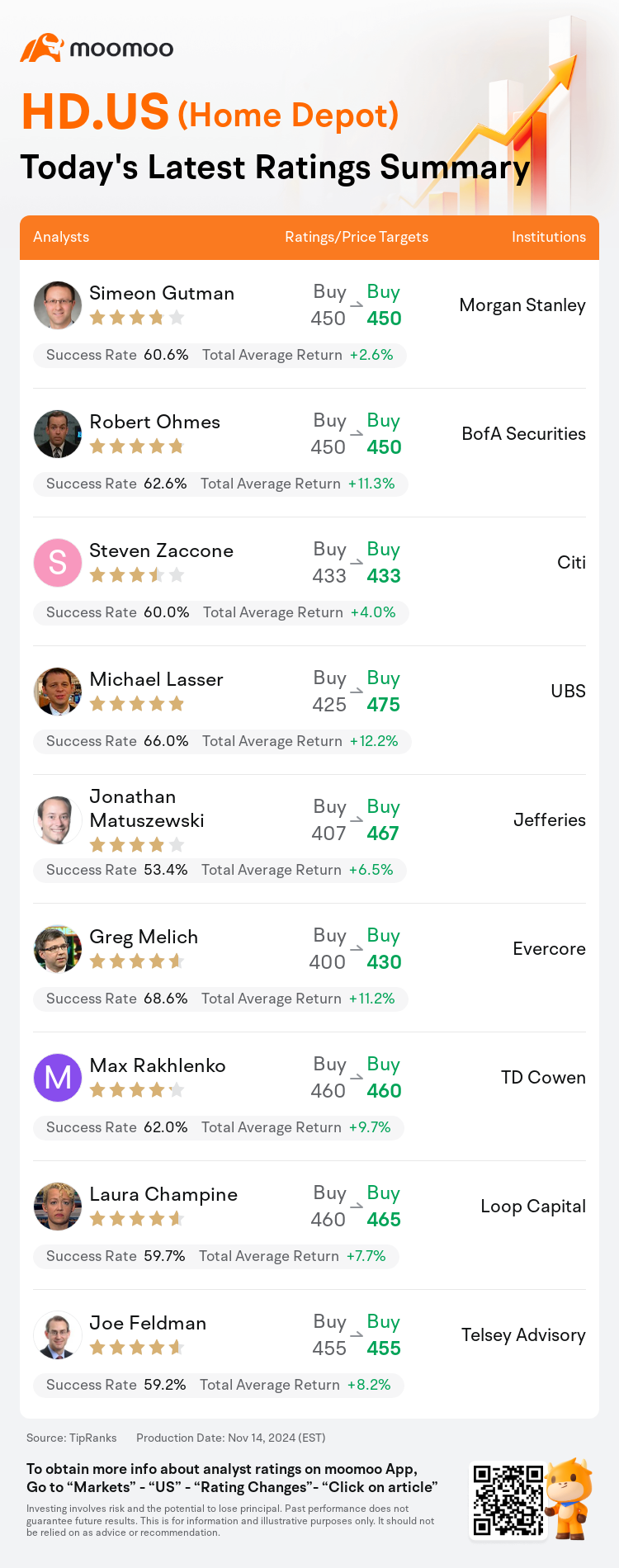

On Nov 14, major Wall Street analysts update their ratings for $Home Depot (HD.US)$, with price targets ranging from $430 to $475.

Morgan Stanley analyst Simeon Gutman maintains with a buy rating, and maintains the target price at $450.

BofA Securities analyst Robert Ohmes maintains with a buy rating, and maintains the target price at $450.

Citi analyst Steven Zaccone maintains with a buy rating, and maintains the target price at $433.

Citi analyst Steven Zaccone maintains with a buy rating, and maintains the target price at $433.

UBS analyst Michael Lasser maintains with a buy rating, and adjusts the target price from $425 to $475.

Jefferies analyst Jonathan Matuszewski maintains with a buy rating, and adjusts the target price from $407 to $467.

Furthermore, according to the comprehensive report, the opinions of $Home Depot (HD.US)$'s main analysts recently are as follows:

The firm's expectations for Home Depot's performance have risen following the company's third-quarter adjusted earnings per share, which surpassed the general market consensus. This outperformance is attributed to comp sales that exceeded forecasts. Consequently, the firm has adjusted its future earnings per share estimate upwards based on the robust third-quarter results.

The company's Q3 results surpassed expectations, and sales trends are becoming more favorable in anticipation of the Federal Reserve's interest rate cuts. Additionally, it is expected that recent severe weather events will stimulate an increase in future demand.

Following 14 consecutive quarters of declining customer traffic, the recent 0.6% dip in comparable store transactions represents the smallest drop since this trend began. This improvement is seen as a positive indicator of change in the company's performance.

The firm has reaffirmed its positive stance on Home Depot after the earnings call, bolstering its optimistic thesis. Independent of weather-related events, Home Depot saw positive comparable sales in October, potentially aided by professional and outdoor categories. This suggests that low-single-digit comparable sales for fiscal 2025 could be more of a baseline expectation, with the possibility for higher figures emerging throughout the year. The aspect of trade credit is seen as a significant and underappreciated component that could greatly benefit the company's narrative.

Here are the latest investment ratings and price targets for $Home Depot (HD.US)$ from 9 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

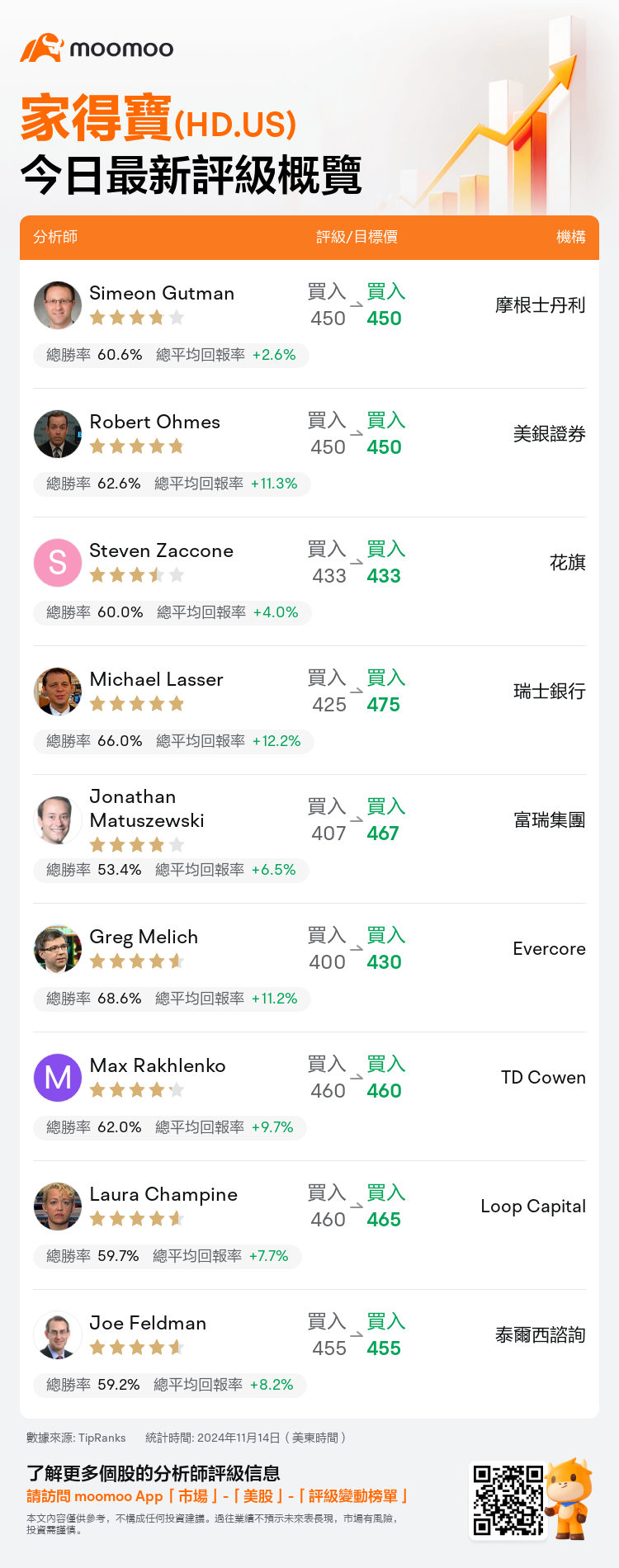

美東時間11月14日,多家華爾街大行更新了$家得寶 (HD.US)$的評級,目標價介於430美元至475美元。

摩根士丹利分析師Simeon Gutman維持買入評級,維持目標價450美元。

美銀證券分析師Robert Ohmes維持買入評級,維持目標價450美元。

花旗分析師Steven Zaccone維持買入評級,維持目標價433美元。

花旗分析師Steven Zaccone維持買入評級,維持目標價433美元。

瑞士銀行分析師Michael Lasser維持買入評級,並將目標價從425美元上調至475美元。

富瑞集團分析師Jonathan Matuszewski維持買入評級,並將目標價從407美元上調至467美元。

此外,綜合報道,$家得寶 (HD.US)$近期主要分析師觀點如下:

由於公司第三季度調整後的每股收益超過了市場普遍預期,該公司對家得寶表現的預期上升。這一超出預期的表現歸因於同比銷售額超出預測。因此,基於強勁的第三季度業績,該公司已上調未來每股收益的預估。

公司的第三季度業績超出預期,銷售趨勢在預期聯邦儲備減息的情況下變得更加有利。此外,預計近期的極端天氣事件將刺激未來需求的增加。

在連續14個季度客戶流量下降後,最近可比門店交易下降0.6%代表着自這一趨勢開始以來的最小下跌。這一改善被視爲公司表現變化的積極信號。

在業績會後,該公司重申了對家得寶的積極看法,增強了其樂觀論點。獨立於天氣相關事件之外,家得寶在10月份看到可比銷售的積極表現,可能得益於專業和戶外類別。這表明,對於2025財年,低個位數的可比銷售可能更多地成爲基線預期,全年都有可能出現更高的數字。貿易信貸的方面被視爲一個重要且被低估的因素,可能會極大地惠及公司的敘述。

以下爲今日9位分析師對$家得寶 (HD.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

花旗分析師Steven Zaccone維持買入評級,維持目標價433美元。

花旗分析師Steven Zaccone維持買入評級,維持目標價433美元。

Citi analyst Steven Zaccone maintains with a buy rating, and maintains the target price at $433.

Citi analyst Steven Zaccone maintains with a buy rating, and maintains the target price at $433.