Is EMCOR Group, Inc.'s (NYSE:EME) Recent Stock Performance Tethered To Its Strong Fundamentals?

Is EMCOR Group, Inc.'s (NYSE:EME) Recent Stock Performance Tethered To Its Strong Fundamentals?

EMCOR Group's (NYSE:EME) stock is up by a considerable 35% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to EMCOR Group's ROE today.

emcor group(NYSE:EME)的股票在過去三個月內大漲35%。鑑於公司出色的表現,我們決定更仔細地研究其財務指標,因爲公司的長期財務狀況通常決定了市場的走勢。具體來說,我們將密切關注EMCOR Group今天的roe。

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

股東權益回報率ROE是測試公司增值能力和管理股東投資的有效性的指標。更簡單地說,它衡量公司在股東權益中的盈利能力。

How To Calculate Return On Equity?

如何計算股東權益報酬率?

ROE can be calculated by using the formula:

roe可以通過以下公式計算:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(來自持續經營) ÷ 股東權益

So, based on the above formula, the ROE for EMCOR Group is:

因此,根據上述公式,EMCOR Group的roe爲:

34% = US$926m ÷ US$2.8b (Based on the trailing twelve months to September 2024).

34% = 92600萬美元 ÷ 28億美元(截至2024年9月的過去十二個月)。

The 'return' is the income the business earned over the last year. That means that for every $1 worth of shareholders' equity, the company generated $0.34 in profit.

「回報」是企業在過去一年中所獲得的收入。這意味着對於每1美元的股東權益,該公司產生了0.34美元的利潤。

Why Is ROE Important For Earnings Growth?

ROE爲什麼對淨利潤增長很重要?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

到目前爲止,我們已經了解了roe衡量公司利潤產生效率的程度。現在我們需要評估公司爲未來增長而重新投資或「保留」的利潤數量,然後了解公司的增長潛力。假設其他一切不變,roe和利潤保留率越高,公司的增長率就越高,而與不一定具備這些特徵的公司相比,這種增長率的相對性就越高。

EMCOR Group's Earnings Growth And 34% ROE

emcor group的淨利潤增長和34%的roe

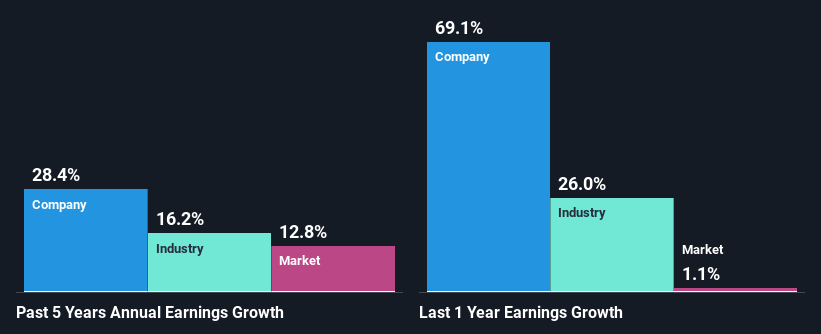

First thing first, we like that EMCOR Group has an impressive ROE. Secondly, even when compared to the industry average of 14% the company's ROE is quite impressive. So, the substantial 28% net income growth seen by EMCOR Group over the past five years isn't overly surprising.

首先,我們喜歡emcor group具有令人印象深刻的roe。其次,即使與行業平均14%的roe相比,該公司的roe也相當令人印象深刻。因此,過去五年emcor group實現的可觀28%淨利潤增長並不令人過度驚訝。

As a next step, we compared EMCOR Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 16%.

作爲下一步,我們將emcor group的淨利潤增長與行業進行了比較,令人高興的是,我們發現該公司的增長高於行業平均增長16%。

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. What is EME worth today? The intrinsic value infographic in our free research report helps visualize whether EME is currently mispriced by the market.

公司附加價值的基礎在很大程度上取決於其利潤增長。投資者應該嘗試確定預期的利潤增長或下降是否已經定價。這樣做將幫助他們確定股票的未來看起來是充滿希望還是不祥。EME今天價值多少?我們免費研究報告中的內在價值信息圖表有助於可視化EME目前是否被市場錯誤定價。

Is EMCOR Group Efficiently Re-investing Its Profits?

emcor group是否有效地再投資其利潤?

EMCOR Group's ' three-year median payout ratio is on the lower side at 6.7% implying that it is retaining a higher percentage (93%) of its profits. So it looks like EMCOR Group is reinvesting profits heavily to grow its business, which shows in its earnings growth.

EMCOR Group的三年中位數分紅比率較低,爲6.7%,暗示其留住了更高百分比(93%)的利潤。因此,看起來EMCOR Group在大量重新投資利潤以發展其業務,這反映在其利潤增長中。

Moreover, EMCOR Group is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 3.7% over the next three years. Regardless, the future ROE for EMCOR Group is predicted to decline to 26% despite the anticipated decrease in the payout ratio. We reckon that there could probably be other factors that could be driving the forseen decline in the company's ROE.

此外,從EMCOR Group至少連續十年支付股息的悠久歷史來看,該公司決心與股東分享利潤。我們最新的分析師數據顯示,公司未來的股息比率預計在未來三年將降至3.7%。儘管股息比率預計會下降,但EMCOR Group的未來ROE預計將下降至26%。我們認爲可能有其他因素推動了公司ROE的預期下降。

Conclusion

結論

On the whole, we feel that EMCOR Group's performance has been quite good. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

總的來說,我們認爲emcor group的表現相當不錯。特別地,我們喜歡公司在業務上大量再投資,並且回報率很高。毫不奇怪,這導致了令人印象深刻的盈利增長。話雖如此,最新的行業分析師預測顯示,公司的盈利增長預期將放緩。想要了解更多關於該公司未來盈利增長預測的信息,請查看這份關於該公司分析師預測的免費報告。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity