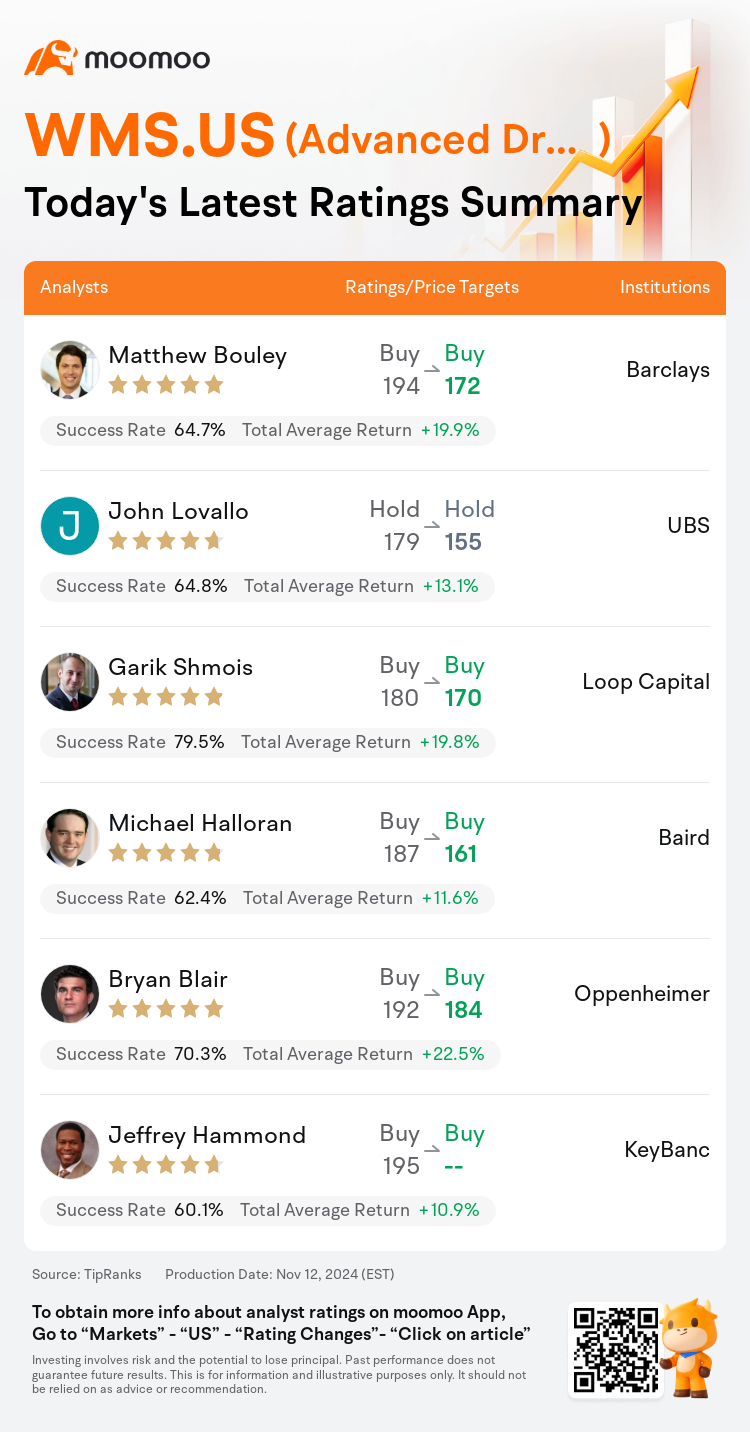

On Nov 12, major Wall Street analysts update their ratings for $Advanced Drainage (WMS.US)$, with price targets ranging from $155 to $184.

Barclays analyst Matthew Bouley maintains with a buy rating, and adjusts the target price from $194 to $172.

UBS analyst John Lovallo maintains with a hold rating, and adjusts the target price from $179 to $155.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Baird analyst Michael Halloran maintains with a buy rating, and adjusts the target price from $187 to $161.

Oppenheimer analyst Bryan Blair maintains with a buy rating, and adjusts the target price from $192 to $184.

Furthermore, according to the comprehensive report, the opinions of $Advanced Drainage (WMS.US)$'s main analysts recently are as follows:

The company's outlook has been adjusted due to a combination of factors including the non-residential sector, weather-related challenges, and rising input costs.

The company's Q2 earnings fell short of expectations, and subsequent guidance revision came unexpectedly as the quarter appeared to be aligning well despite the erratic non-residential environment. Sales did not meet forecasts due to storm-related impacts and adverse price-to-cost conditions. Nonetheless, the period's highlights were bolstered by robust infrastructure and residential sales.

The firm observed that shares declined by 14.3% following the company's Q2 performance, which fell short of expectations, and its subsequent reduction in FY25 guidance. This adjustment was made to account for ongoing volatility in non-residential demand, delays in projects due to hurricanes, and persisting challenges with pricing and costs. In light of the results from the first half of the year and prevailing business trends, the company has revised its FY25 sales forecast. Despite the disappointing results and lowered guidance, the opinion is that the risks for the second half of the year have been significantly mitigated. The firm suggests that the market's reaction may have been excessive and sees this as an opportune moment for investors to consider engaging with this unique water management asset.

The reduction in margins was anticipated due to well-known inconsistencies within the Non-Residential sector. The impression is that the investor concerns largely centered around the extent of margin pressures resulting from pricing strategies. However, this seems primarily linked to elevated input costs rather than a weakening of top-line pricing. Despite a more cautious outlook on end-market and margin trends, the view is that the current decline in share price presents an opportunity to invest in a robust narrative that is bolstered by material conversion drivers and numerous opportunities for sustained margin improvement.

Apart from reducing estimates and adjusting for lower non-residential expectations, the primary concern is centered on the challenge of increasing prices to counterbalance rising material costs, which is essentially a cyclical debate. However, pricing remains stable on a sequential basis, and it is anticipated to recover alongside demand. Moreover, the absolute margin levels remain noteworthy.

Here are the latest investment ratings and price targets for $Advanced Drainage (WMS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

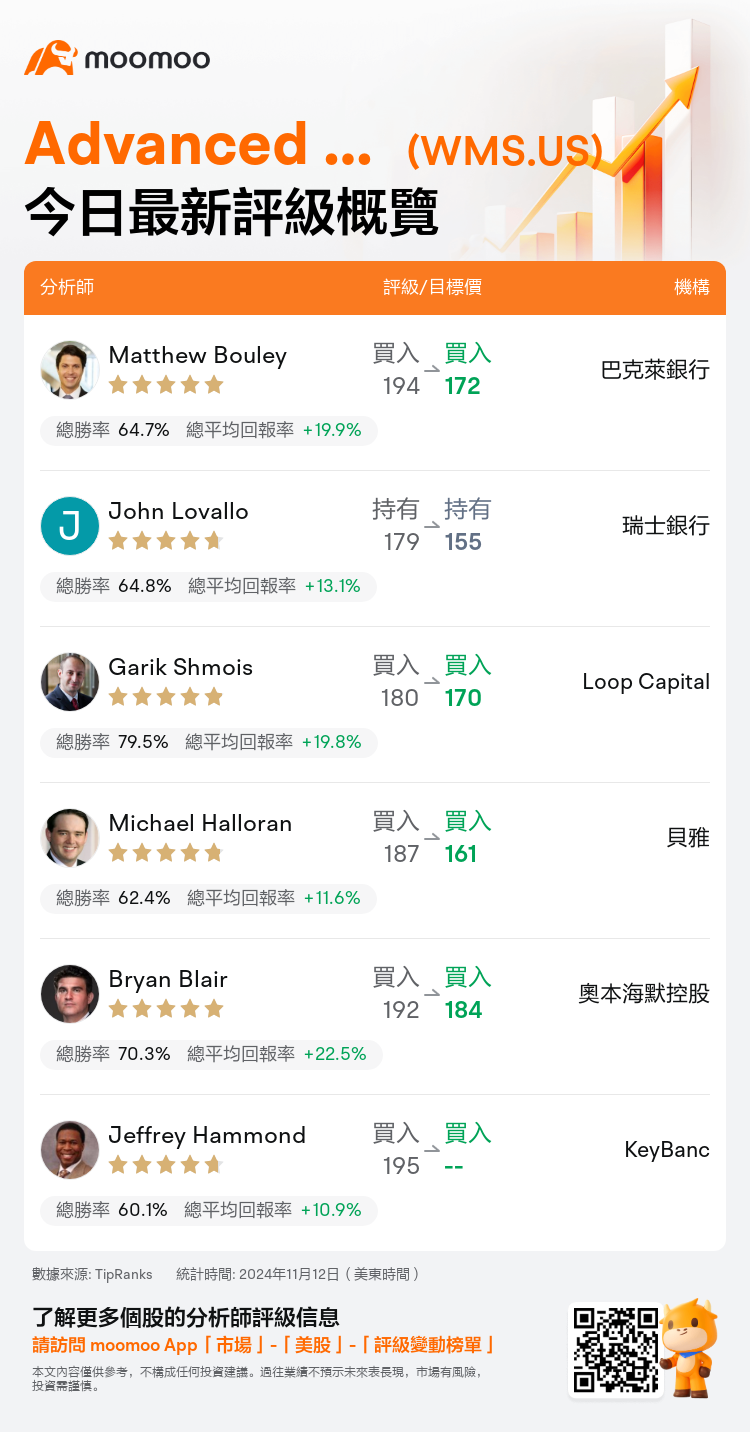

美東時間11月12日,多家華爾街大行更新了$Advanced Drainage (WMS.US)$的評級,目標價介於155美元至184美元。

巴克萊銀行分析師Matthew Bouley維持買入評級,並將目標價從194美元下調至172美元。

瑞士銀行分析師John Lovallo維持持有評級,並將目標價從179美元下調至155美元。

Loop Capital分析師Garik Shmois維持買入評級,並將目標價從180美元下調至170美元。

Loop Capital分析師Garik Shmois維持買入評級,並將目標價從180美元下調至170美元。

貝雅分析師Michael Halloran維持買入評級,並將目標價從187美元下調至161美元。

奧本海默控股分析師Bryan Blair維持買入評級,並將目標價從192美元下調至184美元。

此外,綜合報道,$Advanced Drainage (WMS.US)$近期主要分析師觀點如下:

由於包括非住宅板塊、與天氣相關的挑戰和不斷上升的成本等因素的組合,該公司的前景已經調整。

公司的第二季度收益表現不佳,隨後的指引修訂出乎意料,因爲該季度似乎進展順利,儘管非住宅環境不穩定。由於暴風雨造成的影響和不利的價格成本條件,銷售沒有達到預期。儘管如此,該時期的亮點仍受益於強勁的基礎設施和住宅銷售。

該公司觀察到,隨着公司第二季度業績表現不佳及其隨後對FY25指引的調整,股價下跌了14.3%。此次調整是爲了應對非住宅需求的持續波動、由於颶風引發的項目延遲以及價格和成本方面的持續挑戰。根據上半年的結果和當前業務趨勢,公司已調整了FY25年銷售預測。儘管業績令人失望並降低了指引,但看法是下半年的風險已被顯著緩解。該公司表示市場的反應可能過度,並將這視爲投資者考慮參與這一獨特的水務資產的時機。

由於非住宅板塊存在衆所周知的不一致性,利潤率的下降是可以預期的。投資者關注的主要焦點似乎主要集中在承壓的利潤率所導致的程度。然而,這似乎主要與高昂的成本有關,而不是銷售價格的弱化。儘管對最終市場和利潤率趨勢持較爲謹慎的看法,但當前股價下跌爲投資提供了機會,因爲其受到實質性轉換動力和多種持續提升利潤率的機會的支撐。

除了減少估算和調整較低的非住宅預期之外,主要關注點集中在如何增加價格以抵消不斷上升的材料成本,這本質上是一個循環性的討論。然而,定價在按季度基礎上保持穩定,預計會隨着需求的恢復而恢復。此外,絕對利潤率水平仍然值得注意。

以下爲今日6位分析師對$Advanced Drainage (WMS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Loop Capital分析師Garik Shmois維持買入評級,並將目標價從180美元下調至170美元。

Loop Capital分析師Garik Shmois維持買入評級,並將目標價從180美元下調至170美元。

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.

Loop Capital analyst Garik Shmois maintains with a buy rating, and adjusts the target price from $180 to $170.