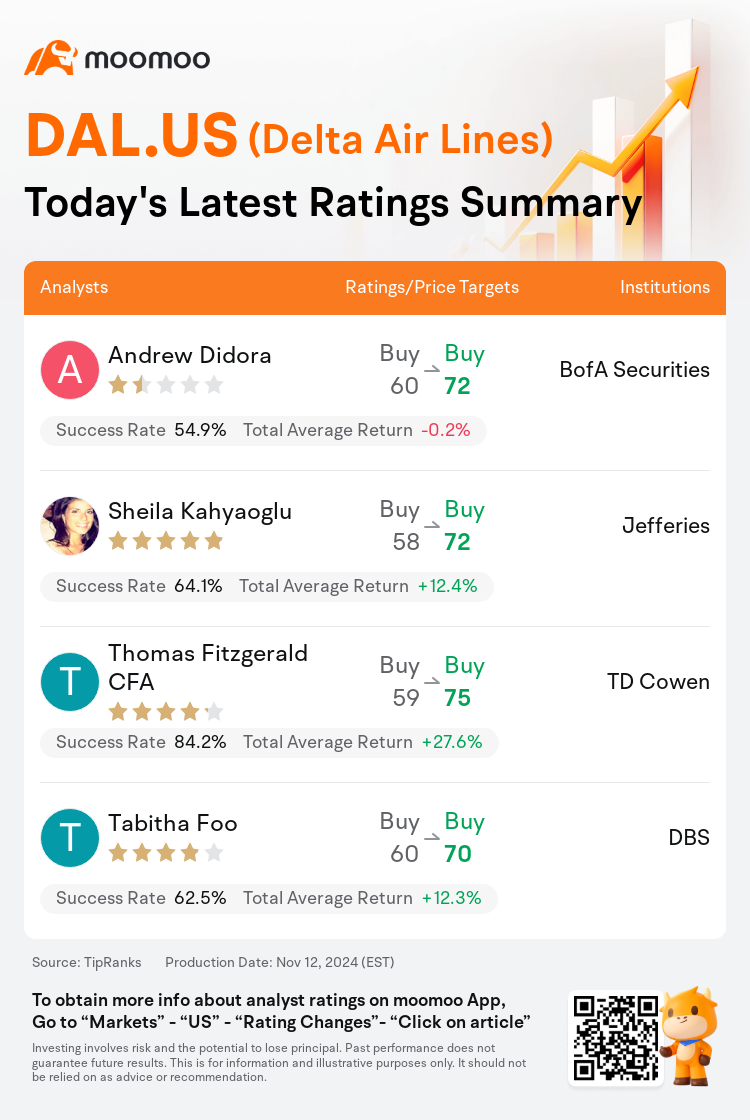

On Nov 12, major Wall Street analysts update their ratings for $Delta Air Lines (DAL.US)$, with price targets ranging from $70 to $75.

BofA Securities analyst Andrew Didora maintains with a buy rating, and adjusts the target price from $60 to $72.

Jefferies analyst Sheila Kahyaoglu maintains with a buy rating, and adjusts the target price from $58 to $72.

TD Cowen analyst Thomas Fitzgerald CFA maintains with a buy rating, and adjusts the target price from $59 to $75.

TD Cowen analyst Thomas Fitzgerald CFA maintains with a buy rating, and adjusts the target price from $59 to $75.

DBS analyst Tabitha Foo maintains with a buy rating, and adjusts the target price from $60 to $70.

Furthermore, according to the comprehensive report, the opinions of $Delta Air Lines (DAL.US)$'s main analysts recently are as follows:

Airline stocks have seen favorable performance since the recent election, with a noted 12% increase in the Dow Jones US Total Market Airlines Index, a movement that is logical considering the high beta nature of airline equities. Presently encouraging fundamentals, characterized by a deceleration in domestic capacity growth, alongside the election outcomes, are viewed as generally positive for the sector's fundamentals and earnings.

The firm anticipates that Delta Air Lines' inaugural investor day next week will reveal guidance for FY25 metrics and establish new long-term targets, particularly pertaining to loyalty/co-brand card programs and non-ticket revenue streams. Anticipated focus areas include strategies related to hubs and partnerships, customer lifecycle engagement, margin enhancements through fleet renewal, operations technology, cost-saving measures, and capital allocation.

Delta Air Lines has been recognized for its adept execution against its three-year targets established in 2021, despite facing non-controllable factors. There is potential for the company to project earnings per share significantly surpassing current expectations by 2027.

Here are the latest investment ratings and price targets for $Delta Air Lines (DAL.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

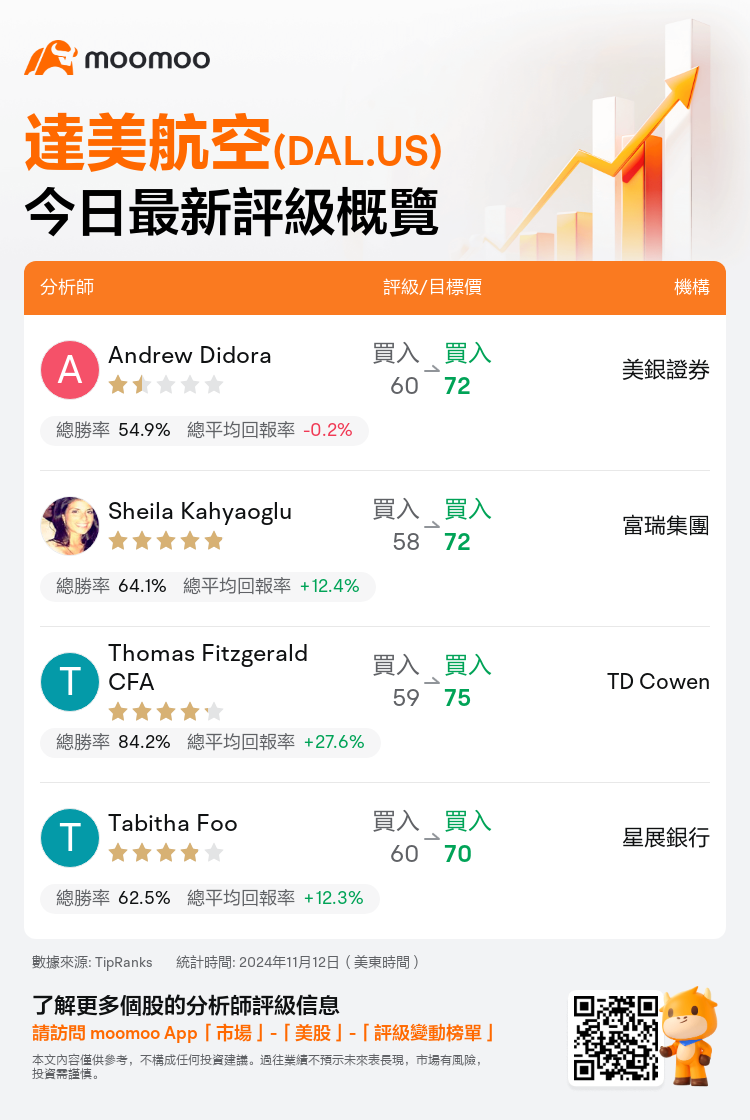

美東時間11月12日,多家華爾街大行更新了$達美航空 (DAL.US)$的評級,目標價介於70美元至75美元。

美銀證券分析師Andrew Didora維持買入評級,並將目標價從60美元上調至72美元。

富瑞集團分析師Sheila Kahyaoglu維持買入評級,並將目標價從58美元上調至72美元。

TD Cowen分析師Thomas Fitzgerald CFA維持買入評級,並將目標價從59美元上調至75美元。

TD Cowen分析師Thomas Fitzgerald CFA維持買入評級,並將目標價從59美元上調至75美元。

星展銀行分析師Tabitha Foo維持買入評級,並將目標價從60美元上調至70美元。

此外,綜合報道,$達美航空 (DAL.US)$近期主要分析師觀點如下:

航空公司股票自最近的選舉以來表現良好,在道瓊斯美國全市場航空公司指數中記錄了12%的增長,這一運動在考慮到航空公司股票高貝塔性質的情況下是合乎邏輯的。目前鼓舞人心的基本面,以國內產能增長放緩和選舉結果爲特徵,被認爲對該行業的基本面和盈利潛力總體上是正面的。

公司預計達美航空下週的首次投資者日將公佈FY25指標的指引,並確定與忠誠度/合作品牌信用卡計劃和非票務收入流有關的新的長期目標,預計重點領域包括與樞紐和合作夥伴關聯的戰略、客戶生命週期參與、通過機隊更新加強邊際增長、運營科技、節省成本措施以及資本配置。

儘管面臨無法控制的因素,但達美航空已被認可爲在2021年設定的三年目標方面有着熟練的執行,該公司有潛力在2027年以前將每股收益的預期大幅超過當前預期。

以下爲今日4位分析師對$達美航空 (DAL.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Thomas Fitzgerald CFA維持買入評級,並將目標價從59美元上調至75美元。

TD Cowen分析師Thomas Fitzgerald CFA維持買入評級,並將目標價從59美元上調至75美元。

TD Cowen analyst Thomas Fitzgerald CFA maintains with a buy rating, and adjusts the target price from $59 to $75.

TD Cowen analyst Thomas Fitzgerald CFA maintains with a buy rating, and adjusts the target price from $59 to $75.