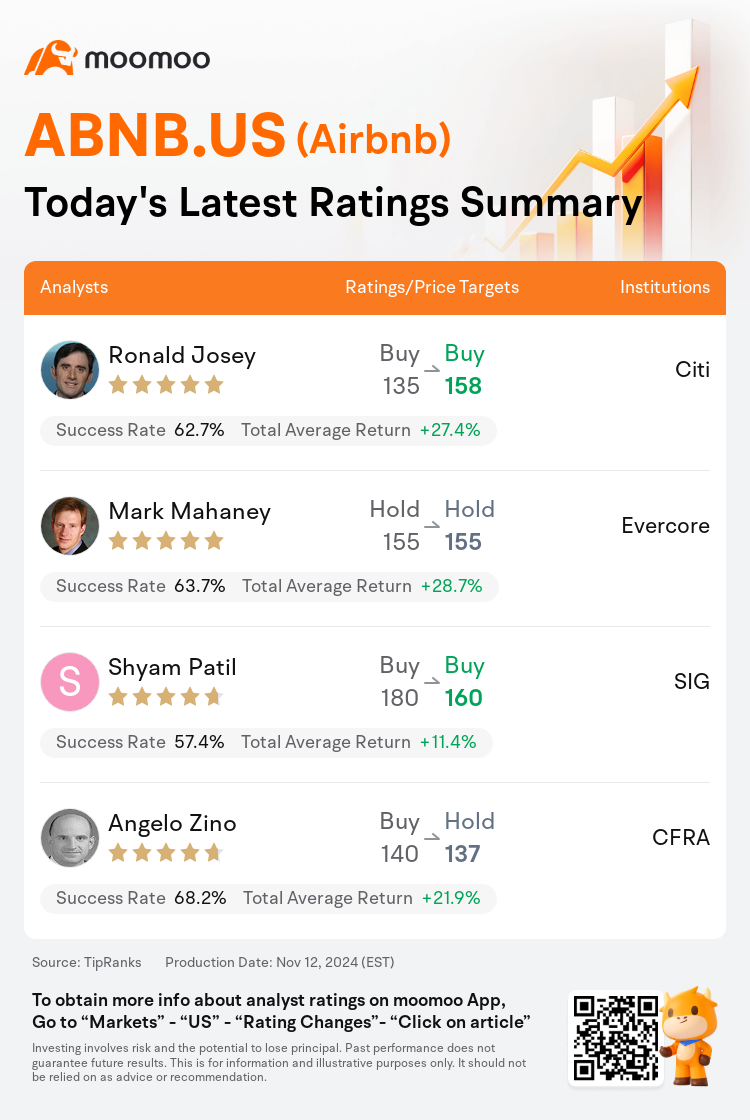

On Nov 12, major Wall Street analysts update their ratings for $Airbnb (ABNB.US)$, with price targets ranging from $137 to $160.

Citi analyst Ronald Josey maintains with a buy rating, and adjusts the target price from $135 to $158.

Evercore analyst Mark Mahaney maintains with a hold rating, and maintains the target price at $155.

SIG analyst Shyam Patil maintains with a buy rating, and adjusts the target price from $180 to $160.

SIG analyst Shyam Patil maintains with a buy rating, and adjusts the target price from $180 to $160.

CFRA analyst Angelo Zino downgrades to a hold rating, and adjusts the target price from $140 to $137.

Furthermore, according to the comprehensive report, the opinions of $Airbnb (ABNB.US)$'s main analysts recently are as follows:

The firm believes Airbnb's investments are poised to drive a resurgence in bookings growth and increase its overall share of the travel market. With the company performing strongly in its essential operations, investors are encouraged to capitalize on any market dislocations.

Airbnb's recent quarterly results were described as 'relatively strong,' bolstered by solid performances across various global regions. However, the continued 'tepid' growth in the company's B2C business, even amidst increasing investments, casts some uncertainty on its projected earnings growth for 2025.

Airbnb's Q3 Gross Bookings surpassed expectations, reaching $20.1B, attributed to an increase in nights booked and higher average daily rates (ADRs). The company's forecast for Q4 indicates that growth in booked nights is expected to pick up pace from the 8% seen in Q3, although profit margins are projected to decline year-over-year due to an uptick in investment spending.

The company's Q3 results aligned closely with investor expectations. Despite the earlier indications of a demand slowdown from U.S. guests and shorter booking periods in Q2, a resurgence in demand trends and a return to normal booking durations contributed to the company's growth trajectory through Q3 and into the subsequent quarter.

Airbnb's third-quarter nights booked exceeded consensus expectations and aligned with those of the buy-side, with guidance suggesting even stronger performance in the fourth quarter. The expectation is now set for a compression of EBITDA margins by upwards of three percentage points leading into 2025.

Here are the latest investment ratings and price targets for $Airbnb (ABNB.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月12日,多家華爾街大行更新了$愛彼迎 (ABNB.US)$的評級,目標價介於137美元至160美元。

花旗分析師Ronald Josey維持買入評級,並將目標價從135美元上調至158美元。

Evercore分析師Mark Mahaney維持持有評級,維持目標價155美元。

海納國際分析師Shyam Patil維持買入評級,並將目標價從180美元下調至160美元。

海納國際分析師Shyam Patil維持買入評級,並將目標價從180美元下調至160美元。

CFRA分析師Angelo Zino下調至持有評級,並將目標價從140美元下調至137美元。

此外,綜合報道,$愛彼迎 (ABNB.US)$近期主要分析師觀點如下:

公司認爲愛彼迎的投資已經準備好推動預訂增長的復甦,並提高其在旅行市場中的整體份額。隨着公司在其重要業務上表現強勁,投資者被鼓勵利用任何市場錯位。

最近的季度結果被形容爲「相對強勁」,受到各地區全球業務表現良好的支撐。然而,儘管在不斷增加的投資中,公司的B2C業務增長仍然「溫吞」,這在一定程度上對其2025年的盈利增長預期帶來一些不確定性。

愛彼迎的第三季度總預訂額超出預期,達到201億元,這歸因於預訂晚間的增加和更高的平均日常費率(ADRs)。公司對第四季度的預測顯示,預訂晚間的增長預計將從第三季度的8%加快,儘管由於投資支出增加,利潤率預計將年度同比下降。

公司的第三季度結果與投資者的預期密切相關。儘管在第二季度有來自美國客人的需求放緩的初期跡象,並且預訂週期較短,而在第三季度和隨後的季度中,需求趨勢的復甦和恢復正常的預訂週期對公司的成長軌跡產生了貢獻。

愛彼迎第三季度的預訂晚間超出共識預期,並與買入方一致,指引預示着四季度甚至更強勁的表現。預期現在設定爲到2025年前壓縮EBITDA利潤率多達三個百分點。

以下爲今日4位分析師對$愛彼迎 (ABNB.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

海納國際分析師Shyam Patil維持買入評級,並將目標價從180美元下調至160美元。

海納國際分析師Shyam Patil維持買入評級,並將目標價從180美元下調至160美元。

SIG analyst Shyam Patil maintains with a buy rating, and adjusts the target price from $180 to $160.

SIG analyst Shyam Patil maintains with a buy rating, and adjusts the target price from $180 to $160.