On Nov 09, major Wall Street analysts update their ratings for $Dynatrace (DT.US)$, with price targets ranging from $55 to $65.

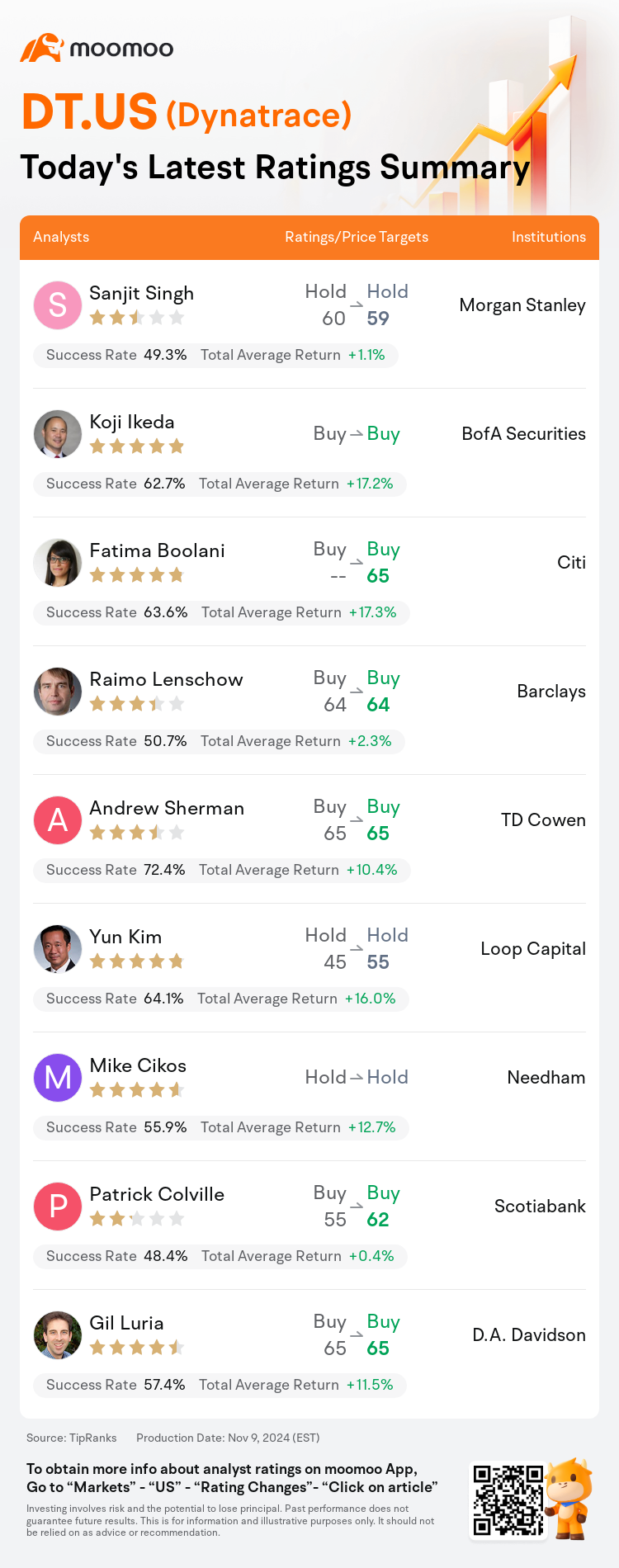

Morgan Stanley analyst Sanjit Singh maintains with a hold rating, and adjusts the target price from $60 to $59.

BofA Securities analyst Koji Ikeda maintains with a buy rating.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Barclays analyst Raimo Lenschow maintains with a buy rating, and maintains the target price at $64.

TD Cowen analyst Andrew Sherman maintains with a buy rating, and maintains the target price at $65.

Furthermore, according to the comprehensive report, the opinions of $Dynatrace (DT.US)$'s main analysts recently are as follows:

Dynatrace recorded a 'solid' fiscal second quarter, yet opted to maintain its outlook for FY25, citing a continuing sales transition. This stance is perceived as potentially too cautious, which leads to a more optimistic view.

After Dynatrace reported better-than-expected Q2 earnings, the total annual recurring revenue growth has shown signs of stability, maintaining around 19%-20% year-over-year for the past several quarters. This trend is gradually building investor confidence despite the heightened execution risks associated with changes in the company's sales structure and longer sales cycles due to larger deal sizes. Additionally, the company experienced some early renewals in the quarter, which may be influenced by its 6-month sales compensation cycle that incentivizes first-half sales activity.

Dynatrace delivered robust second-quarter results, surpassing expectations on both revenue and earnings, with the annual recurring revenue outperforming analyst projections by $30M, driven by both favorable currency exchange conditions and robust expansion bookings. Business trends are perceived to continue positively with increasing momentum towards 2025, bolstered by an expanding Dynatrace Platform Subscription contracting mix, strong log management performance, and evolving sales changes attributable to a growing customer preference for comprehensive, all-in-one observability platforms.

Here are the latest investment ratings and price targets for $Dynatrace (DT.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月9日,多家華爾街大行更新了$Dynatrace (DT.US)$的評級,目標價介於55美元至65美元。

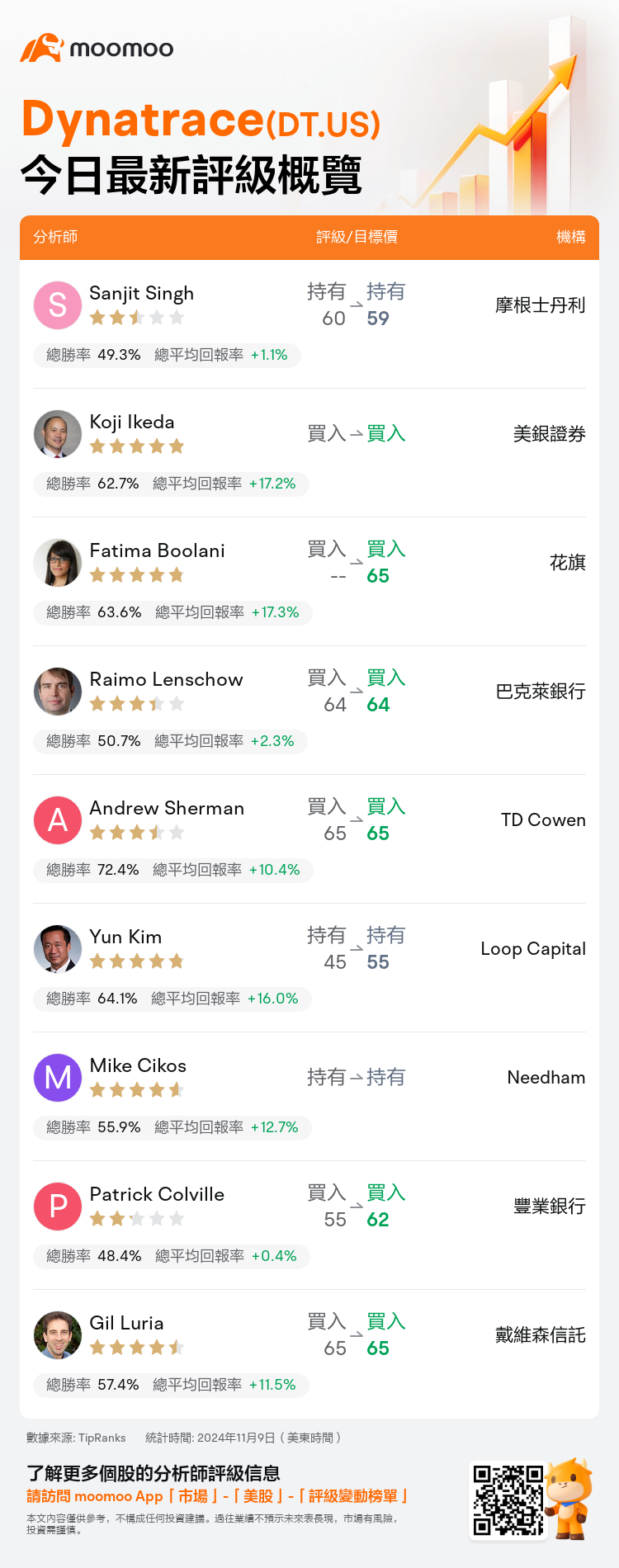

摩根士丹利分析師Sanjit Singh維持持有評級,並將目標價從60美元下調至59美元。

美銀證券分析師Koji Ikeda維持買入評級。

花旗分析師Fatima Boolani維持買入評級,目標價65美元。

花旗分析師Fatima Boolani維持買入評級,目標價65美元。

巴克萊銀行分析師Raimo Lenschow維持買入評級,維持目標價64美元。

TD Cowen分析師Andrew Sherman維持買入評級,維持目標價65美元。

此外,綜合報道,$Dynatrace (DT.US)$近期主要分析師觀點如下:

dynatrace錄得了'紮實的'財季第二季度,但決定維持FY25的展望,稱持續的銷售轉變。這種立場被視爲可能過於謹慎,導致更樂觀的看法。

在Dynatrace報告優於預期的Q2收益後,年度重複收入增長顯示出穩定跡象,過去幾個季度年增長率維持在19%-20%左右。儘管與公司銷售結構變化和更長的銷售週期(由於更大的交易規模)相關的執行風險增加,但這一趨勢逐漸增強了投資者的信心。此外,該公司在該季度經歷了一些提前續約,這可能受其爲期6個月的銷售補償週期影響,該週期鼓勵上半年的銷售活動。

Dynatrace發佈了強勁的第二季度業績報告,在營收和收益方面均超過預期,年度重複收入超出分析師預期3000萬美元,得益於有利的貨幣兌換條件和強勁的擴張預訂。業務趨勢被認爲將繼續保持積極,朝着2025年增長勢頭加強,受益於不斷擴大的Dynatrace平台訂閱合同組合、強勁的日誌管理表現,以及由於客戶越來越偏好全面的、一體化的可觀測平台所致的不斷演變的銷售變化。

以下爲今日9位分析師對$Dynatrace (DT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Fatima Boolani維持買入評級,目標價65美元。

花旗分析師Fatima Boolani維持買入評級,目標價65美元。

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.

Citi analyst Fatima Boolani maintains with a buy rating, and sets the target price at $65.