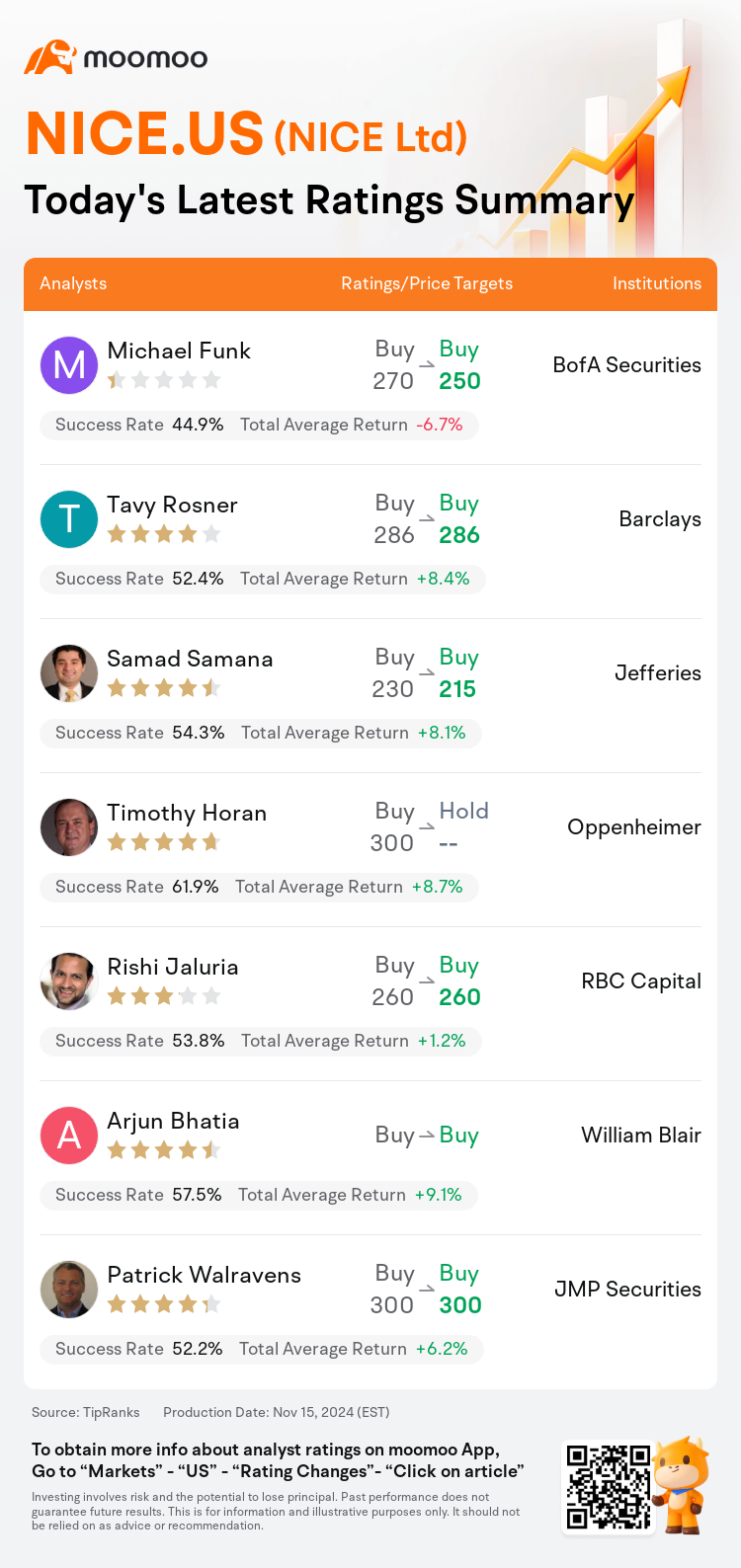

On Nov 15, major Wall Street analysts update their ratings for $NICE Ltd (NICE.US)$, with price targets ranging from $215 to $300.

BofA Securities analyst Michael Funk maintains with a buy rating, and adjusts the target price from $270 to $250.

Barclays analyst Tavy Rosner maintains with a buy rating, and maintains the target price at $286.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Oppenheimer analyst Timothy Horan downgrades to a hold rating.

RBC Capital analyst Rishi Jaluria maintains with a buy rating, and maintains the target price at $260.

Furthermore, according to the comprehensive report, the opinions of $NICE Ltd (NICE.US)$'s main analysts recently are as follows:

The company's third-quarter results slightly surpassed expectations on revenue but did not meet the anticipated growth in cloud revenue, which is a primary focus for investors. Moreover, the company's management has revised its forecast for organic cloud growth down to 16%-17% from the previous expectation of 18% for the year 2024. Despite these developments, the stock is still considered appealing due to its competitive stance, the expected uptick in Contact Center as a Service demand, and its current valuation.

Upon evaluating the Q3 results and anticipating a return to accelerated growth in Q4, it appears that there are more robust underlying business trends and pipeline narratives for Nice as compared to Zoom Video. The more positive outlook for Nice is based on research that has revealed a strong momentum in large-deal closures and an increase in competitive victories.

The company has experienced a slowdown in organic cloud growth, which has decelerated to 16% from 21% in the previous year. Despite strong bookings for new digital and artificial intelligence services, the implementation process has been lengthier than anticipated, as is common with most AI applications. The situation suggests there may be more opportune moments for entry and a potential future uptick in cloud growth.

Following the company's recent quarterly results, it was noted that total revenue and earnings per share surpassed consensus estimates, with the increase in revenue being attributed to product sales, despite Cloud revenue not meeting expectations. Analysts highlight that while management has a positive outlook on future momentum and anticipates an uptick in Cloud growth in the upcoming quarter, concerns linger due to another underwhelming performance in Cloud revenue, the absence of a long-term Cloud forecast, and a CEO transition, which collectively contribute to a period of uncertainty for the company.

Here are the latest investment ratings and price targets for $NICE Ltd (NICE.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

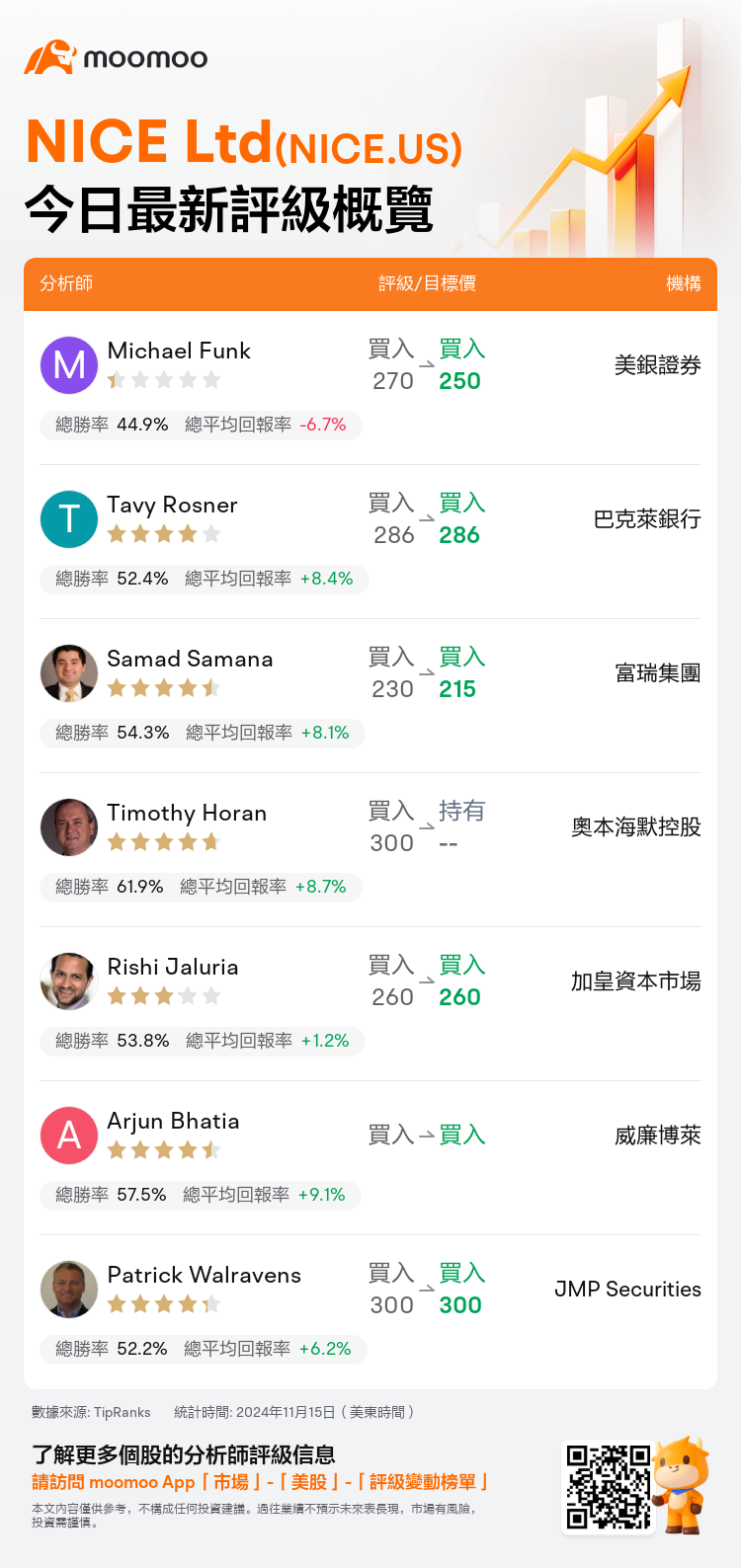

美東時間11月15日,多家華爾街大行更新了$NICE Ltd (NICE.US)$的評級,目標價介於215美元至300美元。

美銀證券分析師Michael Funk維持買入評級,並將目標價從270美元下調至250美元。

巴克萊銀行分析師Tavy Rosner維持買入評級,維持目標價286美元。

富瑞集團分析師Samad Samana維持買入評級,並將目標價從230美元下調至215美元。

富瑞集團分析師Samad Samana維持買入評級,並將目標價從230美元下調至215美元。

奧本海默控股分析師Timothy Horan下調至持有評級。

加皇資本市場分析師Rishi Jaluria維持買入評級,維持目標價260美元。

此外,綜合報道,$NICE Ltd (NICE.US)$近期主要分析師觀點如下:

公司第三季度的業務收入略高於預期,但未達到投資者期待的雲營業收入增長。此外,公司管理層已將有機雲增長預測從2024年的18%下調至16%-17%。儘管存在這些發展,該股仍然被認爲具有吸引力,因爲它在競爭中處於有利地位,預期市場對話中心即服務需求的上升以及其當前估值。

在評估第三季度的業績並預計第四季度的加速增長後,與Zoom Video相比,Nice的潛在商業趨勢和業務故事更爲強勁。Nice的更樂觀前景基於研究結果,揭示了大手交易的強勁勢頭以及競爭勝利的增加。

公司的有機雲增長放緩,從上一年的21%降至16%。儘管對新數字和人工智能服務的預訂強勁,但實施過程比預期更加耗時,這與大多數人工智能應用程序一樣。情況表明可能存在更多入場時機以及雲增長的潛在未來上升。

在公司最近的季度業績後,總營業收入和每股收益超出共識預期,收入增加歸因於產品銷售,儘管雲營業收入未達預期。分析師指出,儘管管理層對未來的勢頭持樂觀態度,並預期即將到來的季度雲增長,但由於雲營業收入再次表現低迷、缺乏長期雲預測以及CEO交接,這些共同導致公司處於一段不確定期。

以下爲今日7位分析師對$NICE Ltd (NICE.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

富瑞集團分析師Samad Samana維持買入評級,並將目標價從230美元下調至215美元。

富瑞集團分析師Samad Samana維持買入評級,並將目標價從230美元下調至215美元。

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.

Jefferies analyst Samad Samana maintains with a buy rating, and adjusts the target price from $230 to $215.