With EPS Growth And More, Sichuan Injet Electric (SZSE:300820) Makes An Interesting Case

With EPS Growth And More, Sichuan Injet Electric (SZSE:300820) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

對於一些投機者來說,投資一家公司扭轉其頹勢,這種刺激非常吸引人,所以即使沒有營業收入,沒有利潤,甚至是短缺記錄的公司,也能夠找到投資者。但正如彼得·林奇在《華爾街的一次升值》中所說,「長線賭注幾乎從來沒有產生回報。」 儘管一個經過資金充足的公司可以承受多年虧損,但它最終需要創造利潤,否則投資者也會離開,公司將會慢慢消亡。

In contrast to all that, many investors prefer to focus on companies like Sichuan Injet Electric (SZSE:300820), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

與其他公司相比,許多投資者更傾向於關注英傑電氣(SZSE:300820)這樣的公司,這家公司不僅有營業收入,而且有利潤。現在並不是說該公司提供了最佳的投資機會,但盈利能力是成功的關鍵因素之一。

How Quickly Is Sichuan Injet Electric Increasing Earnings Per Share?

英傑電氣每股收益增長有多快?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Sichuan Injet Electric has achieved impressive annual EPS growth of 41%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

市場短期內是一臺投票機,但長期來看是一臺稱重機,因此您可以預期股價最終會跟隨每股收益(EPS)的結果。因此,有經驗的投資者密切關注公司每股收益(EPS)進行投資研究。令股東欣喜的是,英傑電氣在過去三年內實現了每股收益年均複合增長41%。如此快速的增長可能會是短暫的,但應該足以引起謹慎的股票選擇者的興趣。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Sichuan Injet Electric achieved similar EBIT margins to last year, revenue grew by a solid 20% to CN¥2.0b. That's progress.

通常有助於查看利息前稅前利潤(EBIT)利潤率以及營業收入增長,以進一步了解公司增長的質量。儘管我們注意到英傑電氣去年實現了類似的EBIt利潤率,但營業收入增長了實質性的20%,達到了人民幣20億。這是進步。

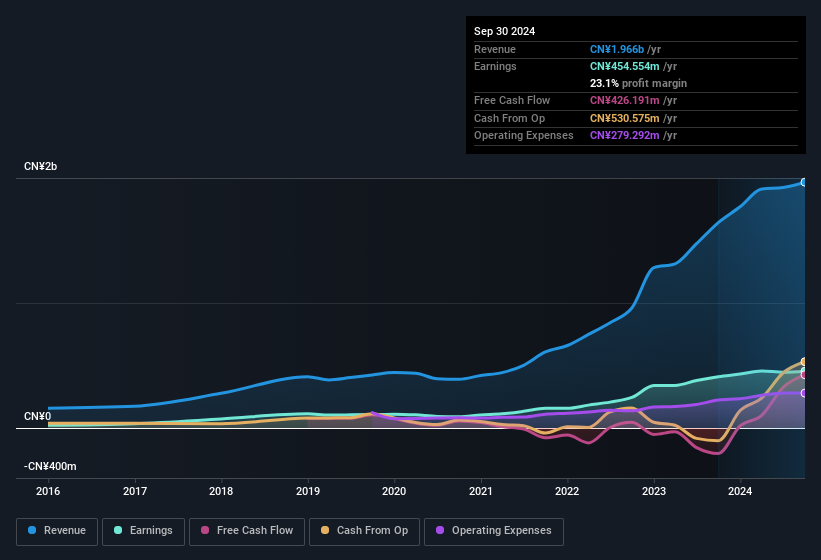

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

在下面的圖表中,您可以看到公司的盈利和收入隨着時間的推移而增長。要獲得更精細的詳細信息,請單擊圖像。

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Sichuan Injet Electric's forecast profits?

在投資中,正如在生活中一樣,未來比過去更重要。爲什麼不查看一下這個免費的交互式可視化,了解英傑電氣的未來利潤預測呢?

Are Sichuan Injet Electric Insiders Aligned With All Shareholders?

英傑電氣內部人是否與所有股東保持一致?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Sichuan Injet Electric will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 67% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. CN¥8.1b That level of investment from insiders is nothing to sneeze at.

看到內部人持有大量已發行股份通常是一個好跡象。他們的動機將與投資者一致,突然的拋售概率對股價的影響將減少。 所以那些對英傑電氣感興趣的人將高興地知道,內部人士顯示了他們的信念,持有公司股份的很大比例。準確地說,公司內部人持有公司的67%股份,因此他們的決定對他們的投資產生了重大影響。 這顯而易見地表明,他們將有動機長期規劃–對於採取持有策略的股東來說,這是一個利好。 81億人民幣,內部人員投資的水平不容忽視。

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Sichuan Injet Electric, with market caps between CN¥7.2b and CN¥23b, is around CN¥1.2m.

看到內部人投資於業務意義重大,但股東可能會想知道薪酬政策是否符合他們的最佳利益。 對董事長薪酬的簡要分析表明符合。 與英傑電氣等規模類似的公司的CEO的中位數總薪酬,市值在72億人民幣和230億人民幣之間,約爲120萬元。

Sichuan Injet Electric's CEO took home a total compensation package worth CN¥631k in the year leading up to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

英傑電氣的CEO在截止到2023年12月的一年中獲得了總額爲63.1萬人民幣的薪酬套餐。 實際上低於同規模公司的CEO的中位數。 CEO的薪酬水平對投資者來說並不是最重要的指標,但當薪酬較爲適度時,這支持CEO與普通股東之間的增強對齊。 這也可能是良好治理的一個跡象,更普遍地說。

Does Sichuan Injet Electric Deserve A Spot On Your Watchlist?

英傑電氣值得加入您的自選嗎?

Sichuan Injet Electric's earnings have taken off in quite an impressive fashion. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Sichuan Injet Electric certainly ticks a few boxes, so we think it's probably well worth further consideration. It is worth noting though that we have found 1 warning sign for Sichuan Injet Electric that you need to take into consideration.

英傑電氣的盈利表現相當出色。對於感興趣的人來說,額外的好處是管理層持有大量股票,CEO的薪酬也相當合理,表明良好的現金管理。巨大的盈利增長表明企業正變得越來越強大。希望這一趨勢持續到未來。英傑電氣確實符合一些要求,所以我們認爲進一步考慮是很值得的。不過值得注意的是,我們發現了1個英傑電氣的警告信號,您需要考慮。

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

雖然不選取增長收益和缺少內部人買入的股票可能會產生效果,但是對於重視這些關鍵指標的投資者,這裏是一份精心挑選的具有巨大增長潛力和內部人信心的CN公司列表。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Sichuan Injet Electric achieved similar EBIT margins to last year, revenue grew by a solid 20% to CN¥2.0b. That's progress.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Sichuan Injet Electric achieved similar EBIT margins to last year, revenue grew by a solid 20% to CN¥2.0b. That's progress.