On Nov 14, major Wall Street analysts update their ratings for $CyberArk (CYBR.US)$, with price targets ranging from $330 to $400.

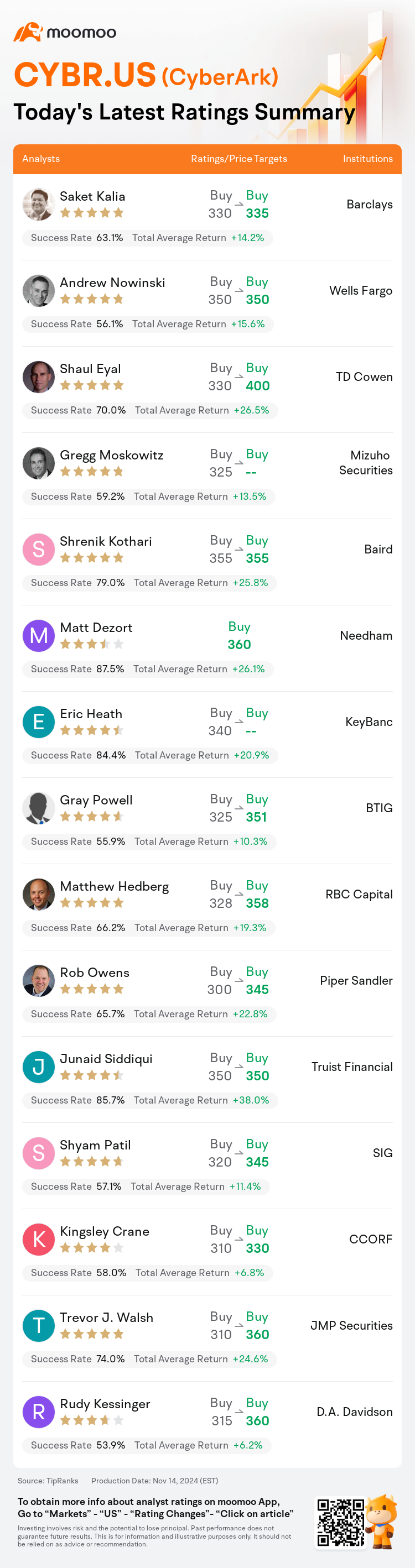

Barclays analyst Saket Kalia maintains with a buy rating, and adjusts the target price from $330 to $335.

Wells Fargo analyst Andrew Nowinski maintains with a buy rating, and maintains the target price at $350.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and adjusts the target price from $330 to $400.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and adjusts the target price from $330 to $400.

Mizuho Securities analyst Gregg Moskowitz maintains with a buy rating.

Baird analyst Shrenik Kothari maintains with a buy rating, and maintains the target price at $355.

Furthermore, according to the comprehensive report, the opinions of $CyberArk (CYBR.US)$'s main analysts recently are as follows:

The company surpassed Q3 expectations for net new annual recurring revenue and increased its fiscal 2024 free cash flow projections.

CyberArk delivered 'another strong quarter' with performance surpassing expectations in Q3 ARR, revenue, and profitability. Despite the announcement of CFO Josh Siegel's departure at year-end, the anticipated smooth transition to the experienced SVP of IR and Finance, Erica Smith, keeps confidence intact. The company is expected to continue securing a widening customer base and capitalize on several long-term favorable trends.

The firm's assessment of CyberArk reflects a positive outlook after a noteworthy Q3 ARR performance and an optimistic Q4 organic projection. The analysis suggests there is additional potential and a beneficial competitive landscape in Privileged Access Management (PAM), and sees competitive advantages in secrets management with the recent Hashi acquisition. Moreover, there are prospects for enhancing security measures atop current SSO/MFA solutions. The firm anticipates that CyberArk could enhance Venafi's growth by utilizing its expanded go-to-market resources, coupled with industry momentum for TLS certificate management. Nonetheless, there remain concerns over the total addressable market (TAM) for certificate management, the synergies with Conjur, and the emerging competition from entities such as ServiceNow, public cloud providers, and others.

Post-market trading saw CyberArk's stock dip by around 1% despite the company reporting solid results. Following the completion of the Venafi acquisition, it is believed that the company is positioned to sustain low-20s Annual Recurring Revenue growth and a free cash flow margin that surpasses the Rule of 40.

CyberArk's third-quarter results were seen as robust amidst what has been described as a rather average earnings season in the security software sector. The company not only achieved its upside target but also raised its guidance organically. Analysts have expressed optimism regarding the company's discussions on workforce identity, secrets management, and the prospects of enhancing Venafi's growth in the upcoming year. It was noted that the organic projections for 2025 remain largely unaltered.

Here are the latest investment ratings and price targets for $CyberArk (CYBR.US)$ from 15 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月14日,多家華爾街大行更新了$CyberArk (CYBR.US)$的評級,目標價介於330美元至400美元。

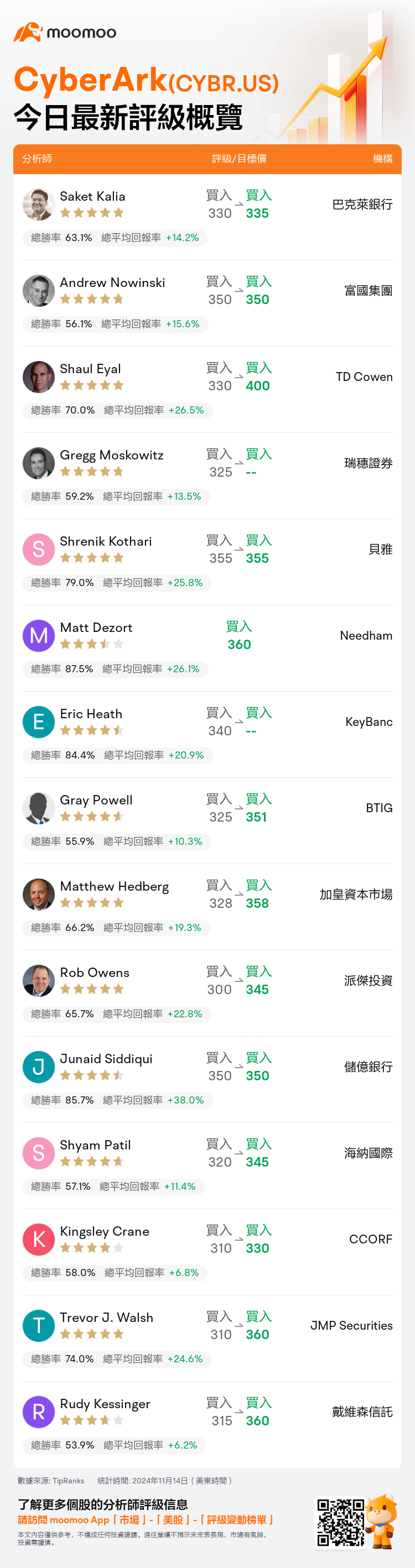

巴克萊銀行分析師Saket Kalia維持買入評級,並將目標價從330美元上調至335美元。

富國集團分析師Andrew Nowinski維持買入評級,維持目標價350美元。

TD Cowen分析師Shaul Eyal維持買入評級,並將目標價從330美元上調至400美元。

TD Cowen分析師Shaul Eyal維持買入評級,並將目標價從330美元上調至400美元。

瑞穗證券分析師Gregg Moskowitz維持買入評級。

貝雅分析師Shrenik Kothari維持買入評級,維持目標價355美元。

此外,綜合報道,$CyberArk (CYBR.US)$近期主要分析師觀點如下:

該公司超出了第三季度的淨新年度經常性營業收入預期,並增加了其2024財年的自由現金流預測。

CyberArk在第三季度的表現超出了預期,在年度經常性營業收入、營業收入和盈利方面交出了'又一個強勁的季度'。儘管首席財務官Josh Siegel宣佈將於年底離職,但預期平穩過渡給經驗豐富的IR和財務高級副總裁Erica Smith帶來了信心。公司預計將繼續穩固不斷擴大的客戶群,並利用幾項長期有利的趨勢。

該公司對CyberArk的評估反映了一個積極的展望,在一個顯著的第三季度年度經常性營業收入表現和一個樂觀的第四季度有機預測之後。分析表明,在特權訪問管理(PAM)領域存在額外潛力和有利的競爭格局,最近的Hashi收購使其在密碼管理方面具備競爭優勢。此外,還有可能加強當前SSO/MFA解決方案之上的安全措施。該公司預計,通過利用其擴大的市場資源和行業動能來增強Venafi的增長,CyberArk可能會增強Venafi的增長。然而,對於證書管理的總地址市場(TAM)、與Conjur的協同效應以及來自ServiceNow、公共雲服務提供商和其他實體的新競爭仍然存在一些擔憂。

CyberArk的股票在美股盤後交易中下跌了約1%,儘管公司報告了出色的業績。隨着Venafi收購的完成,人們認爲公司能夠維持低20%的年度經常性營業收入增長和超過40規則的自由現金流邊際。

CyberArk在安全軟件行業被視爲強勁,儘管據稱這是一個相當平均的收益季節。該公司不僅達到了上限目標,還從內部提高了指導。分析師對該公司關於員工身份、密碼管理以及增強Venafi增長前景的討論表示樂觀。值得注意的是,2025年的內部預測仍然基本保持不變。

以下爲今日15位分析師對$CyberArk (CYBR.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

TD Cowen分析師Shaul Eyal維持買入評級,並將目標價從330美元上調至400美元。

TD Cowen分析師Shaul Eyal維持買入評級,並將目標價從330美元上調至400美元。

TD Cowen analyst Shaul Eyal maintains with a buy rating, and adjusts the target price from $330 to $400.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and adjusts the target price from $330 to $400.