Financial giants have made a conspicuous bullish move on Novo Nordisk. Our analysis of options history for Novo Nordisk (NYSE:NVO) revealed 23 unusual trades.

Delving into the details, we found 56% of traders were bullish, while 26% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $401,684, and 14 were calls, valued at $675,514.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $200.0 for Novo Nordisk over the recent three months.

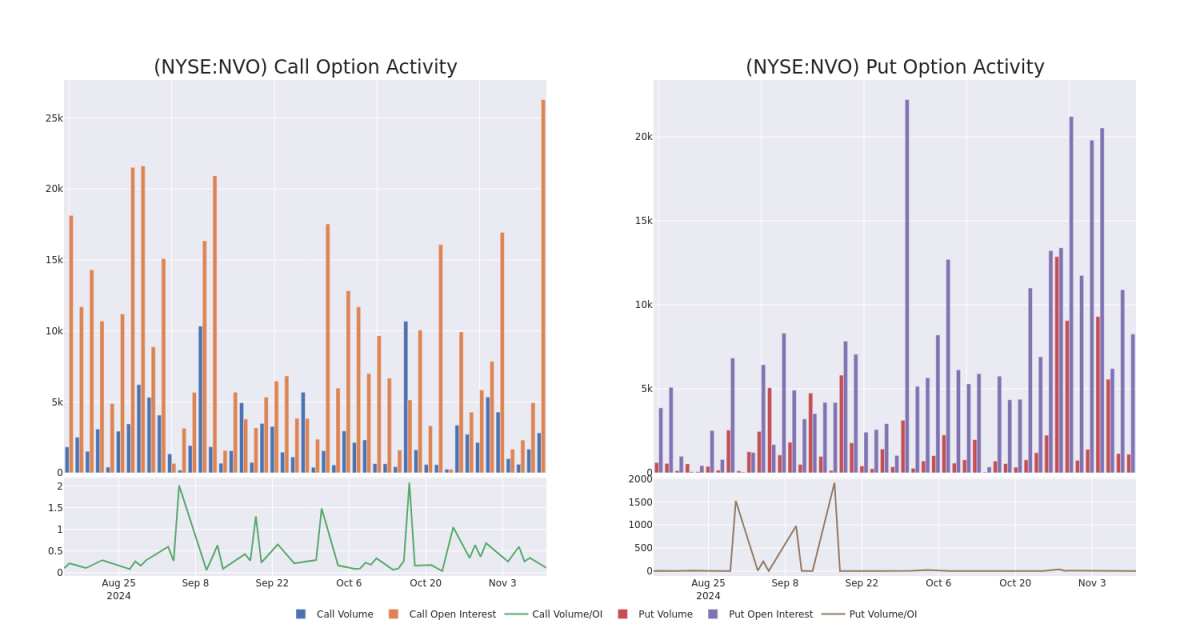

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Novo Nordisk Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| NVO | CALL | SWEEP | BULLISH | 01/17/25 | $2.28 | $2.19 | $2.25 | $125.00 | $112.3K | 6.6K | 702 |

| NVO | PUT | SWEEP | BULLISH | 03/21/25 | $10.7 | $10.65 | $10.65 | $115.00 | $93.7K | 1.1K | 100 |

| NVO | CALL | TRADE | BULLISH | 01/17/25 | $13.65 | $13.5 | $13.6 | $100.00 | $85.6K | 1.1K | 78 |

| NVO | PUT | TRADE | BULLISH | 03/21/25 | $36.25 | $35.95 | $35.95 | $145.00 | $71.9K | 11 | 20 |

| NVO | CALL | SWEEP | BULLISH | 12/20/24 | $2.37 | $2.26 | $2.37 | $120.00 | $70.6K | 9.7K | 632 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

Having examined the options trading patterns of Novo Nordisk, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Novo Nordisk

- With a trading volume of 3,829,487, the price of NVO is up by 1.72%, reaching $109.05.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 79 days from now.

What The Experts Say On Novo Nordisk

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $160. * An analyst from BMO Capital has decided to maintain their Outperform rating on Novo Nordisk, which currently sits at a price target of $156.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

金融巨頭對諾和諾德採取了明顯的看漲舉動。我們對諾和諾德(紐約證券交易所代碼:NVO)期權歷史的分析顯示了23筆不尋常的交易。

深入研究細節,我們發現56%的交易者看漲,而26%的交易者表現出看跌傾向。在我們發現的所有交易中,有9筆是看跌期權,價值爲401,684美元,14筆是看漲期權,價值675,514美元。

預測的價格區間

根據交易活動,看來重要投資者的目標是在最近三個月中將諾和諾德的價格範圍從70.0美元擴大到200.0美元。

交易量和未平倉合約的發展

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Novo Nordisk在指定行使價下期權的流動性和投資者對Novo Nordisk期權的興趣。即將發佈的數據可視化了與諾和諾德的大量交易相關的看漲期權和未平倉合約的波動,在過去30天內,行使價範圍從70.0美元到200.0美元不等。

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Novo Nordisk在指定行使價下期權的流動性和投資者對Novo Nordisk期權的興趣。即將發佈的數據可視化了與諾和諾德的大量交易相關的看漲期權和未平倉合約的波動,在過去30天內,行使價範圍從70.0美元到200.0美元不等。

諾和諾德期權活動分析:過去 30 天

觀察到的最大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

NVO | CALL | SWEEP | BULLISH | 01/17/25 | $2.28 | $2.19 | $2.25 | $125.00 | $112.3K | 6.6K | 702 |

NVO | PUT | SWEEP | BULLISH | 03/21/25 | $10.7 | $10.65 | $10.65 | $115.00 | $93.7K | 1.1K | 100 |

NVO | CALL | TRADE | BULLISH | 01/17/25 | $13.65 | $13.5 | $13.6 | $100.00 | $85.6K | 1.1K | 78 |

NVO | PUT | TRADE | BULLISH | 03/21/25 | $36.25 | $35.95 | $35.95 | $145.00 | $71.9K | 11 | 20 |

NVO | CALL | SWEEP | BULLISH | 12/20/24 | $2.37 | $2.26 | $2.37 | $120.00 | $70.6K | 9.7K | 632 |

關於 Novo Nordisk

諾和諾德擁有全球品牌糖尿病治療市場約三分之一的份額,是全球領先的糖尿病護理產品提供商。該公司總部位於丹麥,生產和銷售各種人用和現代胰島素、注射型糖尿病治療藥物(如 GLP-1 療法)、口服抗糖尿病藥物和肥胖療法。Novo還有一個生物製藥板塊(約佔收入的10%),專門研究血友病和其他疾病的蛋白質療法。

在研究了Novo Nordisk的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

諾和諾德的當前位置

專家對諾和諾德的看法

在過去的30天中,共有2位專業分析師對該股發表了看法,將平均目標股價設定爲158.0美元。

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處查看。* 坎託·菲茨傑拉德的一位分析師將其股票評級下調至增持,目標股價爲160美元。*BMO Capital的一位分析師已決定維持對諾和諾德的跑贏大盤評級,該評級目前的目標股價爲156美元。

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用 Benzinga Pro 了解諾和諾德的最新期權交易,獲取實時提醒。

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Novo Nordisk在指定行使價下期權的流動性和投資者對Novo Nordisk期權的興趣。即將發佈的數據可視化了與諾和諾德的大量交易相關的看漲期權和未平倉合約的波動,在過去30天內,行使價範圍從70.0美元到200.0美元不等。

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了Novo Nordisk在指定行使價下期權的流動性和投資者對Novo Nordisk期權的興趣。即將發佈的數據可視化了與諾和諾德的大量交易相關的看漲期權和未平倉合約的波動,在過去30天內,行使價範圍從70.0美元到200.0美元不等。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk's substantial trades, within a strike price spectrum from $70.0 to $200.0 over the preceding 30 days.