- 要聞

- 結好控股有些信心不足(HKG:1469)的市盈率

Some Confidence Is Lacking In Get Nice Financial Group Limited's (HKG:1469) P/E

Some Confidence Is Lacking In Get Nice Financial Group Limited's (HKG:1469) P/E

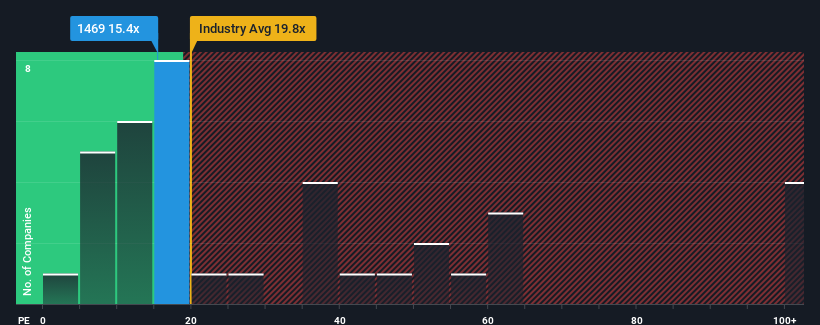

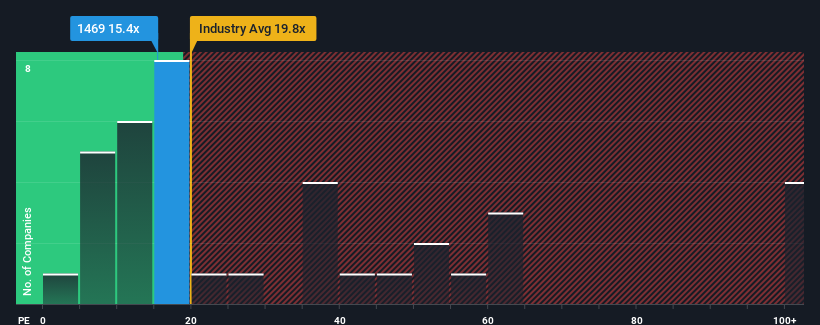

With a price-to-earnings (or "P/E") ratio of 15.4x Get Nice Financial Group Limited (HKG:1469) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Get Nice Financial Group's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

How Is Get Nice Financial Group's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Get Nice Financial Group's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. This isn't what shareholders were looking for as it means they've been left with a 28% decline in EPS over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. This isn't what shareholders were looking for as it means they've been left with a 28% decline in EPS over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Get Nice Financial Group is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Get Nice Financial Group's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Get Nice Financial Group revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for Get Nice Financial Group that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

根據股價與每股收益(或「P/E」)比率爲15.4x的結好控股(HKG:1469)目前可能正在發出非常消極的信號,因爲香港近一半公司的P/E比率低於9x,甚至低於6x的情況並不罕見。然而,P/E可能因某種原因而相當高,需要進一步調查以判斷其是否合理。

例如,考慮結好控股最近財務表現相當普通,因爲收益增長並不存在。許多人可能期望未來一段時間內財務表現會有所改善,這種預期使P/E保持不下跌。如果沒有改善,那麼現有股東可能會對股價的可行性有些擔憂。

結好控股的增長趨勢如何?

存在這樣的假設,即一家公司應該遠遠超越市場,才能認爲結好控股這樣的P/E比率是合理的。

回顧過去一年,公司的淨利潤實際上與前一年幾乎持平。這不是股東們期待的結果,因爲這意味着過去三年總共EPS下降了28%。所以不幸地,我們必須承認公司在這段時間內並未做好增長盈利的工作。

回顧過去一年,公司的淨利潤實際上與前一年幾乎持平。這不是股東們期待的結果,因爲這意味着過去三年總共EPS下降了28%。所以不幸地,我們必須承認公司在這段時間內並未做好增長盈利的工作。

相比之下,市場預測在未來12個月內將實現23%的增長,根據最近中期的盈利結果來看,該公司的下行勢頭令人擔憂。

根據這些信息,我們發現結好控股集團的市盈率高於市場令人擔憂。似乎大多數投資者忽視了最近糟糕的增長率,並希望公司業務前景可以扭轉。只有最勇敢的人會認爲這些價格是可持續的,因爲最近盈利趨勢的延續可能會對股價產生沉重的壓力。

我們從結好控股集團的市盈率中可以學到什麼?

通常,我們比較偏向於限制使用市盈率來確定市場對一家公司整體健康狀況的看法。

我們對結好控股集團的調查顯示,其中期萎縮的盈利並沒有像我們預測的那樣對其高市盈率產生太大影響,考慮到市場預計會增長。目前,我們對高市盈率感到越來越不舒服,因爲這種盈利表現極不可能長時間支持這種積極情緒。如果最近中期盈利趨勢繼續,將使股東的投資面臨重大風險,潛在投資者則面臨支付過高溢價的危險。

值得注意的是,我們發現了1個關於結好控股需要考慮的警告信號。

當然,您可能會通過查看一些良好的候選公司而找到一個絕佳的投資目標。因此,查看一下這份免費的公司列表,這些公司具有強大的增長記錄,價格低廉。

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

風險及免責聲明

moomoo是Moomoo Technologies Inc.公司提供的金融資訊和交易應用程式。

在美國,moomoo上的投資產品和服務由Moomoo Financial Inc.提供,一家受美國證券交易委員會(SEC)監管的持牌主體。 Moomoo Financial Inc.是金融業監管局(FINRA)和證券投資者保護公司(SIPC)的成員。

在新加坡,moomoo上的投資產品和服務是通過Moomoo Financial Singapore Pte. Ltd.提供,該公司受新加坡金融管理局(MAS)監管(牌照號碼︰CMS101000) ,持有資本市場服務牌照 (CMS) ,持有財務顧問豁免(Exempt Financial Adviser)資質。本內容未經新加坡金融管理局的審查。

在澳大利亞,moomoo上的金融產品和服務是通過Moomoo Securities Australia Limited提供,該公司是受澳大利亞證券和投資委員會(ASIC)監管的澳大利亞金融服務許可機構(AFSL No. 224663)。請閱讀並理解我們的《金融服務指南》、《條款與條件》、《隱私政策》和其他披露文件,這些文件可在我們的網站 https://www.moomoo.com/au中獲取。

在加拿大,透過moomoo應用程式提供的僅限訂單執行的券商服務由Moomoo Financial Canada Inc.提供,並受加拿大投資監管機構(CIRO)監管。

在馬來西亞,moomoo上的投資產品和服務是透過Moomoo Securities Malaysia Sdn. Bhd. 提供,該公司受馬來西亞證券監督委員會(SC)監管(牌照號碼︰eCMSL/A0397/2024) ,持有資本市場服務牌照 (CMSL) 。本內容未經馬來西亞證券監督委員會的審查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Moomoo Securities Australia Limited, Moomoo Financial Canada Inc和Moomoo Securities Malaysia Sdn. Bhd., 是關聯公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用瀏覽器的分享功能,分享給你的好友吧