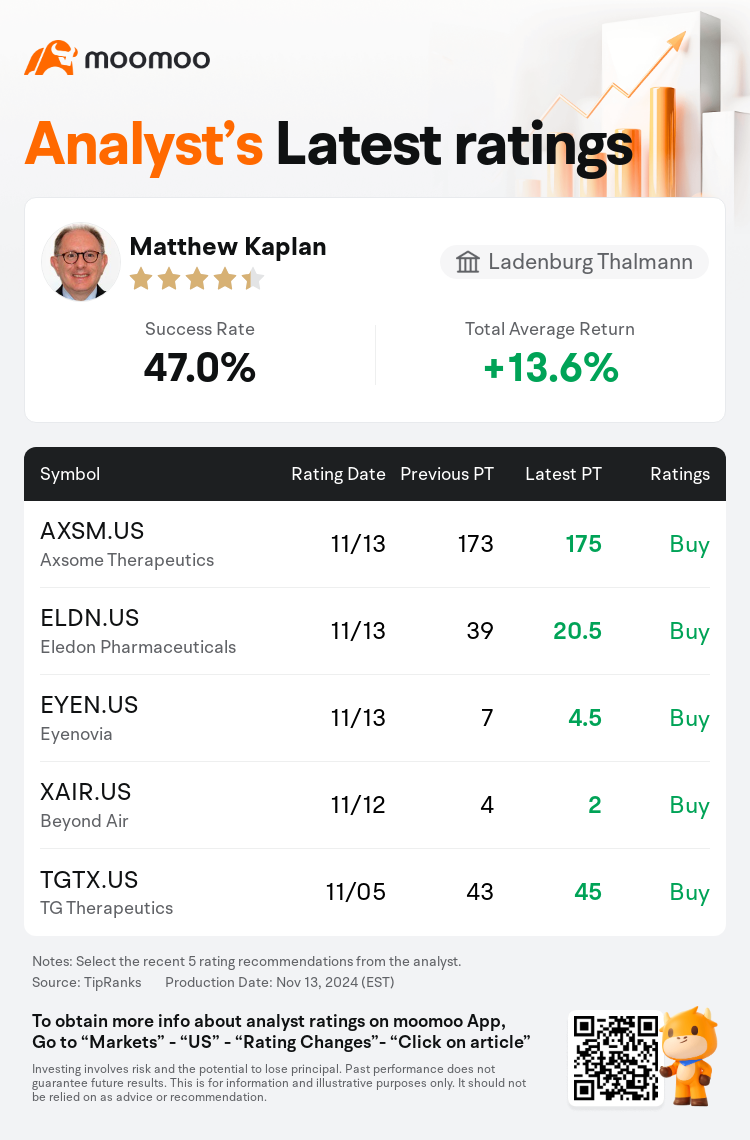

Ladenburg Thalmann analyst Matthew Kaplan maintains $Axsome Therapeutics (AXSM.US)$ with a buy rating, and adjusts the target price from $173 to $175.

According to TipRanks data, the analyst has a success rate of 47.0% and a total average return of 13.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Axsome Therapeutics (AXSM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Axsome Therapeutics (AXSM.US)$'s main analysts recently are as follows:

Following a third-quarter update that presented a revenue surpassing expectations and positive developments in the pipeline, sentiments on Axsome Therapeutics remain optimistic. Clarifications regarding the schedule of two concurrent Phase 3 Auvelity ADA trials have delineated the timeline for upcoming catalyst events, with expectations for simultaneous study outcomes in the fourth quarter. It's believed that achieving success in either one of the two ADA trials would be sufficient to dispel any lingering concerns about the regulatory outlook for this significant label expansion.

The third quarter of 2024 saw robust performance, largely driven by a significant increase in Auvelity sales. The company remains a favored choice due to the anticipation of several key events that could positively influence its stock by the close of the fourth quarter of 2024.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Ladenburg Thalmann分析師Matthew Kaplan維持$Axsome Therapeutics (AXSM.US)$買入評級,並將目標價從173美元上調至175美元。

根據TipRanks數據顯示,該分析師近一年總勝率為47.0%,總平均回報率為13.6%。

此外,綜合報道,$Axsome Therapeutics (AXSM.US)$近期主要分析師觀點如下:

此外,綜合報道,$Axsome Therapeutics (AXSM.US)$近期主要分析師觀點如下:

在第三季度更新中,營業收入超出預期,管道中的積極進展使得對axsome therapeutics的情緒依然樂觀。關於兩項同時進行的3期Auvelity ADA試驗的時間表的澄清,明確了即將發生的催化事件的時間線,預計在第四季度同時獲得研究結果。人們相信,在這兩個ADA試驗中取得任何一個的成功,足以消除人們對這一重要標籤擴展的監管前景的任何 lingering 擔憂。

2024年第三季度表現強勁,主要得益於Auvelity銷售的大幅增長。由於預計有幾項關鍵事件可能在2024年第四季度結束時對其股票產生積極影響,該公司仍然是一個受歡迎的選擇。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Axsome Therapeutics (AXSM.US)$近期主要分析師觀點如下:

此外,綜合報道,$Axsome Therapeutics (AXSM.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of