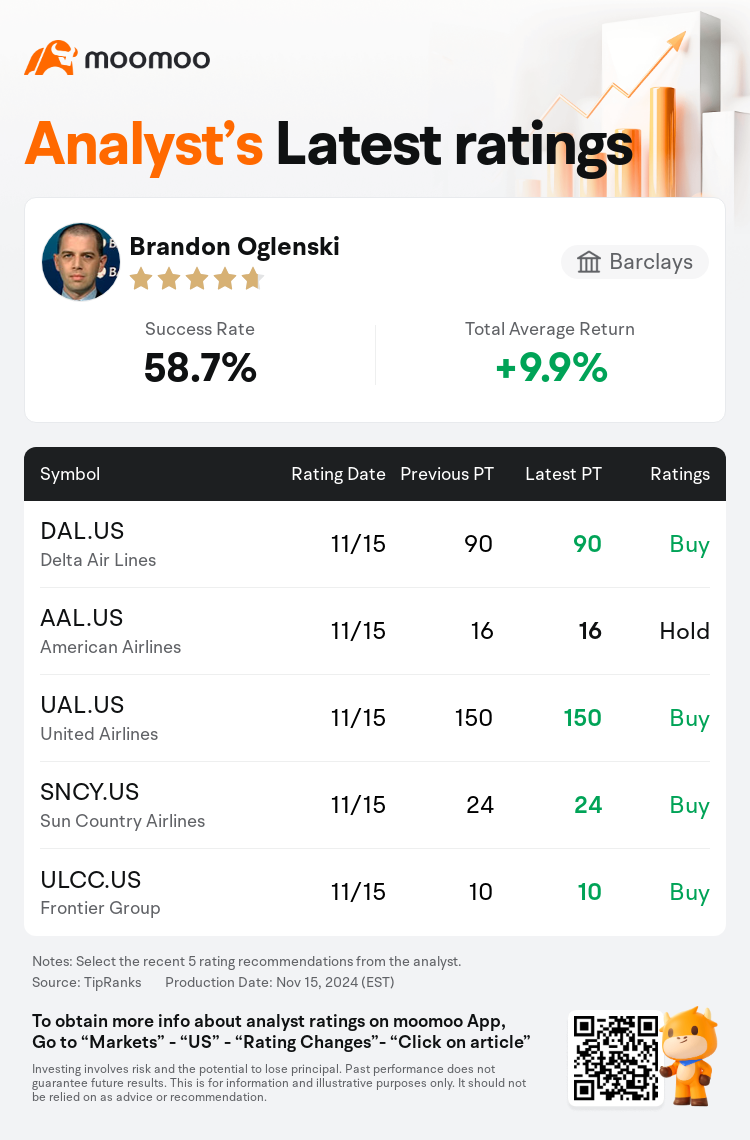

Barclays analyst Brandon Oglenski maintains $United Airlines (UAL.US)$ with a buy rating, and maintains the target price at $150.

According to TipRanks data, the analyst has a success rate of 58.7% and a total average return of 9.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $United Airlines (UAL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $United Airlines (UAL.US)$'s main analysts recently are as follows:

It is anticipated that United Airlines will conclude 2024 with margins closely resembling those seen prior to the pandemic, which would represent the swiftest recovery among the principal airline companies. The company's potential for growth against an enhancing revenue landscape, compared to more limited rivals, along with its advantage from strong premium demand and competitors withdrawing from important cities, are seen as positive factors.

Airline fundamentals are anticipated to see a sharp positive shift in 2025, which could significantly enhance market perceptions of leading companies within the sector. This change is expected to facilitate substantial appreciation in share prices for industry leaders. The combination of these improving fundamentals and a shift in investor sentiment is projected to catalyze a strong surge in airline stocks as the next year approaches. It is expected that the most successful companies will continue to thrive, with airlines poised to offer considerable upside potential. This potential comes as capacity growth is set to stabilize in 2025, while competition among low-cost carriers undergoes a realignment, further solidifying the dominant positions of industry front-runners.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

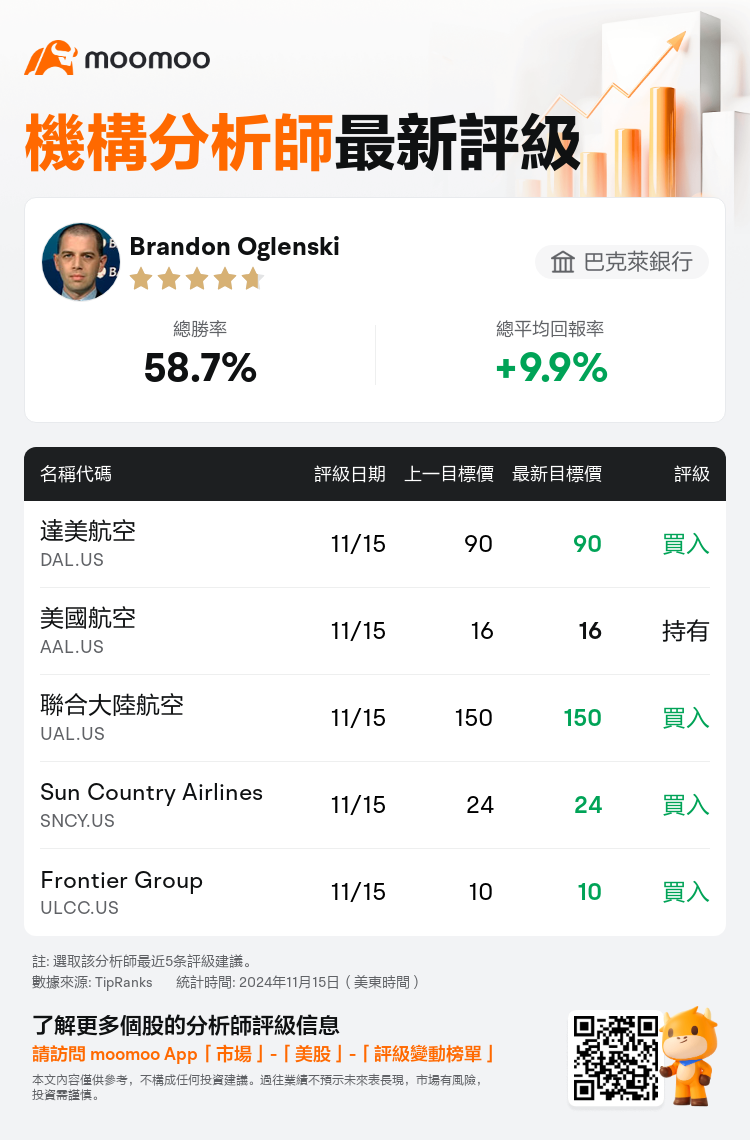

巴克萊銀行分析師Brandon Oglenski維持$聯合大陸航空 (UAL.US)$買入評級,維持目標價150美元。

根據TipRanks數據顯示,該分析師近一年總勝率為58.7%,總平均回報率為9.9%。

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

預計聯合大陸航空將在2024年結束時,其利潤率將與疫情前的水平極爲相似,這將代表主要航空公司中最快的復甦。與競爭對手相比,公司在日益改善的營業收入環境下具有增長潛力,加上強勁的高端需求和競爭對手撤出重要城市的優勢,這些都被視爲積極因素。

預計航空公司基本面將在2025年出現顯著積極變化,這可能顯著提升市場對該板塊領先公司的看法。預計這一變化將促進行業領導者的股票價格大幅上漲。這些改善的基本面和投資者情緒的轉變組合預計將推動航空公司股票在下一年到來時強勁上漲。預計最成功的公司將繼續蓬勃發展,航空公司有望提供可觀的上行潛力。這一潛力出現在2025年的產能增長預計將趨於穩定,而低成本航空公司之間的競爭正在重新調整,進一步鞏固行業領軍者的主導地位。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

此外,綜合報道,$聯合大陸航空 (UAL.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of