Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically...Silver Would Be Down Twice As Much'

Economist Peter Schiff Sees 'A Silver Lining' As Gold Plummets, While Investors Rush To Snap Up Bitcoin Gains: 'Typically...Silver Would Be Down Twice As Much'

As cryptocurrency prices hover around record levels, investors have been keen on adding them to their portfolios. This is evident by the rise in various Bitcoin (CRYPTO: BTC) ETF levels. However, gold prices have declined by nearly 1% in the morning hours as cryptocurrency prices surged. While silver prices have been down too, Peter Schiff, the chairman of SchiffGold.com and chief economist and global strategist at Europac.com suggests that investors should go for silver over Bitcoin as the precious yellow metal declines.

隨着加密貨幣價格徘徊在創紀錄的水平附近,投資者一直熱衷於將其添加到他們的投資組合中。各種比特幣(加密貨幣:BTC)ETF水平的上升就證明了這一點。但是,由於加密貨幣價格的飆升,黃金價格在上午下跌了近1%。儘管白銀價格也有所下跌,但SchiffGold.com董事長兼Europac.com首席經濟學家兼全球策略師彼得·希夫建議,隨着貴金屬的下跌,投資者應該選擇白銀而不是比特幣。

What Happened: Schiff suggests that "typically" silver prices should drop to about half the rate of gold. However, with silver prices holding steady amid market fluctuations, he views this resilience as a "silver lining." Schiff believes this unusual performance makes silver an attractive investment alternative to Bitcoin and gold ETFs, given its relative stability in the current market.

發生了什麼:希夫建議,「通常」 白銀價格應降至黃金價格的一半左右。但是,由於白銀價格在市場波動中保持穩定,他將這種彈性視爲 「一線希望」。希夫認爲,鑑於白銀在當前市場中的相對穩定,這種不尋常的表現使白銀成爲比特幣和黃金ETF的有吸引力的投資替代品。

Also read: Bitcoin Blasts Through $88,000 As Market 'Euphoria,' Regulatory Optimism Take Hold

另請閱讀:隨着市場 「欣快感」,監管樂觀情緒扎根,比特幣突破88,000美元

Why It Matters: Comparing the ETFs of all three assets, we see that gold and silver ETFs have underperformed bitcoin ETFs. Gold spot rates (NASDAQ:XAU) were down 1.05% at $2,591.34 per ounce, Silver spot rates (NASDAQ:XAG) were down by 1.25% at $30.30 per ounce and Bitcoin (CRYPTO: BTC) trading at $87,504.28 per coin at the time of publication.

爲何重要:比較所有三種資產的ETF,我們發現黃金和白銀ETF的表現低於比特幣ETF。在發佈之時,黃金現貨利率(納斯達克股票代碼:XAU)下跌1.05%,至每盎司2591.34美元,白銀現貨利率(納斯達克股票代碼:XAG)下跌1.25%,至每盎司30.30美元,比特幣(加密貨幣:BTC)交易價格爲每枚硬幣87,504.28美元。

Also read: Here's How Much $100 In Dogecoin Today Could Be Worth If DOGE Hits New All-Time Highs

另請閱讀:如果DOGE創下歷史新高,今天的100美元狗狗幣可能值多少錢

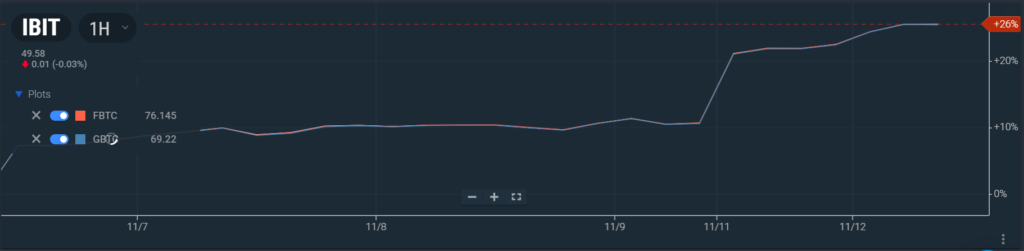

The iShares Bitcoin Trust (NASDAQ:IBIT) was up by 13.5% as of Monday's close. Additionally, the Fidelity Wise Origin Bitcoin Fund (BATS:FBTC) and the Grayscale Bitcoin Trust (NYSE:GBTC) ETFs rose by 13.4% on Monday, as per Benzinga Pro data.

截至週一收盤,iShares比特幣信託基金(納斯達克股票代碼:IBIT)上漲了13.5%。此外,根據Benzinga Pro的數據,富達Wise Origin比特幣基金(BATS: FBTC)和灰度比特幣信託基金(紐約證券交易所代碼:GBTC)ETF週一上漲了13.4%。

According to Benzinga Pro, Franklin Responsibility Sourced Gold ETF (NYSE:FGDL) declined 2.25% as of Monday's close, whereas the SPDR Gold MiniShares Trust (NYSE:GLDM) was down by 2.35% on the same day. iShares Gold Trust Micro Shares (NYSE:IAUM) declined by 2.39% on Monday.

根據Benzinga Pro的數據,富蘭克林責任源黃金ETF(紐約證券交易所代碼:FGDL)截至週一收盤時下跌2.25%,而SPDR黃金迷你股信託基金(紐約證券交易所代碼:GLDM)同日下跌2.35%。iShares Gold Trust微型股票(紐約證券交易所代碼:IAUM)週一下跌2.39%。

Also Read: Gold ETF Hit With $1 Billion Outflow: Investors Dump Safe Haven Asset After Trump Win

另請閱讀:黃金ETF流出10億美元:特朗普獲勝後,投資者拋售避險資產

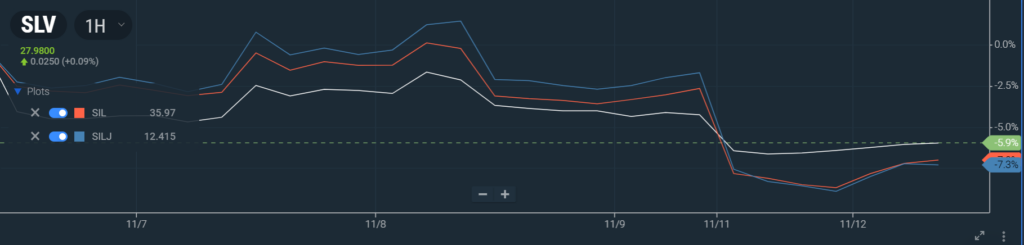

While the gold ETFs fell by over 2% on Monday, silver ETFs were down too. As per Benzinga Pro data, iShares Silver Trust (NYSE:SLV) was down 1.79% on Monday. Similarly, Global X Silver Miners ETF (NYSE:SIL) and Amplify ETF Trust Amplify Junior Silver Miners ETF (NYSE:SILJ) were down by 4.39% and 5.77% as of Monday's close.

儘管週一黃金ETF下跌了2%以上,但白銀ETF也下跌了。根據Benzinga Pro的數據,iShares Silver Trust(紐約證券交易所代碼:SLV)週一下跌了1.79%。同樣,截至週一收盤,Global X Silver Miners ETF(紐約證券交易所代碼:SIL)和Amplify ETF Trust Amplify Junior Silver Miners ETF(紐約證券交易所代碼:SILJ)下跌了4.39%和5.77%。

Also read: Why Trump's Win Has 2 Market Experts Betting On Small Caps, Financials

另請閱讀:爲什麼特朗普的勝利讓兩位市場專家押注小盤股和金融股

Image Via Shutterstock

圖片來自 Shutterstock