Jinke Smart Services Group Co., Ltd.'s (HKG:9666) Popularity With Investors Is Clear

Jinke Smart Services Group Co., Ltd.'s (HKG:9666) Popularity With Investors Is Clear

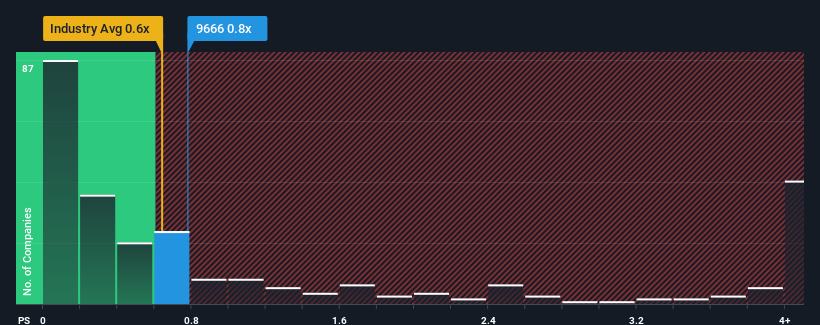

There wouldn't be many who think Jinke Smart Services Group Co., Ltd.'s (HKG:9666) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Real Estate industry in Hong Kong is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Jinke Smart Services Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Jinke Smart Services Group has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Jinke Smart Services Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Jinke Smart Services Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 7.3% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Fortunately, a few good years before that means that it was still able to grow revenue by 7.3% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 5.7% as estimated by the three analysts watching the company. That's shaping up to be similar to the 5.2% growth forecast for the broader industry.

In light of this, it's understandable that Jinke Smart Services Group's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Jinke Smart Services Group's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Real Estate industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Jinke Smart Services Group with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.