Looking At Palo Alto Networks's Recent Unusual Options Activity

Looking At Palo Alto Networks's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Palo Alto Networks.

Looking at options history for Palo Alto Networks (NASDAQ:PANW) we detected 53 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 12 are puts, for a total amount of $838,975 and 41, calls, for a total amount of $3,243,541.

From the overall spotted trades, 12 are puts, for a total amount of $838,975 and 41, calls, for a total amount of $3,243,541.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $250.0 and $480.0 for Palo Alto Networks, spanning the last three months.

Analyzing Volume & Open Interest

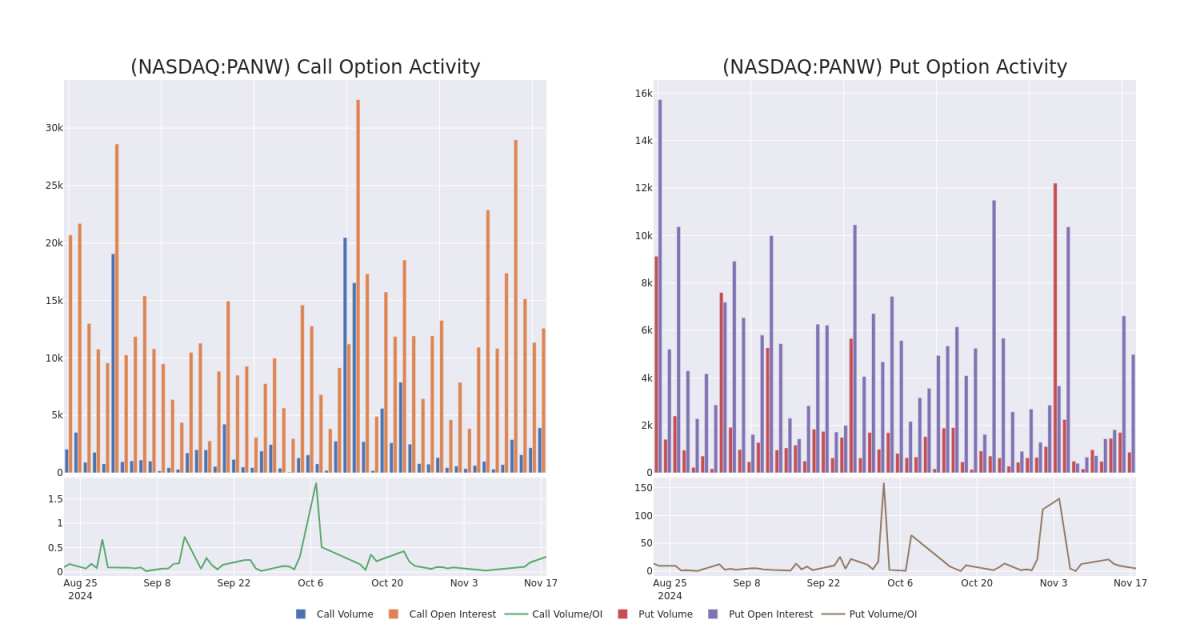

In today's trading context, the average open interest for options of Palo Alto Networks stands at 501.97, with a total volume reaching 4,697.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palo Alto Networks, situated within the strike price corridor from $250.0 to $480.0, throughout the last 30 days.

Palo Alto Networks 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | SWEEP | BEARISH | 01/16/26 | $49.5 | $48.8 | $48.8 | $450.00 | $468.4K | 353 | 96 |

| PANW | CALL | SWEEP | BEARISH | 11/22/24 | $11.9 | $11.65 | $11.65 | $400.00 | $307.5K | 530 | 331 |

| PANW | CALL | TRADE | BEARISH | 11/22/24 | $11.8 | $11.6 | $11.6 | $400.00 | $242.4K | 530 | 692 |

| PANW | PUT | SWEEP | BEARISH | 11/22/24 | $16.1 | $15.45 | $15.7 | $390.00 | $230.8K | 280 | 317 |

| PANW | CALL | SWEEP | BEARISH | 12/20/24 | $18.95 | $18.95 | $18.95 | $392.50 | $161.0K | 0 | 185 |

About Palo Alto Networks

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 80,000 enterprise customers across the world, including more than three fourths of the Global 2000.

After a thorough review of the options trading surrounding Palo Alto Networks, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Palo Alto Networks

- With a volume of 1,180,545, the price of PANW is down -0.14% at $386.46.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 2 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.