Markets Weekly Update (November 15): Powell says Fed in no 'hurry' to lower US interest rates

Markets Weekly Update (November 15): Powell says Fed in no 'hurry' to lower US interest rates

Macro Matters

宏觀事項

Powell Says Fed in No 'Hurry' to Lower US Interest Rates

鮑威爾表示聯儲局不急於降低美國利率

Federal Reserve Chair Jay Powell advocated for a gradual approach to lowering interest rates, emphasizing that the Federal Reserve is not in a rush due to the strong economy and the uneven path of inflation reduction. He praised the US economy's performance and noted significant progress in controlling inflation, though more effort is needed to reach the 2% target.

聯儲局主席傑伊·鮑威爾倡導逐步降低利率的方法,並強調聯儲局由於經濟強勁和通脹降低的不均衡路徑而不急迫。他讚揚了美國經濟的表現,並指出在控制通脹方面取得了重大進展,儘管需要更多努力才能達到2%的目標。

Powell's remarks led to a rise in the two-year Treasury yield and adjusted market expectations for a December rate cut. The Federal Reserve recently reduced its benchmark rate to a range of 4.25% to 4.75%, and officials are expected to proceed cautiously to balance inflation control with maintaining economic strength.

鮑威爾的講話導致兩年期國債收益率上升,調整了市場對12月減息的預期。聯儲局最近將其基準利率降至4.25%至4.75%的區間,預計官員們將謹慎前行,平衡通脹控制與維持經濟實力。

Despite recent increases in inflation metrics, Powell stated that the overall downward trend remains intact, but acknowledged potential bumps along the way. He indicated that the Fed might consider slowing the pace of rate cuts if data supports such a move, aligning with earlier remarks by Fed Governor Adriana Kugler.

儘管最近通脹指標有所增加,鮑威爾表示整體下行趨勢仍然保持,但承認道路可能會有一些坎坷。他表示,如果數據支持,聯儲局可能會考慮放緩減息的步伐,與聯儲局理事阿德里安娜·庫格勒早前的講話一致。

China Stimulus Boosts Domestic Consumption as Trump Tariffs Loom

隨着特朗普徵收關稅的威脅逼近,中國刺激政策推動國內消費

In the fourth quarter, China's economy showed more balance as consumption growth nearly matched factory output, driven by stimulus measures. Retail sales in October grew at the fastest rate in eight months, surpassing economists' forecasts, while industrial production remained strong, supporting the government's 2024 growth target. The rise in consumption is notable given the previous recovery imbalance, where household spending lagged behind production. This internal demand boost becomes crucial as Donald Trump, re-elected as US president, threatens a 60% tariff on most Chinese imports, posing a significant risk to China's export sector.

在第四季度,中國經濟呈現出更多平衡,消費增長几乎與工廠產出相匹配,受刺激措施推動。十月份零售銷售增長速度達八個月以來最快,超過了經濟學家的預測,而工業生產保持強勁,支持政府的2024年增長目標。消費的增長尤爲引人注目,鑑於此前的恢復不平衡,家庭支出落後於生產。在特朗普連任美國總統的情況下,中國的內部需求推動變得至關重要,因爲特朗普威脅對大部分中國進口商品徵收60%的關稅,這對中國的出口部門構成重大風險。

Smart Money Flow

智能資金流

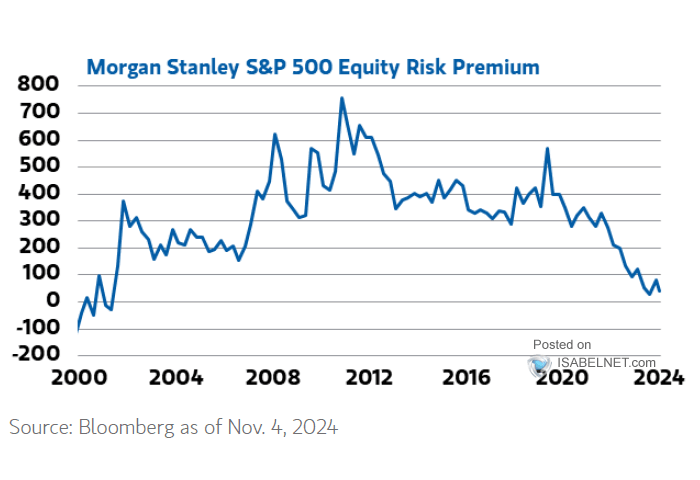

The current equity risk premium suggests that investors are not being adequately compensated for the risks associated with stocks. As a result, US Treasury bonds may appear more attractive than US equities.

當前的權益風險溢價表明投資者對股票所帶來的風險沒有得到充分補償。因此,美國國債可能比美國股票更具吸引力。

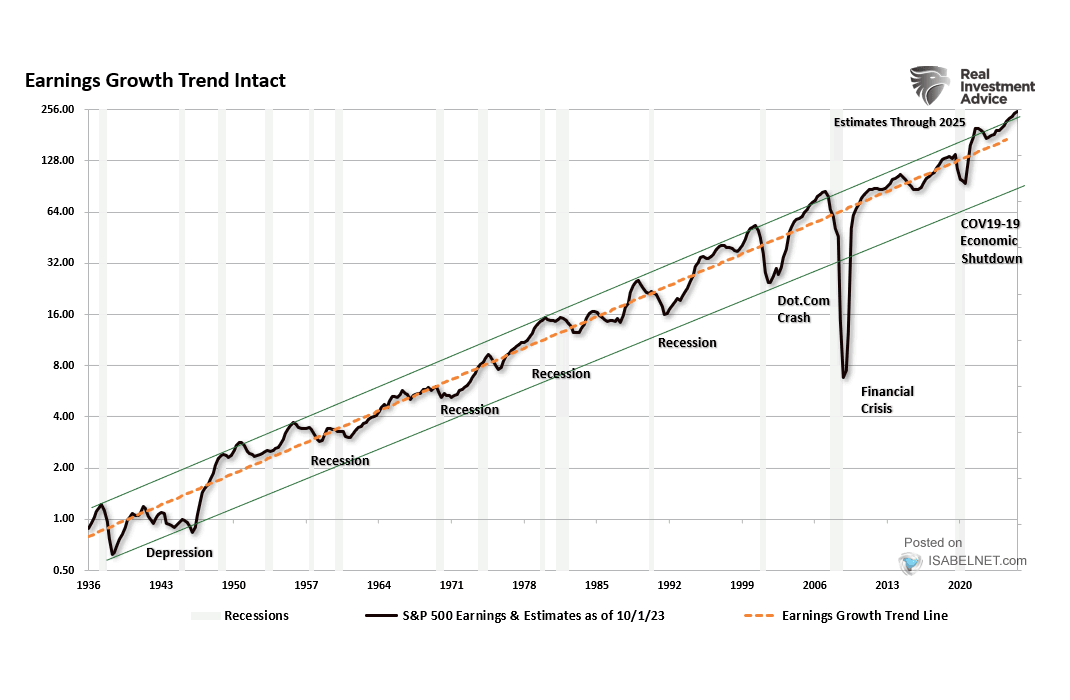

While strong earnings growth projections for 2025 provide a positive backdrop for potential market performance, investors should remain vigilant due to high valuations and market concentration.

儘管2025年強勁的盈利增長預期爲潛在市場表現提供了積極的背景,投資者應保持警惕,因爲高估值和市場集中度較高。

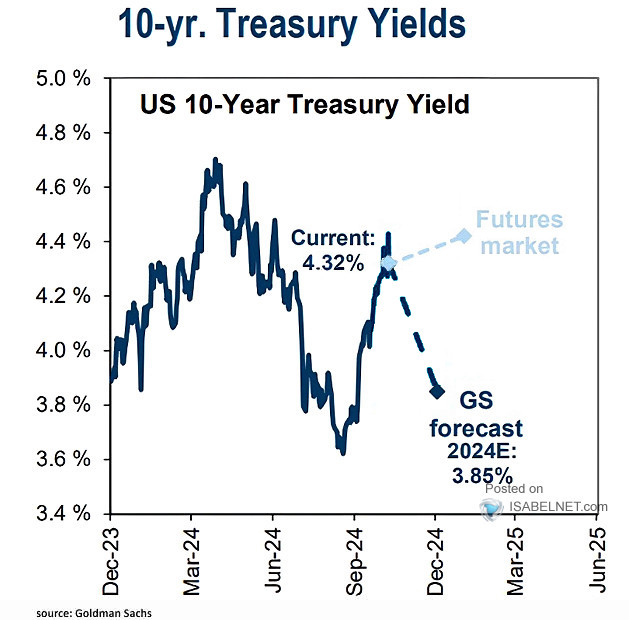

Goldman Sachs forecasts the 10-year U.S. Treasury yield to hit 3.85% by end-2024, diverging from current futures market expectations.

高盛預測,到2024年底,美國10年期國債收益率將達到3.85%,與當前期貨市場的預期背道而馳。

Bitcoin Rises Above $90,000 on Trump Euphoria

比特幣在特朗普的狂熱中上漲至$90,000以上

Bitcoin broke through the $90,000 level on Wednesday, to an all-time high in a rally showing no signs of easing on expectations that Donald Trump as U.S. president will be a boon for cryptocurrencies.

比特幣週三突破9萬美元關口,創下歷史新高,顯示出特朗普即將出任美國總統將成爲加密貨幣的助推力,這一行情沒有放緩的跡象。

Top Corporate News

頭條公司新聞

Alibaba Q2 Results Top Estimates

阿里巴巴第二季度業績超出預期

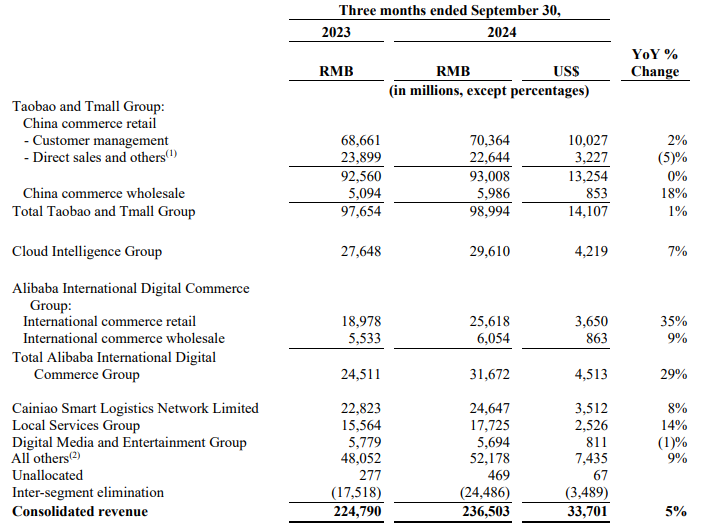

On November 15, Alibaba Group released its Q2 financial report for the fiscal year 2025, showing quarterly revenue of 236.503 billion yuan, a 5% year-on-year increase, in line with market expectations. By focusing on a "user-first, AI-driven" strategy, Alibaba's core business continues to achieve high-quality growth.

阿里巴巴(臨時代碼)在2025財年第二季度發佈業績,顯示季度營業收入2365.03億人民幣,同比增長5%,符合市場預期。通過專注於「以用戶爲先,以人工智能爲驅動」的戰略,阿里巴巴的核心業務繼續實現高質量增長。

Disney's Earnings Surge Amid Box Office and Streaming Successes

迪士尼的收入飆升,歸功於票房和流媒體的成功

Walt Disney's shares increased by over 6% following a 39% rise in earnings, attributed to the box office success of Marvel's "Deadpool & Wolverine" and Pixar's "Inside Out 2," along with strong profits from Disney+ and Hulu streaming services. These gains offset declines in Disney's traditional TV sector. The streaming segment, including ESPN+, achieved a total operating income of $321 million, reversing a prior loss. Disney anticipates a strong holiday box office with upcoming releases like "Moana 2" and "Mufasa: The Lion King." Despite challenges in its "experiences" division, including theme parks and cruise ships, Disney saw record revenues and plans to invest $60 billion in this area over the next decade. The company reported a fiscal fourth-quarter net income of $460 million, with adjusted earnings surpassing Wall Street expectations. CEO Bob Iger's cost-cutting and restructuring efforts have improved share performance, and Disney plans a $3 billion share repurchase in 2025.

沃爾特·迪士尼的股價上漲超過6%,收益增長39%,歸因於漫威的《死侍&金剛狼》和皮克斯的《頭腦特工組2》在票房上的成功,以及Disney+和Hulu流媒體服務的強勁利潤。這些收益抵消了迪士尼傳統電視部門的下降。包括ESPN+的流媒體板塊實現了總營業收入32100萬美元,扭轉了之前的虧損。迪士尼預計假期期間的票房將強勁,包括即將發佈的作品《海洋奇緣2》和《獅子王:激活》。儘管在「體驗」部門的挑戰中,包括主題公園和遊輪,迪士尼實現了創紀錄的營收,並計劃在未來十年投資600億美元在這一領域。公司報告了第四財季的淨利潤46000萬美元,調整後的收益超過了華爾街的預期。首席執行官鮑勃·艾格的削減成本和重組工作改善了股價表現,迪士尼計劃在2025年回購30億美元股份。

Alibaba Is Said to Consider Offering $5 Billion of Bonds

阿里巴巴被稱考慮發行50億美元債券

Alibaba Group Holding Ltd. is considering issuing bonds totaling approximately $5 billion as early as this month, according to people familiar with the matter. The potential bond offering could include both dollar and yuan-denominated portions. This comes after Alibaba's record private placement of $5 billion in convertible bonds in May. The last time Alibaba sold standard dollar notes in public markets was in 2021, with a $5 billion multi-part deal. It is not clear whether the current plan is for a private placement or a public offering.

阿里巴巴控股有限公司考慮本月早些時候發行總額約50億美元的債券,據知情人士透露。可能的債券發行將包括美元和人民幣部分。此前,阿里巴巴在5月份進行了創紀錄的50億美元可轉換債私募。阿里巴巴上一次在公開市場出售標準美元票據是在2021年,當時進行了一項50億美元的多部分交易。目前尚不清楚當前計劃是定向增發還是公開發行。

Currently, it is an opportune time for borrowers to access credit markets in Asia. Yield premiums on dollar securities in the region have recently fallen to all-time lows, following a series of monetary and fiscal stimulus measures by Chinese policymakers, which have increased the appeal of the region's debt.

目前,對亞洲信貸市場進行融資的時機非常適宜。中國政策制定者一系列貨幣和財政刺激措施導致該地區美元證券的收益溢價最近跌至歷史新低,增加了該地區債券的吸引力。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的金融信息和交易應用程序。在美國,Moomoo的投資產品和服務由Moomoo Financial Inc.提供,成爲FINRA/SIPC成員。

Despite recent increases in inflation metrics, Powell stated that the overall downward trend remains intact, but acknowledged potential bumps along the way. He indicated that the Fed might consider slowing the pace of rate cuts if data supports such a move, aligning with earlier remarks by Fed Governor Adriana Kugler.

Despite recent increases in inflation metrics, Powell stated that the overall downward trend remains intact, but acknowledged potential bumps along the way. He indicated that the Fed might consider slowing the pace of rate cuts if data supports such a move, aligning with earlier remarks by Fed Governor Adriana Kugler.