Lander Sports Development (SZSE:000558 Investor Three-year Losses Grow to 19% as the Stock Sheds CN¥413m This Past Week

Lander Sports Development (SZSE:000558 Investor Three-year Losses Grow to 19% as the Stock Sheds CN¥413m This Past Week

It is doubtless a positive to see that the Lander Sports Development Co., Ltd. (SZSE:000558) share price has gained some 31% in the last three months. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 19% in the last three years, significantly under-performing the market.

If the past week is anything to go by, investor sentiment for Lander Sports Development isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Lander Sports Development moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

During five years of share price growth, Lander Sports Development moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

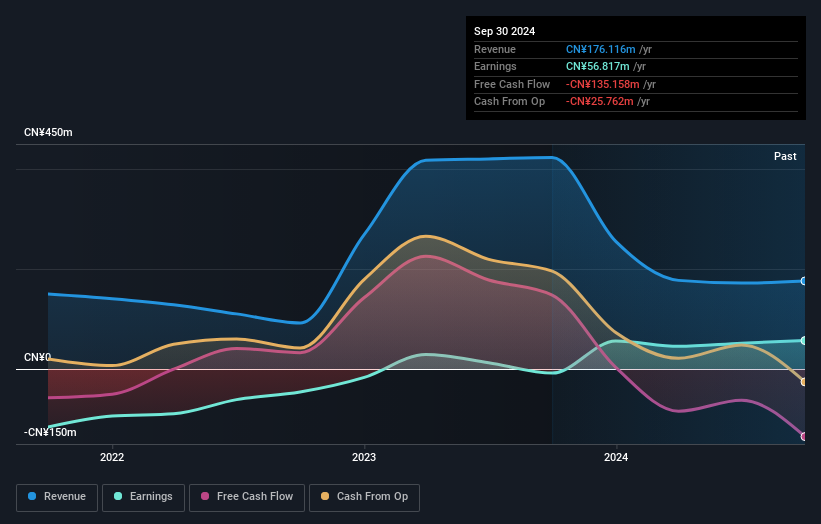

We note that, in three years, revenue has actually grown at a 17% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Lander Sports Development more closely, as sometimes stocks fall unfairly. This could present an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Lander Sports Development's financial health with this free report on its balance sheet.

A Different Perspective

Lander Sports Development shareholders gained a total return of 1.0% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 1.4% per year, over five years. So this might be a sign the business has turned its fortunes around. Before deciding if you like the current share price, check how Lander Sports Development scores on these 3 valuation metrics.

We will like Lander Sports Development better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.