Hefei I-TEK OptoElectronics Co., Ltd. (SHSE:688610) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Hefei I-TEK OptoElectronics Co., Ltd. (SHSE:688610) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

Hefei I-TEK OptoElectronics Co., Ltd. (SHSE:688610) shares have continued their recent momentum with a 29% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

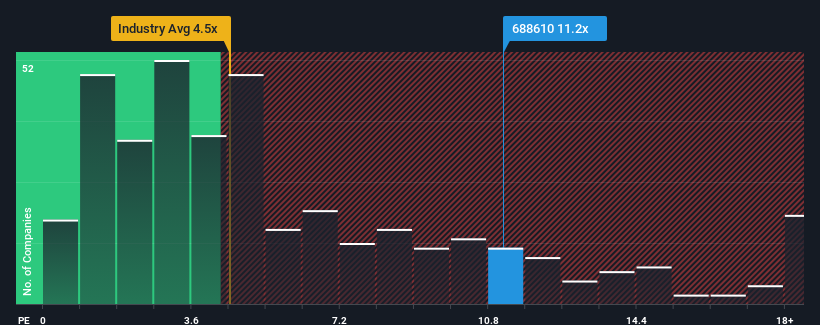

Following the firm bounce in price, Hefei I-TEK OptoElectronics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 11.2x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.5x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Hefei I-TEK OptoElectronics' P/S Mean For Shareholders?

Revenue has risen firmly for Hefei I-TEK OptoElectronics recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hefei I-TEK OptoElectronics will help you shine a light on its historical performance.How Is Hefei I-TEK OptoElectronics' Revenue Growth Trending?

In order to justify its P/S ratio, Hefei I-TEK OptoElectronics would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Hefei I-TEK OptoElectronics would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The strong recent performance means it was also able to grow revenue by 55% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 27% shows it's noticeably less attractive.

With this in mind, we find it worrying that Hefei I-TEK OptoElectronics' P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Hefei I-TEK OptoElectronics' P/S Mean For Investors?

The strong share price surge has lead to Hefei I-TEK OptoElectronics' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hefei I-TEK OptoElectronics revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. Right now we aren't comfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Hefei I-TEK OptoElectronics with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.