Price Over Earnings Overview: Exxon Mobil

Price Over Earnings Overview: Exxon Mobil

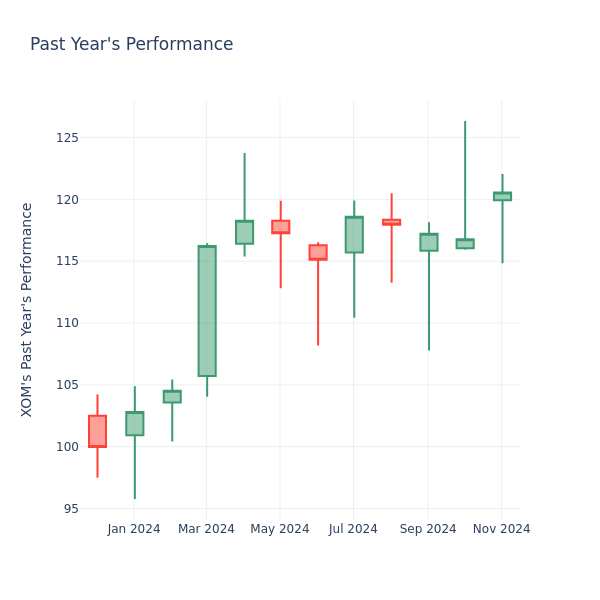

In the current market session, Exxon Mobil Inc. (NYSE:XOM) stock price is at $120.53, after a 0.02% drop. However, over the past month, the company's stock increased by 0.46%, and in the past year, by 15.37%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

在本市場交易日中,埃克森美孚公司(紐約證券交易所代碼:XOM)股價在下跌0.02%後爲120.53美元。但是,在過去的一個月中,該公司的股票上漲了0.46%,在過去的一年中增長了15.37%。股東們可能想知道該股票是否被高估了,即使該公司在本交易日的表現沒有達到面值。

Exxon Mobil P/E Ratio Analysis in Relation to Industry Peers

埃克森美孚與行業同行的市盈率分析

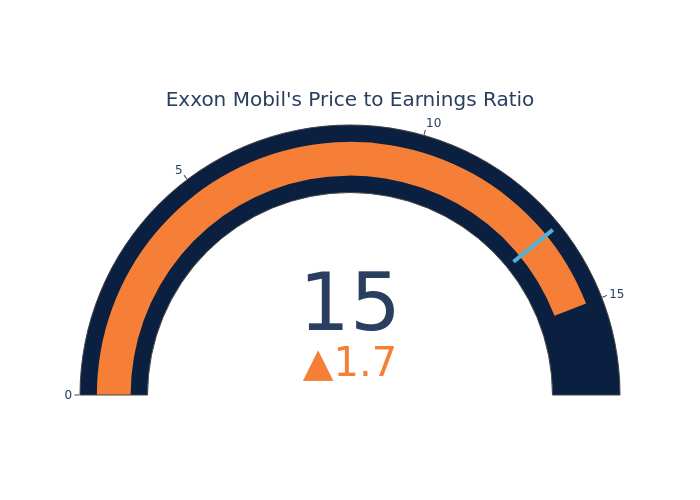

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

市盈率衡量當前股價與公司每股收益。長期投資者使用它來根據過去的收益、歷史數據以及該行業或指數(例如標準普爾500指數)的總體市場數據來分析公司的當前表現。更高的市盈率表明投資者預計該公司將來會表現更好,該股可能被高估了,但不一定。這也可能表明投資者目前願意支付更高的股價,因爲他們預計該公司在接下來的幾個季度中表現會更好。這使投資者也對未來股息的增加保持樂觀。

Exxon Mobil has a better P/E ratio of 15.01 than the aggregate P/E ratio of 13.3 of the Oil, Gas & Consumable Fuels industry. Ideally, one might believe that Exxon Mobil Inc. might perform better in the future than it's industry group, but it's probable that the stock is overvalued.

埃克森美孚的市盈率爲15.01,高於石油、天然氣和消耗性燃料行業13.3的總市盈率。理想情況下,人們可能會認爲埃克森美孚公司未來的表現可能會好於其行業集團,但該股可能被高估了。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

總而言之,儘管市盈率是投資者評估公司市場表現的寶貴工具,但應謹慎使用。低市盈率可能表明估值被低估,但也可能表明增長前景疲軟或金融不穩定。此外,市盈率只是投資者在做出投資決策時應考慮的衆多指標之一,應與其他財務比率、行業趨勢和定性因素一起進行評估。通過採取綜合方法分析公司的財務狀況,投資者可以做出更有可能帶來成功結果的明智決策。

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company's market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company's financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.