Decoding Tesla's Options Activity: What's the Big Picture?

Decoding Tesla's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Tesla. Our analysis of options history for Tesla (NASDAQ:TSLA) revealed 457 unusual trades.

金融巨頭對特斯拉採取了明顯的看漲舉動。我們對特斯拉(納斯達克股票代碼:TSLA)期權歷史的分析顯示,有457筆不尋常的交易。

Delving into the details, we found 46% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 171 were puts, with a value of $12,878,935, and 286 were calls, valued at $44,070,487.

深入研究細節,我們發現46%的交易者看漲,而40%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有171筆是看跌期權,價值爲12,878,935美元,286筆是看漲期權,價值44,070,487美元。

Projected Price Targets

預計價格目標

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $110.0 to $700.0 for Tesla during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注特斯拉在過去一個季度的價格範圍從110.0美元到700.0美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

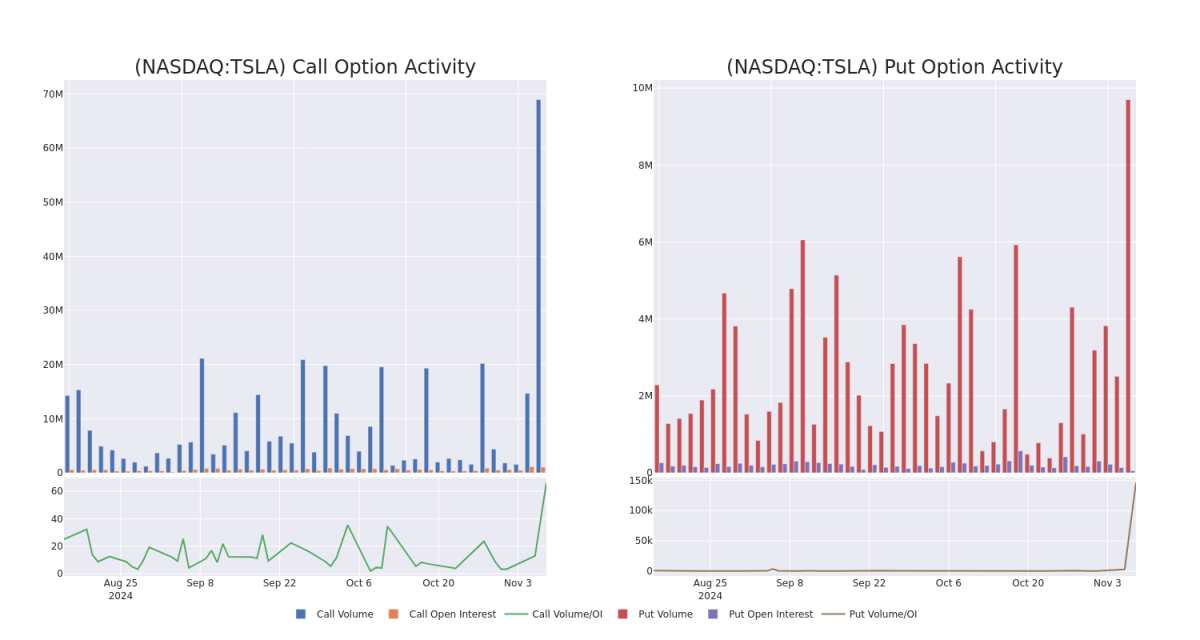

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Tesla's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tesla's whale trades within a strike price range from $110.0 to $700.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤特斯拉期權在給定行使價下的流動性和利息。下面,我們可以觀察過去30天內特斯拉在110.0美元至700.0美元行使價範圍內的所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化。

Tesla Option Activity Analysis: Last 30 Days

特斯拉期權活動分析:過去 30 天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSLA | CALL | SWEEP | NEUTRAL | 06/18/26 | $146.7 | $146.2 | $146.2 | $250.00 | $1.4M | 5.1K | 309 |

| TSLA | CALL | SWEEP | NEUTRAL | 09/19/25 | $71.9 | $70.9 | $71.47 | $355.00 | $914.4K | 762 | 296 |

| TSLA | CALL | SWEEP | BEARISH | 09/19/25 | $121.6 | $120.25 | $120.86 | $255.00 | $773.1K | 4.4K | 148 |

| TSLA | CALL | SWEEP | BEARISH | 11/15/24 | $10.55 | $10.45 | $10.45 | $350.00 | $241.7K | 32.1K | 32.7K |

| TSLA | CALL | TRADE | BULLISH | 01/17/25 | $232.5 | $232.05 | $232.5 | $110.00 | $232.5K | 3.9K | 75 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TSLA | 打電話 | 掃 | 中立 | 06/18/26 | 146.7 美元 | 146.2 美元 | 146.2 美元 | 250.00 美元 | 140 萬美元 | 5.1K | 309 |

| TSLA | 打電話 | 掃 | 中立 | 09/19/25 | 71.9 美元 | 70.9 美元 | 71.47 美元 | 355.00 美元 | 914.4 萬美元 | 762 | 296 |

| TSLA | 打電話 | 掃 | 粗魯的 | 09/19/25 | 121.6 美元 | 120.25 美元 | 120.86 美元 | 255.00 美元 | 773.1 萬美元 | 4.4K | 148 |

| TSLA | 打電話 | 掃 | 粗魯的 | 11/15/24 | 10.55 美元 | 10.45 美元 | 10.45 美元 | 350.00 美元 | 241.7 萬美元 | 32.1K | 32.7K |

| TSLA | 打電話 | 貿易 | 看漲 | 01/17/25 | 232.5 美元 | 232.05 美元 | 232.5 美元 | 110.00 美元 | 232.5 萬美元 | 3.9K | 75 |

About Tesla

關於特斯拉

Tesla is a vertically integrated battery electric vehicle automaker and developer of autonomous driving software. The company has multiple vehicles in its fleet, which include luxury and midsize sedans, crossover SUVs, a light truck, and a semi truck. Tesla also plans to begin selling more affordable vehicles, a sports car, and a robotaxi. Global deliveries in 2023 were a little over 1.8 million vehicles. The company sells batteries for stationary storage for residential and commercial properties including utilities and solar panels and solar roofs for energy generation. Tesla also owns a fast-charging network.

特斯拉是一家垂直整合的電池電動汽車製造商和自動駕駛軟件開發商。該公司的車隊中有多輛車,包括豪華和中型轎車、跨界越野車、一輛輕型卡車和一輛半掛卡車。特斯拉還計劃開始銷售更實惠的汽車、跑車和機器人出租車。2023年的全球交付量略高於180萬輛。該公司銷售住宅和商業物業固定存儲用電池,包括公用事業和太陽能電池板以及用於發電的太陽能屋頂。特斯拉還擁有快速充電網絡。

In light of the recent options history for Tesla, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於特斯拉最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Tesla's Current Market Status

特斯拉當前的市場狀況

- With a trading volume of 59,854,724, the price of TSLA is down by -2.6%, reaching $340.89.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 71 days from now.

- TSLA的價格下跌了-2.6%,至340.89美元,交易量爲59,854,724美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於71天后發佈。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Tesla options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的特斯拉期權交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Tesla's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tesla's whale trades within a strike price range from $110.0 to $700.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Tesla's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Tesla's whale trades within a strike price range from $110.0 to $700.0 in the last 30 days.