Institutional Investors in Conduent Incorporated (NASDAQ:CNDT) See US$59m Decrease in Market Cap Last Week, Although Long-term Gains Have Benefitted Them.

Institutional Investors in Conduent Incorporated (NASDAQ:CNDT) See US$59m Decrease in Market Cap Last Week, Although Long-term Gains Have Benefitted Them.

Key Insights

關鍵見解

- Significantly high institutional ownership implies Conduent's stock price is sensitive to their trading actions

- A total of 11 investors have a majority stake in the company with 52% ownership

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

- 高機構所有權意味着Conduent的股價對其交易行爲很敏感

- 共有11名投資者持有該公司的多數股權,所有權爲52%

- 公司過去的表現以及所有權數據可以使人們對企業前景有一個很好的了解

To get a sense of who is truly in control of Conduent Incorporated (NASDAQ:CNDT), it is important to understand the ownership structure of the business. The group holding the most number of shares in the company, around 73% to be precise, is institutions. Put another way, the group faces the maximum upside potential (or downside risk).

要了解誰真正控制了Conduent Incorporated(納斯達克股票代碼:CNDT),了解該業務的所有權結構非常重要。持有該公司股份最多的集團是機構,準確地說約爲73%。換句話說,該集團面臨最大的上行潛力(或下行風險)。

Institutional investors endured the highest losses after the company's market cap fell by US$59m last week. However, the 34% one-year returns may have helped alleviate their overall losses. They should, however, be mindful of further losses in the future.

上週該公司的市值下降了5900萬美元后,機構投資者遭受了最大的損失。但是,34%的一年期回報率可能有助於減輕他們的總體損失。但是,他們應該注意將來的進一步損失。

Let's take a closer look to see what the different types of shareholders can tell us about Conduent.

讓我們仔細看看不同類型的股東能告訴我們關於Conduent的什麼。

What Does The Institutional Ownership Tell Us About Conduent?

關於Conduent,機構所有權告訴我們什麼?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

機構投資者通常將自己的回報與常見指數的回報進行比較。因此,他們通常會考慮收購相關基準指數中包含的大型公司。

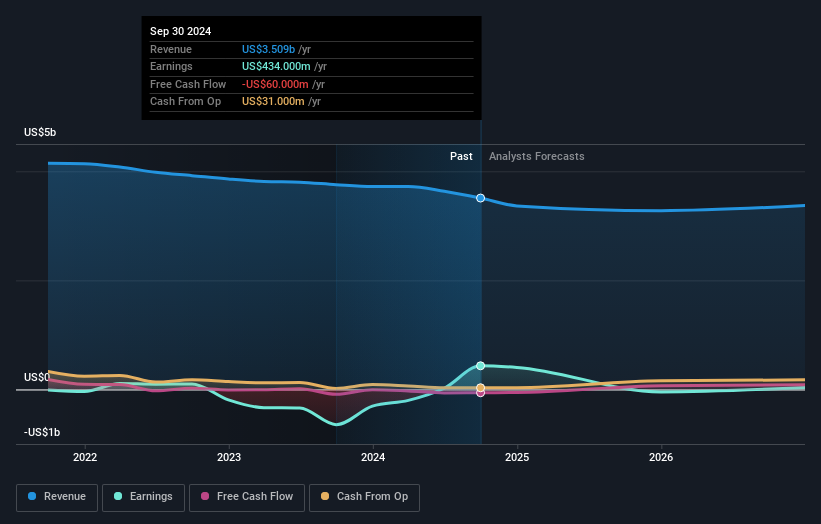

We can see that Conduent does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Conduent's earnings history below. Of course, the future is what really matters.

我們可以看到,Conduent確實有機構投資者;他們持有公司很大一部分股票。這可能表明該公司在投資界具有一定程度的信譽。但是,最好謹慎行事,不要依賴機構投資者所謂的驗證。他們也是,有時候會弄錯。如果多家機構同時改變對股票的看法,你可能會看到股價快速下跌。因此,值得在下面查看Conduent的收益記錄。當然,未來才是真正重要的。

Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. We note that hedge funds don't have a meaningful investment in Conduent. Our data shows that Neuberger Berman Investment Advisers LLC is the largest shareholder with 9.4% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 8.2% and 7.9%, of the shares outstanding, respectively. In addition, we found that Clifford Skelton, the CEO has 2.5% of the shares allocated to their name.

由於機構投資者擁有已發行股票的一半以上,董事會可能必須注意他們的偏好。我們注意到,對沖基金沒有對Conduent進行有意義的投資。我們的數據顯示,紐伯格·伯曼投資顧問有限責任公司是最大股東,已發行股份佔9.4%。同時,第二和第三大股東分別持有已發行股份的8.2%和7.9%。此外,我們發現首席執行官克利福德·斯凱爾頓以其名義分配了2.5%的股份。

Looking at the shareholder registry, we can see that 52% of the ownership is controlled by the top 11 shareholders, meaning that no single shareholder has a majority interest in the ownership.

查看股東登記處,我們可以看到52%的所有權由前11名股東控制,這意味着沒有一個股東在所有權中擁有多數權益。

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There is some analyst coverage of the stock, but it could still become more well known, with time.

研究機構所有權是衡量和篩選股票預期表現的好方法。通過研究分析師的情緒也可以達到同樣的目的。有一些分析師對這隻股票的報道,但隨着時間的推移,它仍可能變得更加廣爲人知。

Insider Ownership Of Conduent

Conduent 的內部所有權

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

儘管內部人士的確切定義可能是主觀的,但幾乎每個人都認爲董事會成員是內部人士。公司管理層對董事會負責,後者應代表股東的利益。值得注意的是,有時高層管理人員自己也是董事會成員。

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

當內部所有權表明領導層像公司的真正所有者一樣思考時,內部所有權是積極的。但是,高度的內部所有權也可以賦予公司內部的一小部分人巨大的權力。在某些情況下,這可能是負面的。

Shareholders would probably be interested to learn that insiders own shares in Conduent Incorporated. As individuals, the insiders collectively own US$53m worth of the US$627m company. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

股東們可能會有興趣得知內部人士擁有Conduent Incorporated的股份。作爲個人,內部人士共同擁有這家價值6.27億美元的公司價值5300萬美元。這至少顯示出一定的對齊性。你可以點擊這裏查看這些內部人士是否在買入或賣出。

General Public Ownership

一般公有制

The general public, who are usually individual investors, hold a 19% stake in Conduent. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

公衆通常是個人投資者,持有Conduent19%的股份。儘管這種所有權規模可能不足以影響對他們有利的政策決定,但它們仍然可以對公司政策產生集體影響。

Next Steps:

後續步驟:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that Conduent is showing 2 warning signs in our investment analysis , you should know about...

儘管值得考慮擁有公司的不同群體,但還有其他因素更爲重要。請注意,Conduent在我們的投資分析中顯示了兩個警告信號,您應該知道...

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

如果你像我一樣,你可能需要考慮這家公司是會成長還是會萎縮。幸運的是,您可以查看這份免費報告,其中顯示了分析師對其未來的預測。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注意:本文中的數字是使用過去十二個月的數據計算得出的,這些數據是指截至財務報表日期當月最後一天的12個月期間。這可能與全年年度報告數據不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎?直接聯繫我們。或者,發送電子郵件給編輯組(網址爲)simplywallst.com。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.