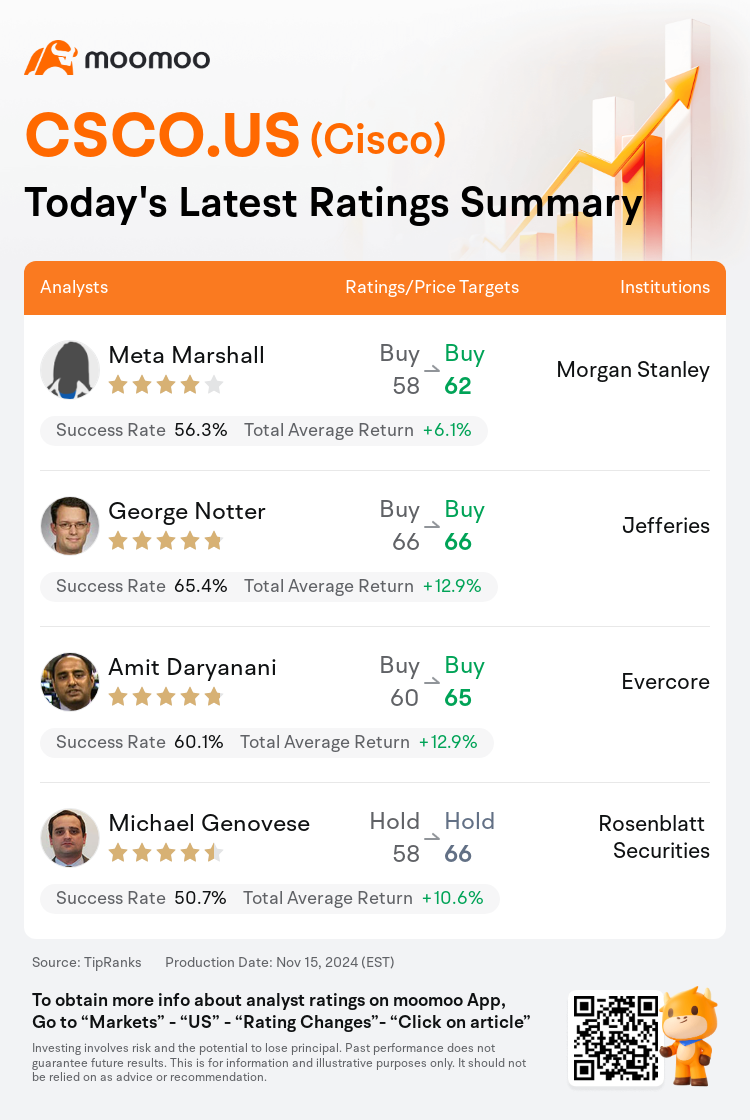

On Nov 15, major Wall Street analysts update their ratings for $Cisco (CSCO.US)$, with price targets ranging from $62 to $66.

Morgan Stanley analyst Meta Marshall maintains with a buy rating, and adjusts the target price from $58 to $62.

Jefferies analyst George Notter maintains with a buy rating, and maintains the target price at $66.

Evercore analyst Amit Daryanani maintains with a buy rating, and adjusts the target price from $60 to $65.

Evercore analyst Amit Daryanani maintains with a buy rating, and adjusts the target price from $60 to $65.

Rosenblatt Securities analyst Michael Genovese maintains with a hold rating, and adjusts the target price from $58 to $66.

Furthermore, according to the comprehensive report, the opinions of $Cisco (CSCO.US)$'s main analysts recently are as follows:

Cisco's Q1 performance modestly surpassed expectations, primarily driven by Splunk's notable outperformance. Analysts note that the U.S. Federal segment is an important aspect to monitor, but overall, they remain bolstered in their positive stance on the company's prospects.

Cisco experienced a Q1 revenue decline that was marginally better than market expectations, with a decrease of 5.6% compared to the anticipated 6.1%. Earnings per share also surpassed consensus estimates. Guidance for FY25 revenue was increased by roughly $200 million, largely reflecting the positive results. The potential for growth acceleration in the latter half of the year is supported by robust order growth in Cloud/AI and Security segments. Updated business models reflect these enhancing business trends.

Cisco's product orders have shown an increase of 9%, which indicates a positive turn in the company's business trajectory. This growth follows a 6% rise in the previous quarter. Despite the unpredictability surrounding the timing of AI revenue recognition, expectations are set for it to commence in the latter half of 2025 based on company commentary. Furthermore, while the company's recent record gross margins and the forecasted range of 68%-69% for FY25 are encouraging, they warrant a cautious approach.

The recent fiscal Q1 report has led analysts to focus on Cisco's modest outperformance and updated guidance, which was balanced by better-than-anticipated artificial intelligence orders and positive developments in core networking orders. Despite this, the limited adjustment to the fiscal 2025 growth forecast and consistent AI guidance has been a point of contention. Nonetheless, the potential advantages for Cisco arising from the growing opportunities in AI networking and the enhancement of its valuation are seen as significant factors.

Cisco's fiscal Q1 sales performance met expectations while an outperformance in margins led to surpassing earnings projections. It was anticipated that order growth, excluding certain acquisitions, would be higher. Nonetheless, there is a sense that the business has found a stable footing. Despite this, growth prospects up to fiscal 2025 appear restrained, even when considering the lower baseline for comparison.

Here are the latest investment ratings and price targets for $Cisco (CSCO.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月15日,多家華爾街大行更新了$思科 (CSCO.US)$的評級,目標價介於62美元至66美元。

摩根士丹利分析師Meta Marshall維持買入評級,並將目標價從58美元上調至62美元。

富瑞集團分析師George Notter維持買入評級,維持目標價66美元。

Evercore分析師Amit Daryanani維持買入評級,並將目標價從60美元上調至65美元。

Evercore分析師Amit Daryanani維持買入評級,並將目標價從60美元上調至65美元。

羅森布拉特證券分析師Michael Genovese維持持有評級,並將目標價從58美元上調至66美元。

此外,綜合報道,$思科 (CSCO.US)$近期主要分析師觀點如下:

思科第一季度的表現略微超出了預期,主要受益於splunk的顯著表現。分析師指出,美國聯邦部門是一個重要的關注點,但總體上,他們對公司的前景保持樂觀。

思科在第一季度的營業收入下降幅度稍微好於市場預期,下降了5.6%,而預期下降爲6.1%。每股收益也超出了共識預期。對FY25營業收入的指導提高了大約20000萬,主要反映了積極的結果。下半年增長加速的潛力得到了雲/人工智能和安防-半導體領域強勁訂單增長的支持。更新的業務模型反映了這些良好的業務趨勢。

思科的產品訂單增長了9%,這表明公司的業務軌跡呈現積極轉變。這一增長是在上一季度增長6%之後發生的。儘管關於人工智能營業收入確認時機的不確定性,預計將在2025年下半年開始,根據公司的評論。此外,儘管公司最近的記錄毛利率和對FY25的預測區間68%-69%令人鼓舞,但仍需保持謹慎態度。

最近的財政第一季度報告使分析師把焦點放在思科的適度超預期和更新的指導上,這一指導得益於優於預期的人工智能訂單和核心網絡訂單的積極發展。儘管如此,財政2025年增長預期的有限調整和一致的人工智能指導引發了爭議。不過,思科在人工智能網絡日益增長的機會和估值提升方面潛在的優勢被視爲重要因素。

思科的財政第一季度銷售表現符合預期,而毛利率的超預期使得盈利預測得到提升。預計訂單增長(不包括某些收購)會更高。然而,似乎業務已經找到了一種穩定的立足點。儘管如此,直到財政2025年的增長前景顯得有限,即便考慮到較低的比較基準。

以下爲今日4位分析師對$思科 (CSCO.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

Evercore分析師Amit Daryanani維持買入評級,並將目標價從60美元上調至65美元。

Evercore分析師Amit Daryanani維持買入評級,並將目標價從60美元上調至65美元。

Evercore analyst Amit Daryanani maintains with a buy rating, and adjusts the target price from $60 to $65.

Evercore analyst Amit Daryanani maintains with a buy rating, and adjusts the target price from $60 to $65.