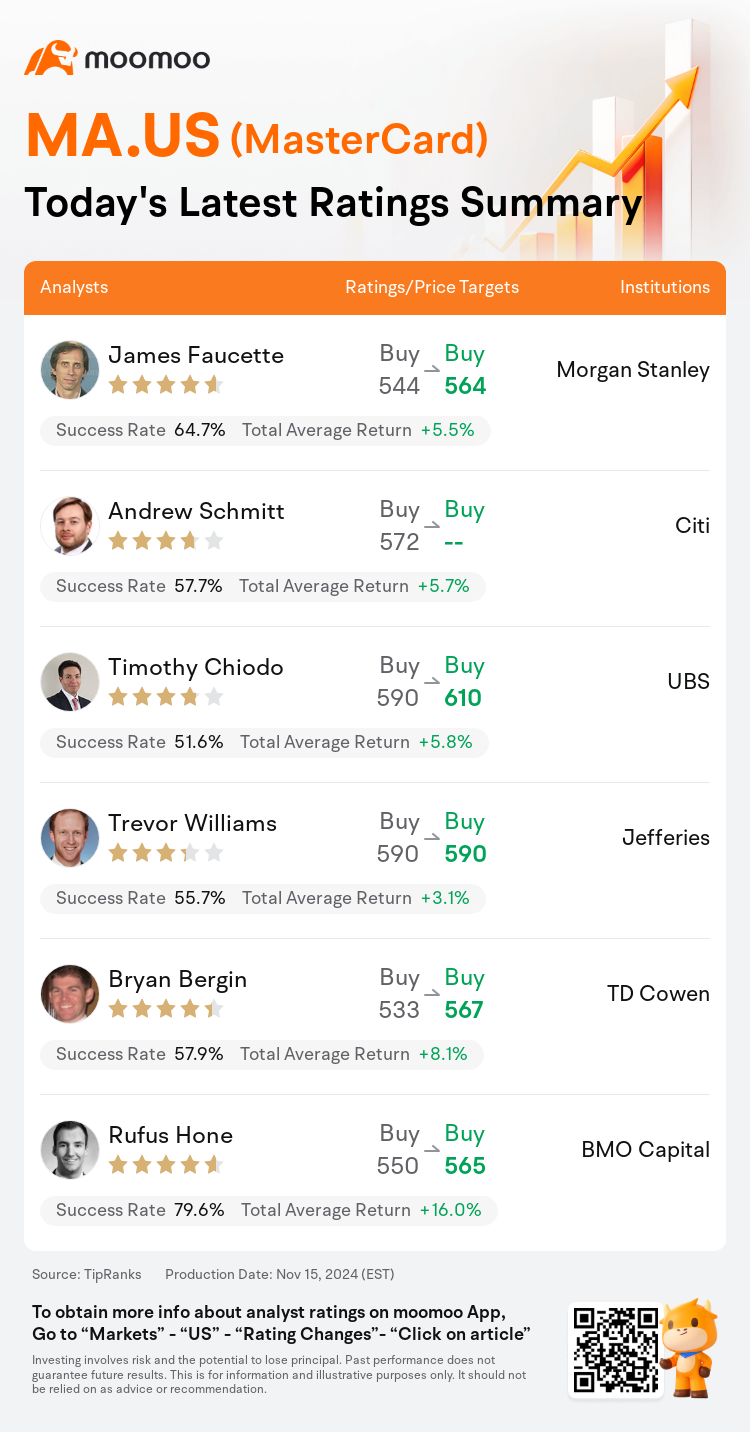

On Nov 15, major Wall Street analysts update their ratings for $MasterCard (MA.US)$, with price targets ranging from $564 to $610.

Morgan Stanley analyst James Faucette maintains with a buy rating, and adjusts the target price from $544 to $564.

Citi analyst Andrew Schmitt maintains with a buy rating.

UBS analyst Timothy Chiodo maintains with a buy rating, and adjusts the target price from $590 to $610.

UBS analyst Timothy Chiodo maintains with a buy rating, and adjusts the target price from $590 to $610.

Jefferies analyst Trevor Williams maintains with a buy rating, and maintains the target price at $590.

TD Cowen analyst Bryan Bergin maintains with a buy rating, and adjusts the target price from $533 to $567.

Furthermore, according to the comprehensive report, the opinions of $MasterCard (MA.US)$'s main analysts recently are as follows:

MasterCard's recent investor day has reaffirmed key aspects of the investment thesis, suggesting that the company's shares have the potential to grow in line with earnings and experience a slight increase in valuation multiples. The outlook provided by the company, which includes high-end low-double-digit revenue growth, an operating margin of at least 55%, and mid-teen adjusted EPS growth, aligns with current market predictions and fits investor anticipations.

The analyst indicated that MasterCard's investor day reinforced the company's appealing and sustainable growth outlook, with foundational elements supporting a consistent double-digit growth path into 2027.

The company has provided financial targets for 2025-2027 and has discussed with investors the potential for continued growth in consumer payments as well as the acceleration of a secular shift in commercial payments and new flows. Furthermore, the financial targets presented appear to be 'conservative' and seem to suggest a 2-3 point slowdown in payment network revenue growth by 2027.

The firm holds a perspective that MasterCard continues to have a robust secular growth runway ahead, which remains firm in spite of concerns from investors following a prolonged period of expansion. Additionally, the firm emphasizes the beneficial cycle between the company's payment and services operations.

Here are the latest investment ratings and price targets for $MasterCard (MA.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

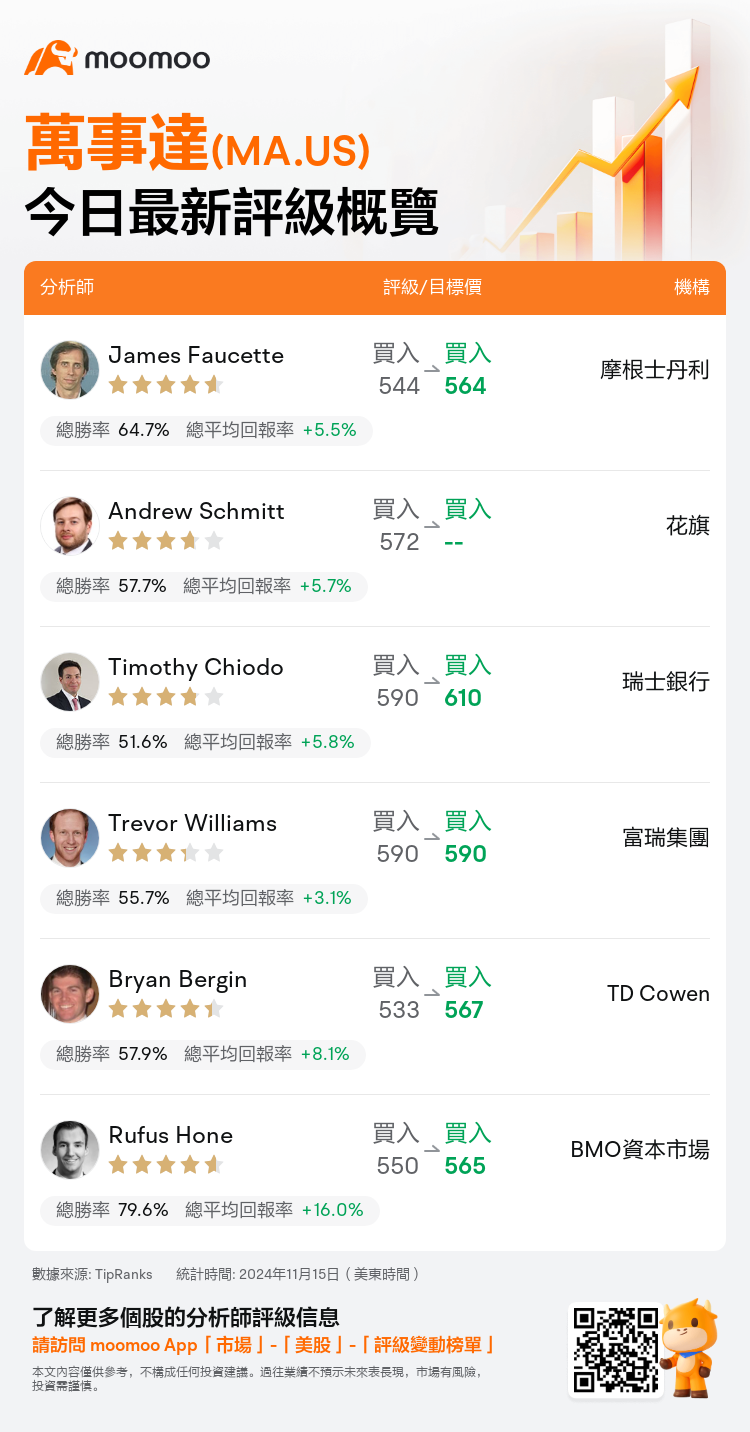

美東時間11月15日,多家華爾街大行更新了$萬事達 (MA.US)$的評級,目標價介於564美元至610美元。

摩根士丹利分析師James Faucette維持買入評級,並將目標價從544美元上調至564美元。

花旗分析師Andrew Schmitt維持買入評級。

瑞士銀行分析師Timothy Chiodo維持買入評級,並將目標價從590美元上調至610美元。

瑞士銀行分析師Timothy Chiodo維持買入評級,並將目標價從590美元上調至610美元。

富瑞集團分析師Trevor Williams維持買入評級,維持目標價590美元。

TD Cowen分析師Bryan Bergin維持買入評級,並將目標價從533美元上調至567美元。

此外,綜合報道,$萬事達 (MA.US)$近期主要分析師觀點如下:

萬事達最近的投資者日再次確認了投資論點的關鍵方面,表明公司股票有潛力隨盈利同步增長,並經歷輕微的估值倍數增加。公司提供的展望包括高端低兩位數營業收入增長,至少55%的營業利潤率,以及中青少年調整後每股收益增長,符合目前市場預測並符合投資者預期。

分析師指出,萬事達的投資者日強化了公司吸引人和可持續增長的展望,基礎元素支持着2027年進入一條持續的兩位數增長路徑。

公司已經爲2025年至2027年制定了財務目標,並與投資者討論了消費者支付持續增長以及商業支付和新流的長期轉變加速。此外,所提出的財務目標似乎「保守」,並似乎暗示到2027年支付網絡營收增長放緩2-3個點。

公司認爲,萬事達仍然具有強勁的長期增長前景,儘管投資者擔憂已經延續了很長一段擴張期。此外,公司強調了公司支付和服務業務之間的有益循環。

以下爲今日6位分析師對$萬事達 (MA.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

瑞士銀行分析師Timothy Chiodo維持買入評級,並將目標價從590美元上調至610美元。

瑞士銀行分析師Timothy Chiodo維持買入評級,並將目標價從590美元上調至610美元。

UBS analyst Timothy Chiodo maintains with a buy rating, and adjusts the target price from $590 to $610.

UBS analyst Timothy Chiodo maintains with a buy rating, and adjusts the target price from $590 to $610.