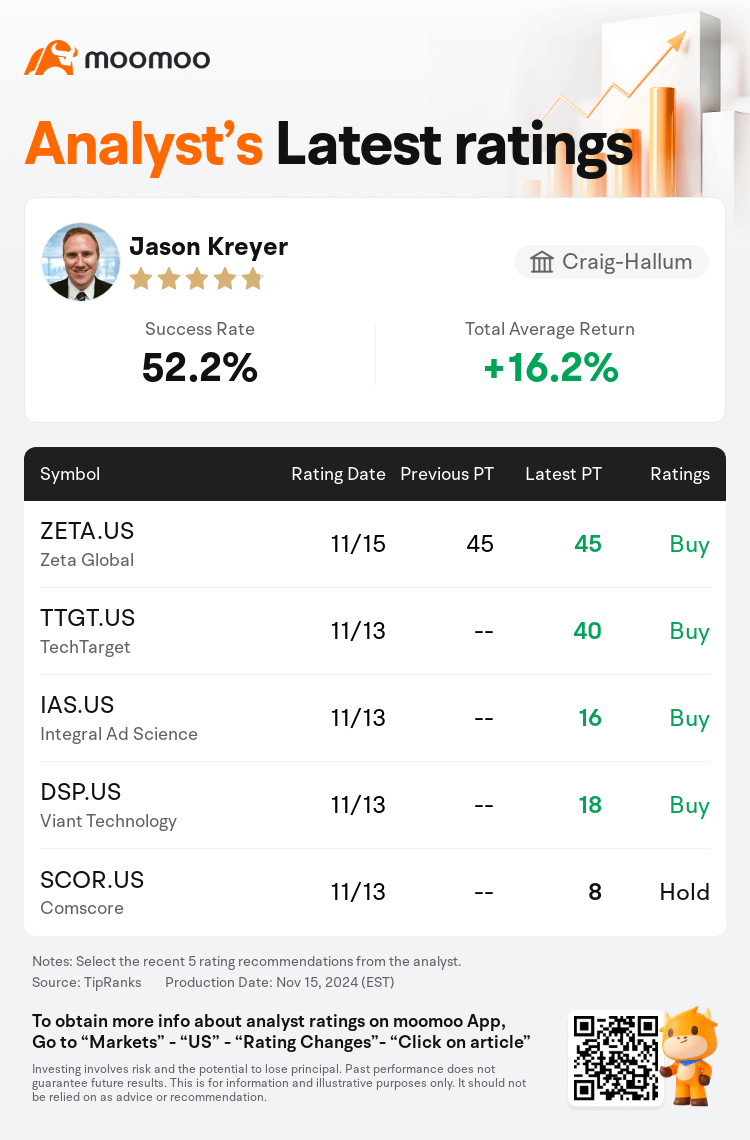

Craig-Hallum analyst Jason Kreyer maintains $Zeta Global (ZETA.US)$ with a buy rating, and maintains the target price at $45.

According to TipRanks data, the analyst has a success rate of 52.2% and a total average return of 16.2% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Zeta Global (ZETA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Zeta Global (ZETA.US)$'s main analysts recently are as follows:

Despite a short report challenging Zeta Global's data gathering and revenue creation methods, analysts continue to support the company's unique marketing and advertising proposition, which is expected to secure long-term market share. Nevertheless, the report has heightened the perceived risks related to execution and regulations surrounding its data practices, leading to a decrease in the revenue projections for 2025 and 2026 by approximately 10%.

The shares of Zeta Global experienced a significant drop following the release of a report from a short seller. There remain unanswered questions that prevent a more bullish stance, as it will require time for both the market and analysts to gain clarity on the issues brought to light. The spectrum of potential outcomes currently suggests a less attractive risk-adjusted return.

Following the Q3 report, the underlying revenue growth trends for Zeta Global were observed to be consistent with the previous quarter. The discussion regarding the company's revenue prospects for 2025 is largely focused on the potential for advocacy retention and the opportunity for agency expansion.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

Craig-Hallum分析師Jason Kreyer維持$Zeta Global (ZETA.US)$買入評級,維持目標價45美元。

根據TipRanks數據顯示,該分析師近一年總勝率為52.2%,總平均回報率為16.2%。

此外,綜合報道,$Zeta Global (ZETA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Zeta Global (ZETA.US)$近期主要分析師觀點如下:

儘管有一份簡短的報告對Zeta Global的數據收集和創收方法提出了質疑,但分析師繼續支持該公司獨特的營銷和廣告主張,預計這將確保長期的市場份額。儘管如此,該報告加劇了與數據實踐相關的執行和監管的感知風險,導致2025年和2026年的收入預測下降了約10%。

賣空者發佈報告後,Zeta Global的股價大幅下跌。仍有一些懸而未決的問題阻礙了更看漲的立場,因爲市場和分析師都需要時間才能弄清楚所暴露的問題。目前,一系列潛在結果表明,經風險調整後的回報不那麼有吸引力。

第三季度報告發布後,觀察到Zeta Global的基本收入增長趨勢與上一季度一致。關於公司2025年收入前景的討論主要集中在保留宣傳的可能性和機構擴張的機會上。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Zeta Global (ZETA.US)$近期主要分析師觀點如下:

此外,綜合報道,$Zeta Global (ZETA.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of