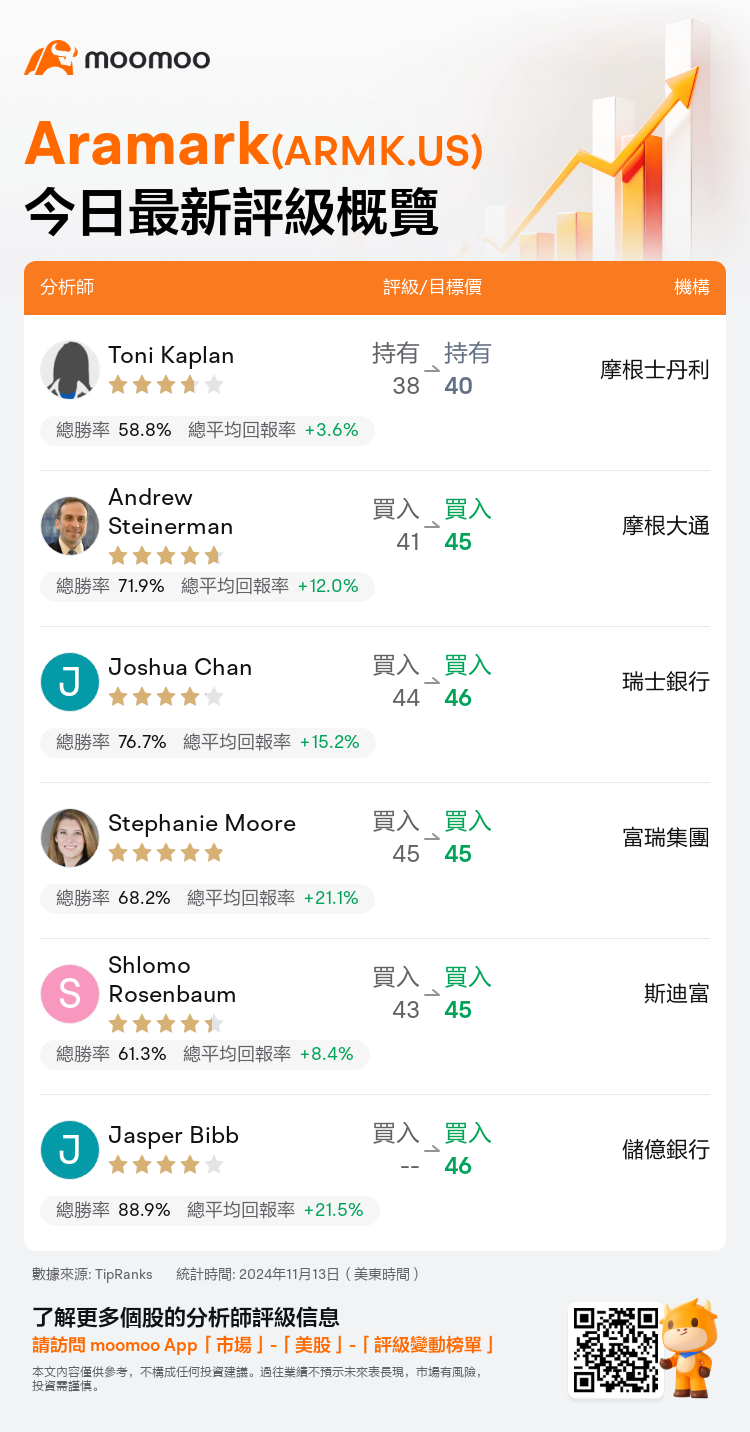

On Nov 13, major Wall Street analysts update their ratings for $Aramark (ARMK.US)$, with price targets ranging from $40 to $46.

Morgan Stanley analyst Toni Kaplan maintains with a hold rating, and adjusts the target price from $38 to $40.

J.P. Morgan analyst Andrew Steinerman maintains with a buy rating, and adjusts the target price from $41 to $45.

UBS analyst Joshua Chan maintains with a buy rating, and adjusts the target price from $44 to $46.

UBS analyst Joshua Chan maintains with a buy rating, and adjusts the target price from $44 to $46.

Jefferies analyst Stephanie Moore maintains with a buy rating, and maintains the target price at $45.

Stifel analyst Shlomo Rosenbaum maintains with a buy rating, and adjusts the target price from $43 to $45.

Furthermore, according to the comprehensive report, the opinions of $Aramark (ARMK.US)$'s main analysts recently are as follows:

The firm has adjusted its future adjusted AOI estimates upwards by 1.5% for FY25 and 3% for FY26 in response to Aramark's reported Q4 organic growth, which was modest. The company's reported AOI and EPS were roughly in line with projections, and their outlook for FY25 met expectations.

Aramark's recent quarter was described as having a mixed performance. The company experienced some notable contract terminations and intentionally stepped away from contracts with lower margins, along with a few significant deals being postponed to the next quarter, leading to revenues for the fourth quarter and forward-looking guidance that didn't meet expectations. Nevertheless, these incidents are regarded as occasional, rather than indicative of a shift in the company's overall direction. The company's narrative remains favorable in the eyes of the analyst.

The firm stated that Q4 results aligned with expectations across the business, noting that organic revenue growth slowed as anticipated alongside solid and predicted AOI margins.

Here are the latest investment ratings and price targets for $Aramark (ARMK.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月13日,多家華爾街大行更新了$Aramark (ARMK.US)$的評級,目標價介於40美元至46美元。

摩根士丹利分析師Toni Kaplan維持持有評級,並將目標價從38美元上調至40美元。

摩根大通分析師Andrew Steinerman維持買入評級,並將目標價從41美元上調至45美元。

瑞士銀行分析師Joshua Chan維持買入評級,並將目標價從44美元上調至46美元。

瑞士銀行分析師Joshua Chan維持買入評級,並將目標價從44美元上調至46美元。

富瑞集團分析師Stephanie Moore維持買入評級,維持目標價45美元。

斯迪富分析師Shlomo Rosenbaum維持買入評級,並將目標價從43美元上調至45美元。

此外,綜合報道,$Aramark (ARMK.US)$近期主要分析師觀點如下:

該公司已根據Aramark報告的Q4有限的有機增長,將其未來調整後每股收益的預期上調了1.5%至2025財年和3%至2026財年。該公司報告的每股收益和每股收益大致符合預期,並且他們對2025財年的展望符合預期。

aramark最近的季度被描述爲表現有好有壞。公司經歷了一些顯著的合同終止,並有意退出一些低毛利合同,還有一些重要交易被推遲到下一個季度,導致第四季度的營業收入和未來指導不符合預期。儘管如此,這些事件被視爲偶發性事件,而不是公司整體發展方向的標誌。分析師認爲公司的敘述仍然積極看待。

該公司表示,Q4的業務表現符合預期,指出在有機營業收入增長如預期地放緩的同時,卓越且可預測的AOI利潤率。

以下爲今日6位分析師對$Aramark (ARMK.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Joshua Chan維持買入評級,並將目標價從44美元上調至46美元。

瑞士銀行分析師Joshua Chan維持買入評級,並將目標價從44美元上調至46美元。

UBS analyst Joshua Chan maintains with a buy rating, and adjusts the target price from $44 to $46.

UBS analyst Joshua Chan maintains with a buy rating, and adjusts the target price from $44 to $46.