Should Shareholders Have Second Thoughts About A Pay Rise For Bortex Global Limited's (HKG:8118) CEO This Year?

Should Shareholders Have Second Thoughts About A Pay Rise For Bortex Global Limited's (HKG:8118) CEO This Year?

Key Insights

主要見解

- Bortex Global's Annual General Meeting to take place on 22nd of November

- CEO CL Shao's total compensation includes salary of HK$600.0k

- The overall pay is 80% below the industry average

- Bortex Global's three-year loss to shareholders was 71% while its EPS was down 109% over the past three years

- 濠亮環球將於11月22日舉行年度股東大會

- 首席執行官CL邵的總薪酬包括60萬港元的薪水

- 總薪酬低於行業平均水平80%。

- 濠亮環球股東的三年虧損爲71%,而其每股收益在過去三年中下降了109%

Performance at Bortex Global Limited (HKG:8118) has not been particularly rosy recently and shareholders will likely be holding CEO CL Shao and the board accountable for this. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 22nd of November. From our analysis below, we think CEO compensation looks appropriate for now.

濠亮環球有限公司(HKG:8118)的表現最近並不是特別好,並且股東很可能會追究CEO邵仲霖和董事會對此負責。股東們有機會影響管理層改變表現,可以通過在11月22日即將舉行的股東大會上投票決定行政薪酬等決議。從我們以下的分析來看,我們認爲CEO的薪酬目前看起來是合適的。

Comparing Bortex Global Limited's CEO Compensation With The Industry

將濠亮環球與行業板塊的CEO薪酬進行比較

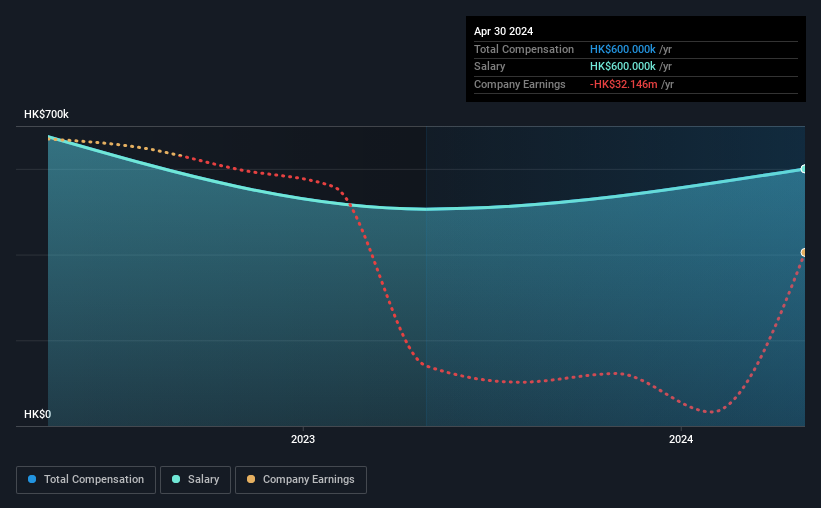

According to our data, Bortex Global Limited has a market capitalization of HK$31m, and paid its CEO total annual compensation worth HK$600k over the year to April 2024. Notably, that's an increase of 19% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth HK$600k.

根據我們的數據,濠亮環球有限公司的市值爲3100萬港元,並在2024年4月之前的一年中支付給其CEO的總年薪價值爲60萬港元。值得注意的是,這比前一年增長了19%。值得一提的是,CEO的薪酬完全由價值60萬港元的薪水組成。

For comparison, other companies in the Hong Kong Electrical industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$3.1m. Accordingly, Bortex Global pays its CEO under the industry median. Moreover, CL Shao also holds HK$444k worth of Bortex Global stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

以供參考,香港電氣行業中市值低於16億港元的其他公司報告的CEO總薪酬中位數爲310萬港元。因此,濠亮環球支付給其CEO的薪酬低於行業中位數。此外,邵仲霖還直接持有濠亮環球價值44.4萬港元的股票,這向我們透露出他對公司有着重要的個人投入。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$600k | HK$506k | 100% |

| Other | - | - | - |

| Total Compensation | HK$600k | HK$506k | 100% |

| 組成部分 | 2024 | 2023 | 比例(2024年) |

| 薪資 | 600,000港幣 | 506,000港幣 | 100% |

| 其他 | - | - | - |

| 總補償 | 60萬港幣 | 506,000港幣 | 100% |

Talking in terms of the industry, salary represented approximately 75% of total compensation out of all the companies we analyzed, while other remuneration made up 25% of the pie. Speaking on a company level, Bortex Global prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

就行業而言,薪水約佔我們分析的所有公司總補償的75%,而其他薪酬則佔25%。 而在公司層面上,濠亮環球更傾向於走傳統路線,通過薪水支付所有薪酬。 如果薪水佔據了總薪酬的主導地位,這意味着CEO的薪酬往往較少偏向於通常與績效掛鉤的變量部分。

Bortex Global Limited's Growth

濠亮環球有限公司的增長

Over the last three years, Bortex Global Limited has shrunk its earnings per share by 109% per year. In the last year, its revenue is down 53%.

過去三年來,濠亮環球有限公司每股收益年均減少了109%。在過去一年裏,其營業收入下降了53%。

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

很少股東會高興地看到每股收益下降了。而營業收入同比下降的事實可以說勾畫出了一幅醜陋的圖景。很難說公司全速前進,因此股東可能會對高薪的CEO薪酬感到厭惡。雖然我們沒有針對該公司的分析師預測,股東可能希望查看這份詳細的歷史收益、營業收入和現金流量圖。

Has Bortex Global Limited Been A Good Investment?

濠亮環球有限公司是一個好投資嗎?

With a total shareholder return of -71% over three years, Bortex Global Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

在過去三年中,濠亮環球有限公司的股東總回報率爲-71%,股東們大體上會感到失望。因此,股東們可能希望公司在CEO薪酬方面更加節制。

To Conclude...

總之...

Bortex Global pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

濠亮環球通過薪酬的形式支付CEO的報酬,完全忽視非薪酬性質的報酬。鑑於股東們沒有看到任何投資回報,更不用說缺乏盈利增長,這可能表明其中很少有股東願意給CEO加薪。在即將舉行的股東大會上,他們可以質疑管理層的計劃和策略是否能扭轉業績,並重新評估他們對該公司的投資觀點。

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 3 which are potentially serious) in Bortex Global we think you should know about.

CEO報酬是一個重要的領域,但我們也需要關注公司的其他屬性。我們進行了研究,在濠亮環球中發現了4個警示信號(其中3個可能很嚴重),我們認爲您應該了解。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

當然,你可能會通過觀察其他股票的不同漲跌幅來找到一筆不錯的投資。所以,可以看一下這個有趣的公司的免費列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Talking in terms of the industry, salary represented approximately 75% of total compensation out of all the companies we analyzed, while other remuneration made up 25% of the pie. Speaking on a company level, Bortex Global prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Talking in terms of the industry, salary represented approximately 75% of total compensation out of all the companies we analyzed, while other remuneration made up 25% of the pie. Speaking on a company level, Bortex Global prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.