Kiu Hung International Holdings Limited (HKG:381) Stocks Shoot Up 178% But Its P/S Still Looks Reasonable

Kiu Hung International Holdings Limited (HKG:381) Stocks Shoot Up 178% But Its P/S Still Looks Reasonable

Despite an already strong run, Kiu Hung International Holdings Limited (HKG:381) shares have been powering on, with a gain of 178% in the last thirty days. This latest share price bounce rounds out a remarkable 1,030% gain over the last twelve months.

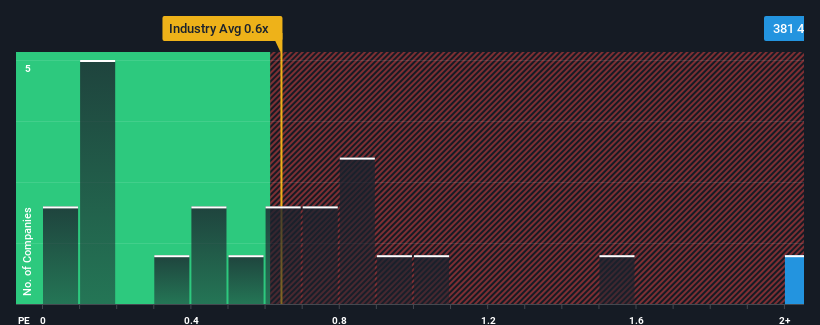

Following the firm bounce in price, when almost half of the companies in Hong Kong's Leisure industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Kiu Hung International Holdings as a stock not worth researching with its 4.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Kiu Hung International Holdings Has Been Performing

As an illustration, revenue has deteriorated at Kiu Hung International Holdings over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kiu Hung International Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Kiu Hung International Holdings would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Kiu Hung International Holdings would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.4%. Still, the latest three year period has seen an excellent 64% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's understandable that Kiu Hung International Holdings' P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Kiu Hung International Holdings' P/S Mean For Investors?

Kiu Hung International Holdings' P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Kiu Hung International Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Kiu Hung International Holdings (including 3 which shouldn't be ignored).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.