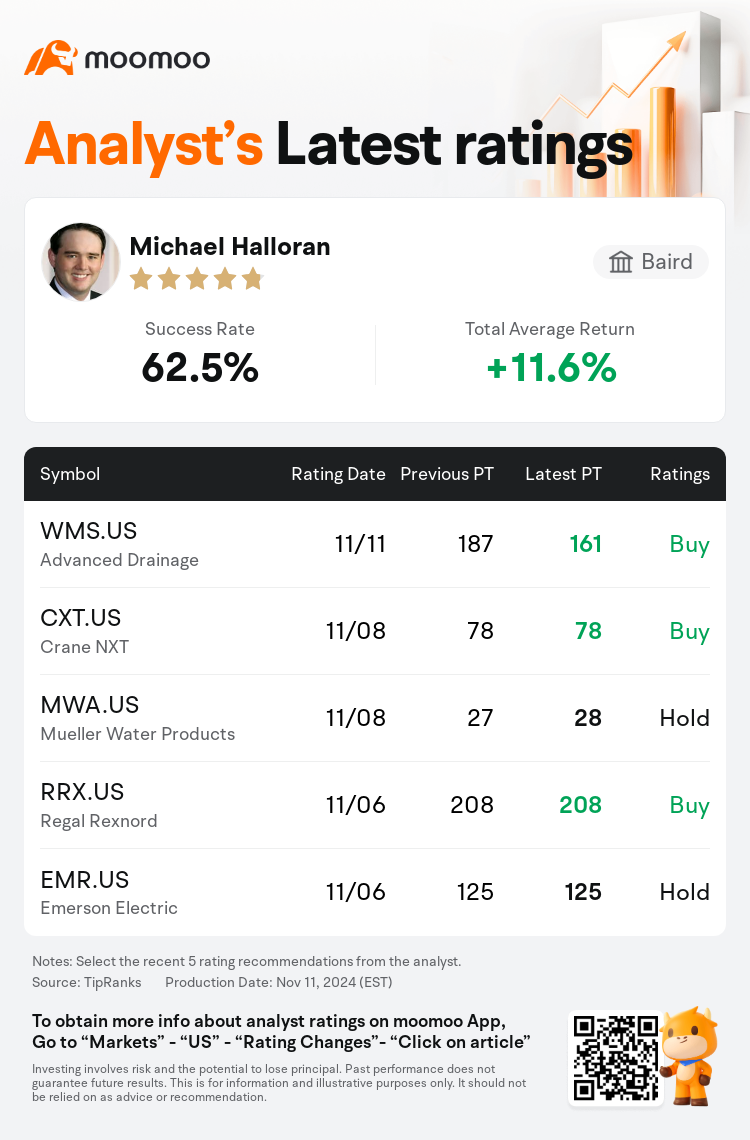

Baird analyst Michael Halloran maintains $Advanced Drainage (WMS.US)$ with a buy rating, and adjusts the target price from $187 to $161.

According to TipRanks data, the analyst has a success rate of 62.5% and a total average return of 11.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Advanced Drainage (WMS.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Advanced Drainage (WMS.US)$'s main analysts recently are as follows:

The company has reduced its guidance due to a multitude of pressures including non-residential sector challenges, weather-related impacts, and rising input costs, as shared with investors.

The firm has adjusted its stance on Advanced Drainage following their recent quarterly results. The modification is a reflection of the market's reaction to margin pressures that were anticipated, albeit to a lesser degree, and are primarily attributed to increased input costs rather than a decline in top-line pricing. The analyst perceives the current dip in share value as an opportunity to invest in a promising narrative, bolstered by the momentum of material conversion and numerous opportunities for sustained margin improvement.

Beyond adjustments to estimates and expectations for reduced non-residential demand, the focus is on the challenge of raising prices to counteract increased material costs. However, this is primarily a cyclical matter. Currently, pricing remains stable, and it is anticipated that pricing will bounce back alongside demand, with the company still maintaining commendable margin levels.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

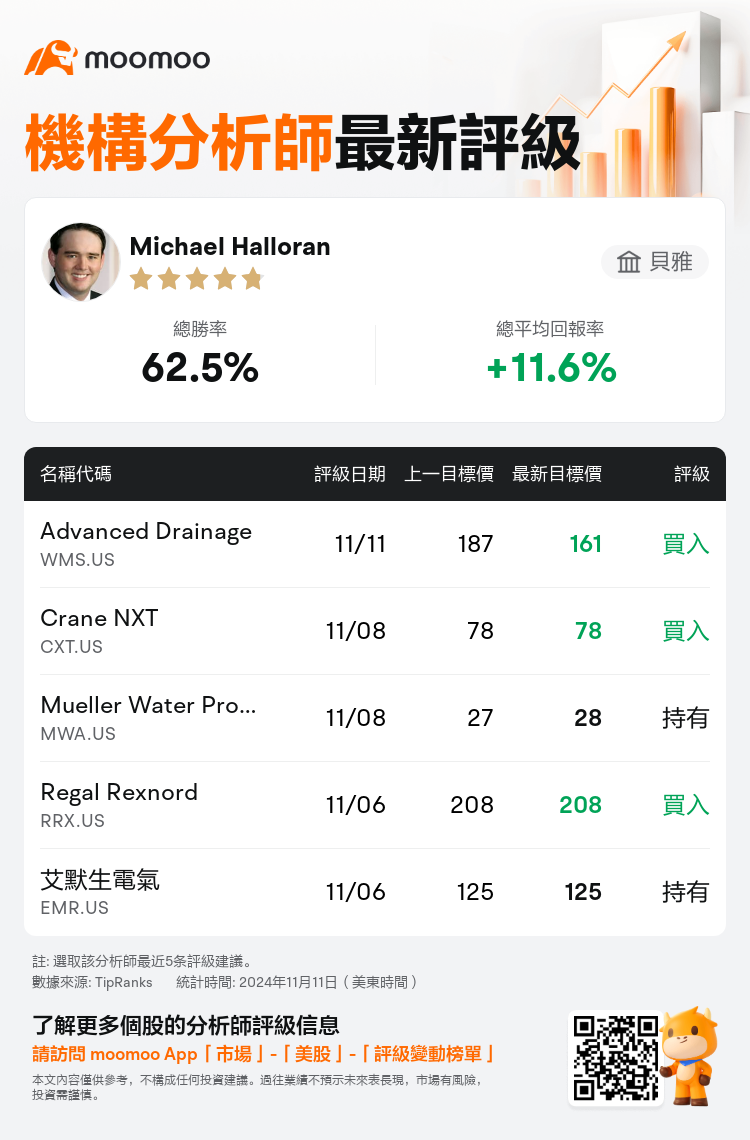

貝雅分析師Michael Halloran維持$Advanced Drainage (WMS.US)$買入評級,並將目標價從187美元下調至161美元。

根據TipRanks數據顯示,該分析師近一年總勝率為62.5%,總平均回報率為11.6%。

此外,綜合報道,$Advanced Drainage (WMS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Advanced Drainage (WMS.US)$近期主要分析師觀點如下:

因多種壓力,包括非住宅板塊挑戰、與天氣相關的影響和上升的輸入成本,公司已經調降了其指引,這一信息已分享給投資者。

公司根據最近的季度業績調整了對advanced drainage的立場。這一修改反映了市場對預期的利潤壓力的反應,儘管程度較低,主要歸因於增加的輸入成本而非銷售額定價下降。分析師認爲當前股價下跌是一個投資於一個有前景故事的機會,這個故事得到了材料轉換勢頭和持續提高利潤率的衆多機會的支持。

除了調整對降低非住宅需求的預期和預期之外,焦點在於應對增加的材料成本挑戰提高價格。然而,這主要是一個週期性問題。目前,定價仍然穩定,預計價格將隨着需求一起反彈,公司仍將保持值得稱讚的利潤率水平。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Advanced Drainage (WMS.US)$近期主要分析師觀點如下:

此外,綜合報道,$Advanced Drainage (WMS.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of