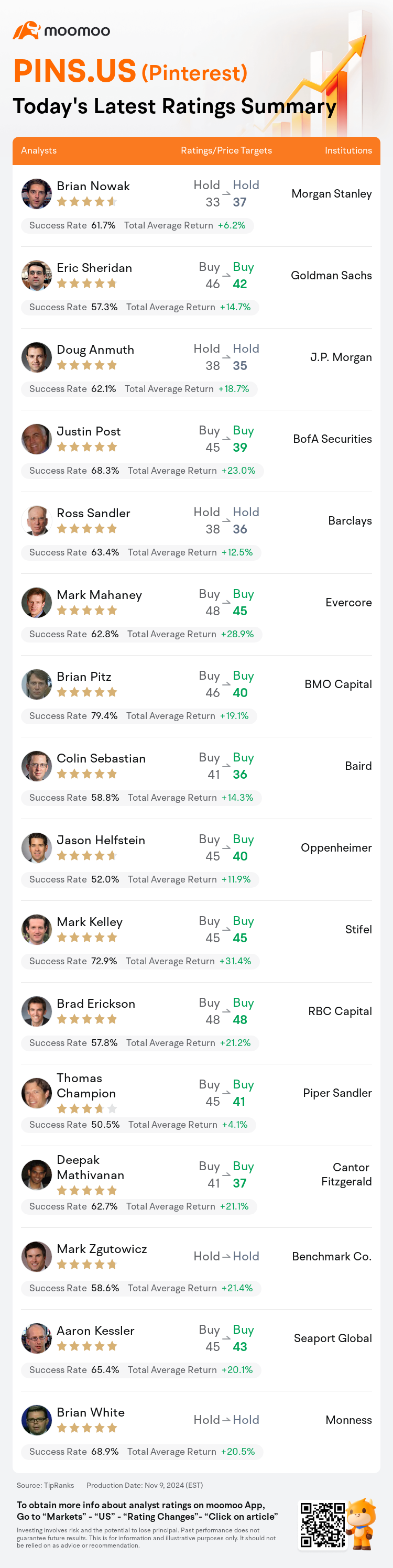

On Nov 09, major Wall Street analysts update their ratings for $Pinterest (PINS.US)$, with price targets ranging from $35 to $48.

Morgan Stanley analyst Brian Nowak maintains with a hold rating, and adjusts the target price from $33 to $37.

Goldman Sachs analyst Eric Sheridan maintains with a buy rating, and adjusts the target price from $46 to $42.

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $38 to $35.

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $38 to $35.

BofA Securities analyst Justin Post maintains with a buy rating, and adjusts the target price from $45 to $39.

Barclays analyst Ross Sandler maintains with a hold rating, and adjusts the target price from $38 to $36.

Furthermore, according to the comprehensive report, the opinions of $Pinterest (PINS.US)$'s main analysts recently are as follows:

Pinterest's Q3 revenue aligned with projections, highlighted by user expansion and margin growth, according to an analyst. In response to the company's 'soft' Q4 outlook, revisions include a 2% reduction in the forecasted FY25 revenue and a 1% decrease in the EBITDA projection. Nonetheless, there is anticipation for consistent advancement in 2025.

Macro trends are perceived to be relatively stable overall, yet persistent pressures in the Food & Beverage sector since December 2023 are impacting Pinterest's sales growth as the holiday season approaches.

Persistent category headwinds from the third quarter are continuing into the fourth, prompting revisions in revenue forecasts, with a 2% reduction for the year 2025 and a 2.2% decrease for 2026. Analysts anticipate that Pinterest's growth rates may begin to recover in the second quarter of 2025, with a more certain rebound expected by the third quarter, as the company overcomes these challenges.

Pinterest's user growth re-acceleration and increasing engagement poise the company for enhanced monetization opportunities globally. However, there is an adjustment in the long-term EBITDA projection owing to investments in technological talent and, to a lesser extent, ongoing sales and marketing expenses.

Pinterest's Q3 revenue and gross profit aligned with expectations, though Q4 revenue projections fell slightly below forecasts. It is suggested that the company may experience a positive shift in 2025 as macroeconomic pressures subside.

Here are the latest investment ratings and price targets for $Pinterest (PINS.US)$ from 16 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月9日,多家華爾街大行更新了$Pinterest (PINS.US)$的評級,目標價介於35美元至48美元。

摩根士丹利分析師Brian Nowak維持持有評級,並將目標價從33美元上調至37美元。

高盛集團分析師Eric Sheridan維持買入評級,並將目標價從46美元下調至42美元。

摩根大通分析師Doug Anmuth維持持有評級,並將目標價從38美元下調至35美元。

摩根大通分析師Doug Anmuth維持持有評級,並將目標價從38美元下調至35美元。

美銀證券分析師Justin Post維持買入評級,並將目標價從45美元下調至39美元。

巴克萊銀行分析師Ross Sandler維持持有評級,並將目標價從38美元下調至36美元。

此外,綜合報道,$Pinterest (PINS.US)$近期主要分析師觀點如下:

pinterest的第三季度營業收入與預期相符,突出用戶擴張和利潤增長,根據分析師的說法。針對公司「乏味」的第四季度展望,修訂包括將預測的2025財年營業收入減少2%和EBITDA預測減少1%。儘管如此,人們對2025年持續發展充滿期待。

宏觀趨勢整體被認爲相對穩定,但自2023年12月以來,食品飲料板塊持續存在壓力,這正影響到pinterest在節日季節臨近時的銷售增長。

第三季度持續存在的種類阻力延續到第四季度,促使修訂營業收入預測,2025年減少2%,2026年減少2.2%。分析師預計,pinterest的增長率可能在2025年第二季度開始恢復,預計在第三季度以更確定的反彈,公司克服這些挑戰。

pinterest的用戶增長重新加速和日益增強的參與度使公司在全球範圍內擁有增強的貨幣化機會。然而,由於對技術人才的投資以及在較小程度上持續的銷售和營銷費用,長期EBITDA預測發生調整。

pinterest的第三季度營業收入和毛利潤與預期相符,儘管第四季度營業收入預測略低於預期。有跡象顯示,隨着宏觀經濟壓力的減輕,公司可能在2025年經歷積極的變化。

以下爲今日16位分析師對$Pinterest (PINS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

摩根大通分析師Doug Anmuth維持持有評級,並將目標價從38美元下調至35美元。

摩根大通分析師Doug Anmuth維持持有評級,並將目標價從38美元下調至35美元。

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $38 to $35.

J.P. Morgan analyst Doug Anmuth maintains with a hold rating, and adjusts the target price from $38 to $35.