Top 4 Real Estate Stocks That May Rocket Higher In November

Top 4 Real Estate Stocks That May Rocket Higher In November

可能在11月飆升的前四家房地產業股票

The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

房地產板塊中最超賣的股票爲買入低估公司提供良機。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

Lineage Inc (NASDAQ:LINE)

Lineage公司(納斯達克: LINE)

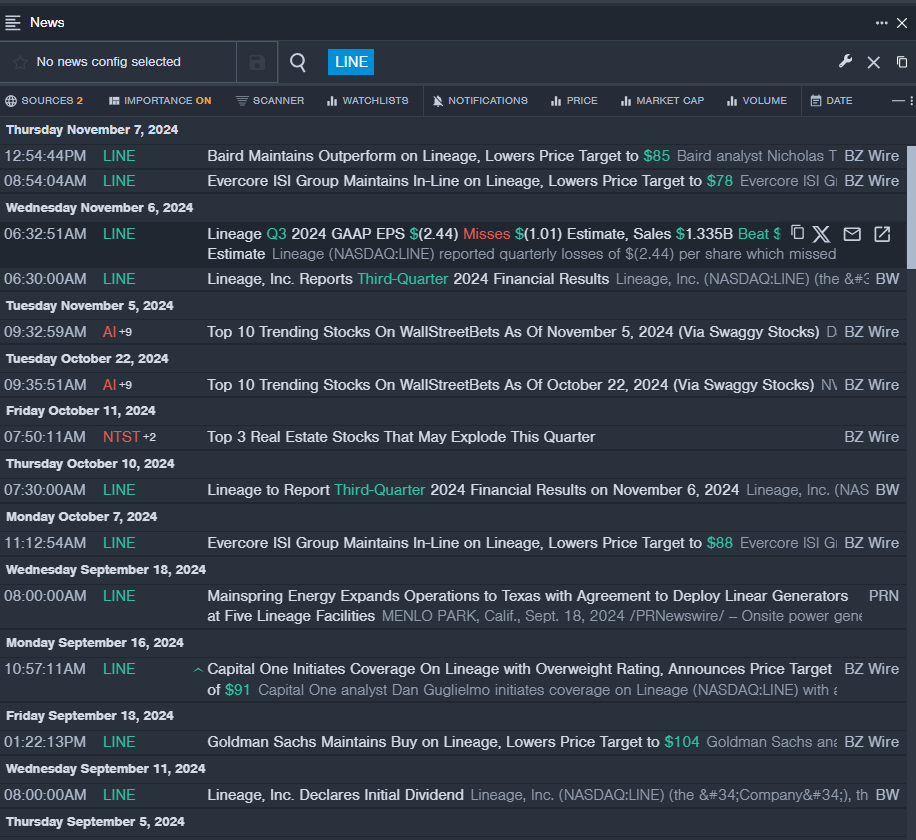

- On Nov. 6, Lineage reported a quarterly loss of $2.44 per share which missed the analyst consensus estimate of a loss of $1.01 per share. The company reported quarterly sales of $1.335 billion which beat the analyst consensus estimate of $1.329 billion by 0.44 percent. The company's stock fell around 11% over the past month and has a 52-week low of $66.94.

- RSI Value: 22.05

- LINE Price Action: Shares of Lineage fell 1.1% to close at $67.32 on Friday.

- Benzinga Pro's real-time newsfeed alerted to latest LINE news.

- 11月6日,Lineage報告每股虧損2.44美元,超過分析師共識預期的1.01美元虧損。公司每季度銷售額爲13.35億美元,比分析師共識預期的13.29億美元高出0.44%。該公司股價在過去一個月下跌約11%,52周最低價爲66.94美元。

- RSI數值: 22.05

- LINE股價走勢: Lineage股票週五下跌1.1%,收於67.32美元。

- Benzinga Pro的實時新聞提醒了最新LINE新聞。

Americold Realty Trust Inc (NYSE:COLD)

美寒地產信託公司(紐約交易所:COLD)

- On Nov, 7, Americold Realty Trust reported worse-than-expected third-quarter financial results. George Chappelle, Chief Executive Officer of Americold Realty Trust, stated, "We are pleased with our third quarter results where we delivered AFFO per share of $0.35, an increase of 11% versus prior year's quarter. This performance was again driven by organic growth as we produced double digit year-over-year growth in the Global Warehouse Same Store NOI of approximately 11% on a constant currency basis." The company's stock fell around 15% over the past month and has a 52-week low of $21.87.

- RSI Value: 18.80

- COLD Price Action: Shares of Americold Realty Trust fell 1.8% to close at $22.76 on Friday.

- Benzinga Pro's charting tool helped identify the trend in COLD stock.

- 11月7日,美寒地產信託公司報告了遜於預期的第三季度財務業績。美寒地產信託公司首席執行官喬治·沙佩爾表示:「我們對第三季度的業績感到滿意,我們的每股經調節資金流量爲0.35美元,比去年同期增長了11%。這一業績再次得益於有機增長,我們在全球倉儲相同店鋪經營淨營收方面獲得了約11%的年度增長率,按恒定匯率計算。」該公司的股價在過去一個月左右下跌了約15%,52周最低價爲21.87美元。

- RSI值:18.80

- COLD價格走勢:美寒地產信託公司股票週五下跌1.8%,收於22.76美元。

- Benzinga Pro的圖表工具幫助識別了COLD股票的趨勢。

Diversified Healthcare Trust (NASDAQ:DHC)

多樣化醫療保健信託基金(NASDAQ:DHC)

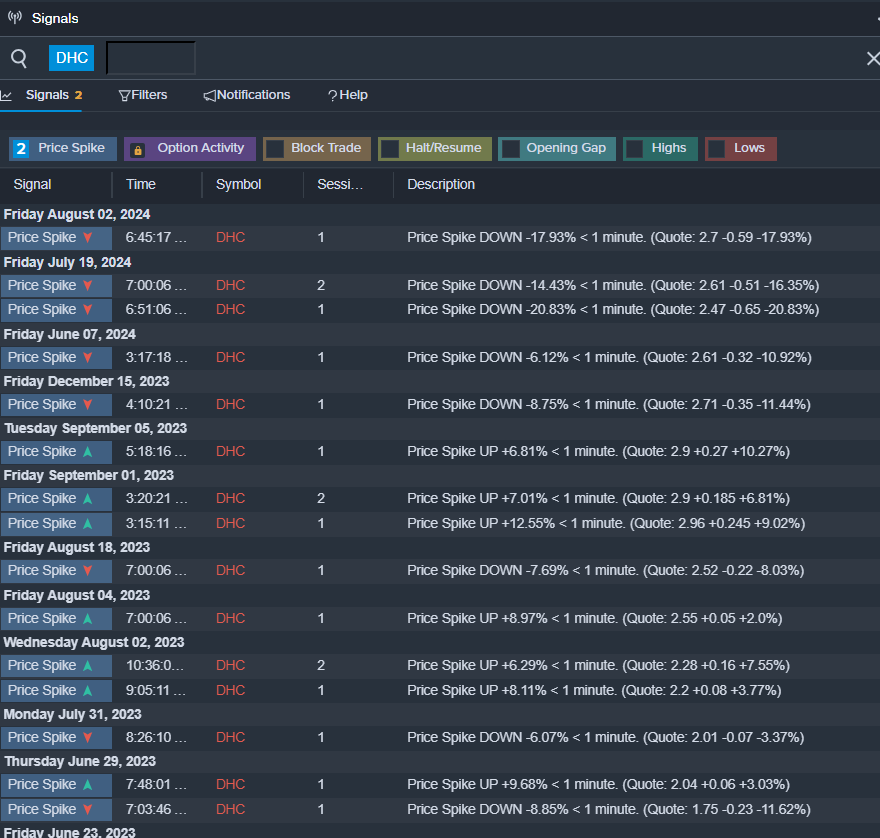

- On Nov. 4, Diversified Healthcare Trust shares are trading lower after the company reported worse-than-expected third-quarter financial results. The company's stock fell around 25% over the past five days and has a 52-week low of $1.94.

- RSI Value: 25.68

- DHC Price Action: Shares of Diversified Healthcare Trust fell 1.9% to close at $2.63 on Friday.

- Benzinga Pro's signals feature notified of a potential breakout in DHC shares.

- 11月4日,diversified healthcare trust股票下跌,因爲該公司業績低於預期。過去五天,該公司的股價下跌了約25%,52周最低價爲1.94美元。

- RSI數值:25.68

- DHC價格走勢:Diversified Healthcare Trust股價下跌1.9%,週五收盤價爲2.63美元。

- 貝寧港Pro的信號功能提醒DHC股票存在潛在突破。

Innovative Industrial Properties Inc (NYSE:IIPR)

創新工業房地產(紐約證券交易所:IIPR)

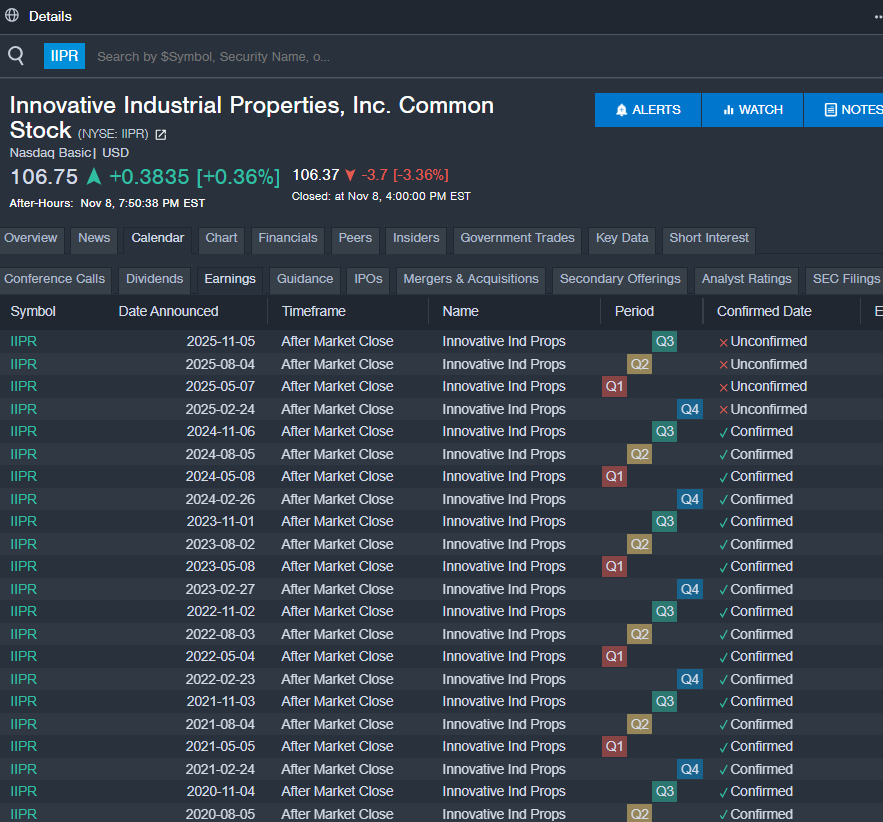

- On Nov. 6, Innovative Industrial Properties reported worse-than-expected third-quarter financial results. The company's shares lost around 16% over the past five days. The company's 52-week low is $73.04.

- RSI Value: 20.87

- IIPR Price Action: Shares of IIPR fell 3.4% to close at $106.37 on Friday.

- Benzinga Pro's earnings calendar was used to track upcoming IIPR earnings reports.

- 11月6日,創新工業房地產公佈了財務報告,低於預期。過去五天,該公司股票下跌了約16%,52周最低價爲73.04美元。

- RSI數值:20.87

- IIPR股價走勢:週五收盤時,IIPR股價下跌3.4%,至106.37美元。

- Benzinga Pro的業績日曆被用於跟蹤即將發佈的IIPR業績。

Read More:

閱讀更多:

- Dow, S&P 500 Notch Best Week Of Year As Tesla Surges Post Trump Win: Investor Sentiment Improves, Fear & Greed Index Remains In 'Neutral' Zone

- 道指、標普500創下本年度最佳一週,特斯拉飆升,特朗普贏得後股市投資者情緒改善,恐懼與貪婪指數仍處於'中立'區域