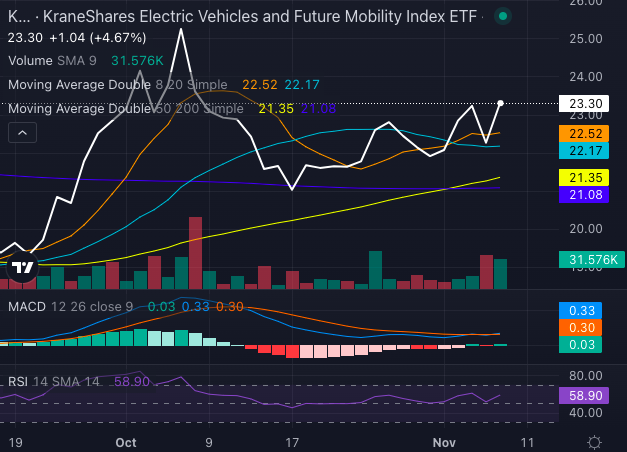

The KraneShares Electric Vehicles and Future Mobility Index ETF (NYSE:KARS) has just hit a significant milestone, making a Golden Cross that has investors' attention piqued and driving optimism.

KraneShares電動汽車和未來出行指數ETF(紐約證券交易所代碼:KARS)剛剛達到了一個重要的里程碑,金十字勳章引起了投資者的注意力,推動了樂觀情緒。

The ETF, which tracks the global transition to electric vehicles (EVs) and future mobility, is experiencing a surge, with its price moving above its five, 20 and 50-day exponential moving averages, signaling strong bullish momentum.

追蹤全球向電動汽車(EV)和未來出行過渡的ETF正在飆升,其價格突破了五天、20天和50天的指數移動平均線,這表明了強勁的看漲勢頭。

The ETF is benefitting from its top-tier holdings, which include a mix of the EV sector's biggest names: BYD Co Ltd (OTCPK: BYDDF), Tesla Inc. (NASDAQ:TSLA) and Geely Automobile Holdings Ltd (OTCPK: GELYF). It includes emerging players as well: Li Auto Inc (NASDAQ:LI), XPeng Inc (NASDAQ:XPEV) and Arcadium Lithium PLC (NYSE:ALTM).

該ETF受益於其頂級持股,其中包括電動汽車行業的知名企業:比亞迪有限公司(OTCPK:BYDF)、特斯拉公司(納斯達克股票代碼:TSLA)和吉利汽車控股有限公司(場外交易代碼:GELYF)。它還包括新興參與者:理想汽車公司(納斯達克股票代碼:LI)、小鵬公司(納斯達克股票代碼:XPEV)和Arcadium Lithium PLC(紐約證券交易所代碼:ALTM)。

Read Also: What Does GM's Electric Future Look Like After Chevrolet Bolt's Exit? Last Year's Delivery Numbers Could Give A Hint

另請閱讀:雪佛蘭Bolt退出後,通用汽車的電動未來會是什麼樣子?去年的交付數字可能會給出提示

Chart created using Benzinga Pro

使用 Benzinga Pro 創建的圖表

KARS ETF Drives Up A Golden Cross

KARS ETF 推動金十字架上漲

With a share price of $23.30, KARS is in the sweet spot for technical analysts. The 50-day simple moving average (SMA) has crossed over the 200-day SMA, triggering the Golden Cross. The ETF's eight-day SMA is at $22.52, the 20-day at $22.17 and the 50-day at $21.35. All these indicators show bullish signals, reinforcing the bullish sentiment surrounding the ETF.

KARS的股價爲23.30美元,是技術分析師的最佳選擇。50天簡單移動平均線(SMA)已突破200天均線,觸發了黃金交叉。該ETF的八天均線爲22.52美元,20天均線爲22.17美元,50天均線爲21.35美元。所有這些指標都顯示出看漲信號,強化了圍繞ETF的看漲情緒。

It's currently trading at a price above its 200-day SMA of $21.08, further solidifying the case for upside potential.

它目前的交易價格高於其200天均線21.08美元,進一步鞏固了上行潛力的理由。

The ETF is up 5% over the past five days and its 52-week high of $26.10 is well within reach. Despite a year-to-date decline of 7.32%, the recent uptick signals that KARS may be bouncing back, driven largely by the outperformance of its key holdings.

該ETF在過去五天中上漲了5%,其52周高點26.10美元觸手可及。儘管今年迄今爲止下跌了7.32%,但最近的上漲表明KARS可能正在反彈,這主要是由其主要持股的跑贏大盤推動的。

KARS Top Holdings Driving The Charge

KARS Top Holdings 推動了衝擊

KraneShares' KARS ETF is led by major EV players. BYD, the Chinese electric vehicle titan, is its top holding, making up 4.15% of the fund. Tesla (TSLA), a staple in the EV world, follows closely behind at 4.13%, while Geely, Xpeng and Li Auto continue to support the ETF's forward momentum.

KraneShares的KARS ETF由主要的電動汽車公司領導。中國電動汽車巨頭比亞迪是其最大持股,佔該基金的4.15%。電動汽車領域的主要產品特斯拉(TSLA)緊隨其後,爲4.13%,而吉利、小鵬和理想汽車繼續支持該ETF的前進勢頭。

Tesla and BYD have been standouts this year, with BYD up 36.61% year-to-date and Tesla climbing 19.52%.

特斯拉和比亞迪今年表現出色,比亞迪今年迄今上漲了36.61%,特斯拉上漲了19.52%。

Meanwhile, Li Auto has faced some struggles, down 25.96% this year, but the market is still hungry for electric vehicle exposure.

同時,理想汽車也面臨一些困難,今年下跌了25.96%,但市場仍然渴望獲得電動汽車的曝光率。

A Bullish Outlook, But Some Caution

前景看漲,但要謹慎

While the Golden Cross signals bullish movement, KARS' Relative Strength Index (RSI) is currently at 58.9, suggesting the ETF is nearing overbought territory. With a MACD indicator of 0.33, there's still potential for more upside, but cautious optimism remains prudent as the market watches for any signs of cooling.

儘管金十字表示看漲,但KARS的相對強弱指數(RSI)目前爲58.9,這表明該ETF已接近超買區域。MACD指標爲0.33,仍有進一步上漲的潛力,但在市場觀察任何降溫跡象的同時,謹慎的樂觀情緒仍然是謹慎的。

- Rivian Q3 Earnings Highlights: Revenue, EPS Miss, CEO Confident In Q4 Gross Profit, R2 Being 'Fundamental Driver' Of Growth

- Rivian 第三季度收益亮點:收入、每股收益不足、首席執行官對第四季度毛利充滿信心,R2 是增長的 「基本驅動力」

Image: Shutterstock

圖片:Shutterstock