On Nov 13, major Wall Street analysts update their ratings for $Maplebear (CART.US)$, with price targets ranging from $48 to $56.

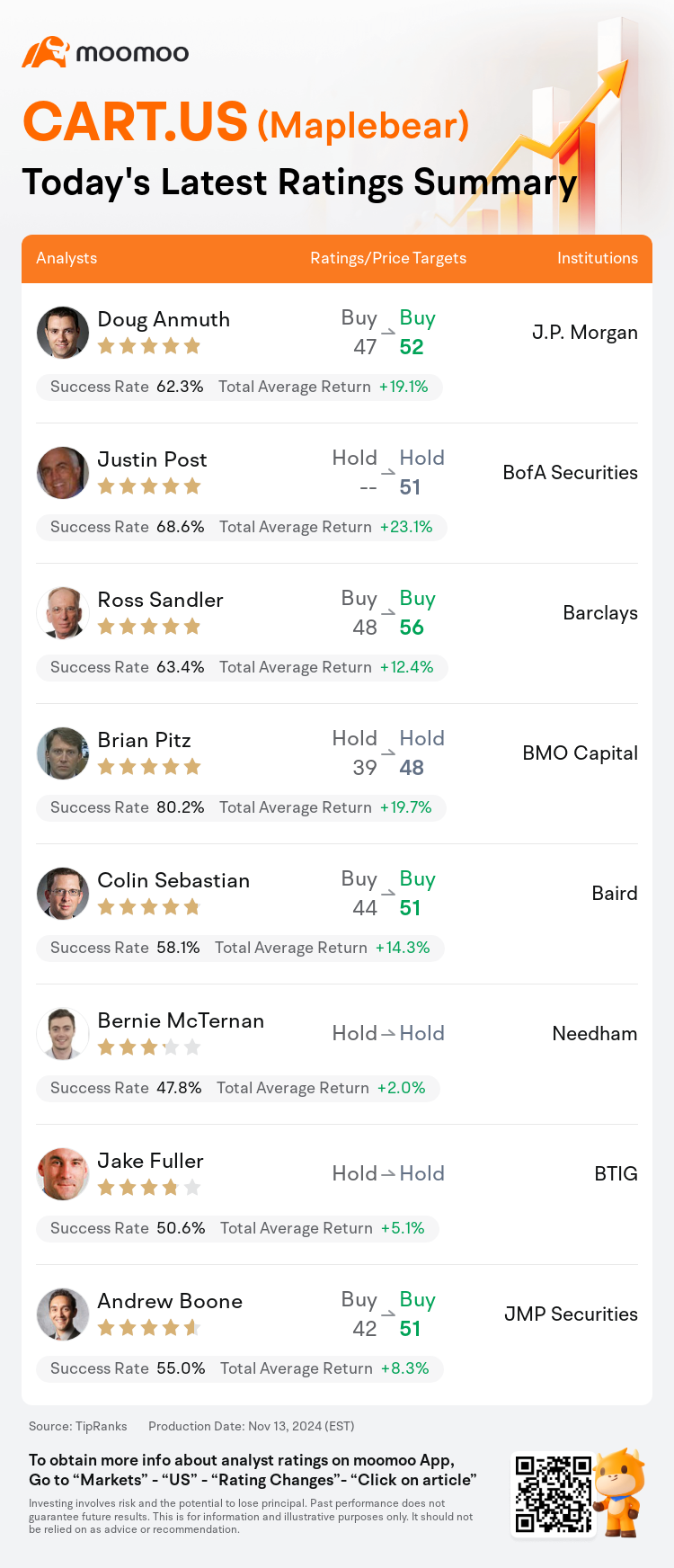

J.P. Morgan analyst Doug Anmuth maintains with a buy rating, and adjusts the target price from $47 to $52.

BofA Securities analyst Justin Post maintains with a hold rating, and sets the target price at $51.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $48 to $56.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $48 to $56.

BMO Capital analyst Brian Pitz maintains with a hold rating, and adjusts the target price from $39 to $48.

Baird analyst Colin Sebastian maintains with a buy rating, and adjusts the target price from $44 to $51.

Furthermore, according to the comprehensive report, the opinions of $Maplebear (CART.US)$'s main analysts recently are as follows:

Instacart's Q3 outcomes were robust, though the Q4 adjusted EBITDA forecast didn't meet investor expectations. Analysts note that management has reaffirmed their dedication to achieving yearly margin enhancements incrementally as the company navigates the trade-offs between profitability and growth investments in areas such as affordability, technology, and marketing.

Following Instacart's Q3 report, there has been a slight reduction in the Gross Transaction Value (GTV) and revenue forecasts for the fourth quarter. Looking ahead to 2025, the valuation basis sees a minor increase in GTV projections alongside reduced forecasts for both revenue and EBITDA.

Instacart shares are beginning to mirror the company's robust fundamental narrative, with its EBITDA valuation lagging behind its peers by a significant margin. The comprehensive nature of the company's services exemplifies the considerable challenges that competitors, who generally treat grocery as a supplementary option, are likely to encounter.

Instacart is experiencing an uptick in Gross Transaction Value (GTV) due to enhancements in their products, and the projections for 2025 appear to remain on the conservative side. The company is aggressively pursuing growth through increased marketing efforts, which saw a significant rise in the third quarter at 23% year-over-year compared to the second quarter's 6% increase. Although these efforts may dilute value in the short term, it is perceived as a strategically sound decision to ensure sustained double-digit growth.

Instacart's third-quarter results surpassed expectations, showcasing robust online grocery growth, consistent market share, increased order frequency, and additional revenue from Uber Eats collaborations.

Here are the latest investment ratings and price targets for $Maplebear (CART.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月13日,多家華爾街大行更新了$Maplebear (CART.US)$的評級,目標價介於48美元至56美元。

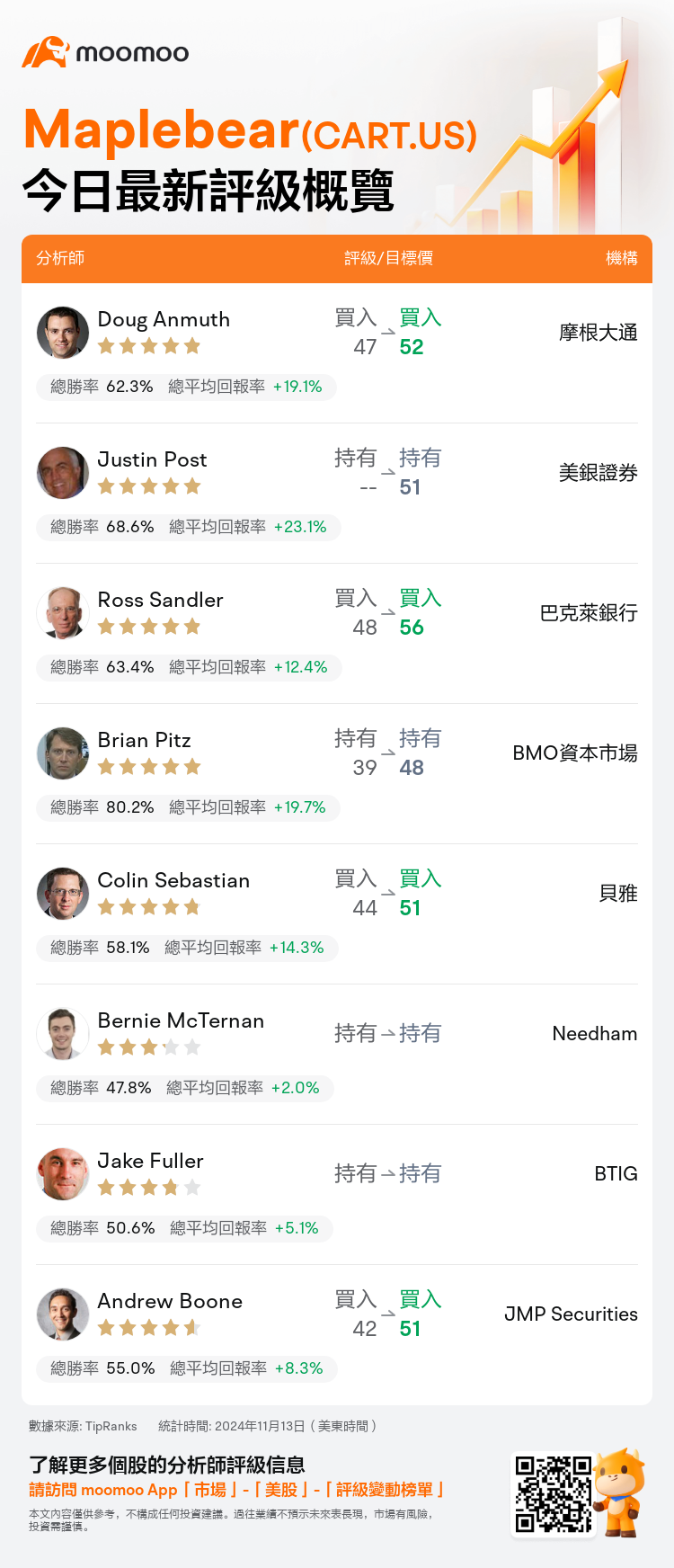

摩根大通分析師Doug Anmuth維持買入評級,並將目標價從47美元上調至52美元。

美銀證券分析師Justin Post維持持有評級,目標價51美元。

巴克萊銀行分析師Ross Sandler維持買入評級,並將目標價從48美元上調至56美元。

巴克萊銀行分析師Ross Sandler維持買入評級,並將目標價從48美元上調至56美元。

BMO資本市場分析師Brian Pitz維持持有評級,並將目標價從39美元上調至48美元。

貝雅分析師Colin Sebastian維持買入評級,並將目標價從44美元上調至51美元。

此外,綜合報道,$Maplebear (CART.US)$近期主要分析師觀點如下:

Instacart的第三季度業績表現強勁,儘管第四季度調整後的EBITDA預測未達到投資者預期。分析師指出,管理層已重申他們致力於在公司在利潤和成長投資之間權衡的同時逐步實現年度利潤率提高,涵蓋可負擔性、科技和營銷等領域。

在Instacart的第三季度報告後,第四季度的毛交易價值(GTV)和營業收入預測均出現輕微下調。展望2025年,估值基礎顯示GTV預測略有增加,同時營收和EBITDA的預測有所減少。

Instacart股價開始反映出公司強勁的基本故事,其EBITDA估值明顯落後於同行公司。公司服務的全面性展示了競爭對手可能會遇到的相當大挑戰,他們通常將雜貨視爲補充選擇。

由於產品改進,Instacart的毛交易價值(GTV)出現上升,2025年的預測似乎保守。公司正在通過增加營銷力度積極追求增長,第三季度的營銷力度同比增長23%,而第二季度僅增長6%。儘管這些努力可能會在短期內削弱價值,但被視爲一項戰略上明智的決定,以確保持續的兩位數增長。

Instacart的第三季度業績超出預期,展示了強勁的在線雜貨增長、穩定的市場份額、增加的訂單頻率以及與Uber Eats合作帶來的額外營收。

以下爲今日8位分析師對$Maplebear (CART.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Ross Sandler維持買入評級,並將目標價從48美元上調至56美元。

巴克萊銀行分析師Ross Sandler維持買入評級,並將目標價從48美元上調至56美元。

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $48 to $56.

Barclays analyst Ross Sandler maintains with a buy rating, and adjusts the target price from $48 to $56.