Suzhou Sunmun Technology Co., Ltd.'s (SZSE:300522) Stock Price Dropped 13% Last Week; Retail Investors Would Not Be Happy

Suzhou Sunmun Technology Co., Ltd.'s (SZSE:300522) Stock Price Dropped 13% Last Week; Retail Investors Would Not Be Happy

Key Insights

主要見解

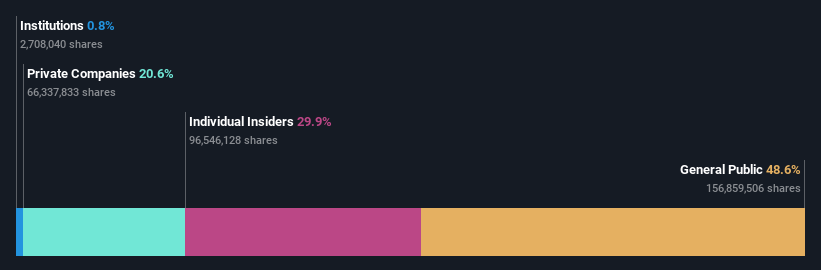

- The considerable ownership by retail investors in Suzhou Sunmun Technology indicates that they collectively have a greater say in management and business strategy

- A total of 9 investors have a majority stake in the company with 50% ownership

- Insiders own 30% of Suzhou Sunmun Technology

- 零售投資者在世名科技中擁有的相當大比例股權表明,他們共同對管理和業務策略有更大的發言權

- 總共有9個投資者持有該公司50%的股權。

- 內部人士擁有世名科技30%的股份

If you want to know who really controls Suzhou Sunmun Technology Co., Ltd. (SZSE:300522), then you'll have to look at the makeup of its share registry. We can see that retail investors own the lion's share in the company with 49% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

如果您想知道誰真正控制着世名科技股份有限公司(SZSE:300522),那麼您將不得不查看其股東名冊的構成。我們可以看到,零售投資者在公司中擁有最大比例的股權,達到49%。也就是說,如果股票上漲(或者如果市場出現下行),該團體將獲益最多(或者損失最多)。

While insiders who own 30% came under pressure after market cap dropped to CN¥3.8b last week,retail investors took the most losses.

上週市值下降至38億元人民幣後,持有30%股份的內部人士遭受壓力,零售投資者蒙受最大損失。

In the chart below, we zoom in on the different ownership groups of Suzhou Sunmun Technology.

在下面的圖表中,我們將重點關注蘇州世名科技不同的所有權群體。

What Does The Lack Of Institutional Ownership Tell Us About Suzhou Sunmun Technology?

機構持股缺失對蘇州世名科技意味着什麼?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

通常,不活躍的小公司缺少機構投資者,但大公司缺少機構投資者則不太常見。

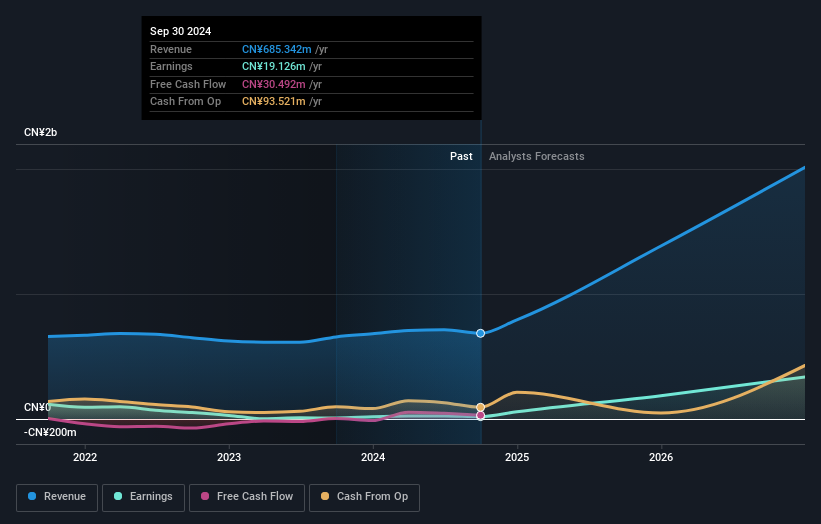

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. Alternatively, there might be something about the company that has kept institutional investors away. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Suzhou Sunmun Technology, for yourself, below.

機構不持有某股票有多種解釋。最常見的原因是公司相對於管理的基金規模太小,因此機構無需過多關注該公司。另外,可能是公司的某些特點讓機構投資者望而卻步。機構投資者可能並不認爲公司過去的業務增長令人印象深刻,或者可能有其他因素在起作用。您可以在下方看到蘇州世名科技過去的營業收入表現。

We note that hedge funds don't have a meaningful investment in Suzhou Sunmun Technology. Looking at our data, we can see that the largest shareholder is the CEO Shi Ming Lu with 23% of shares outstanding. In comparison, the second and third largest shareholders hold about 17% and 2.8% of the stock.

我們注意到對於世名科技,對沖基金並沒有意義上的投資。從我們的數據中可以看出,最大的股東是CEO陸仕明,持有23%的股份。相比之下,第二和第三大股東持有大約17%和2.8%的股票。

On further inspection, we found that more than half the company's shares are owned by the top 9 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

進一步調查發現,超過一半的公司股份由前9大股東持有,這表明較大股東的利益在一定程度上被小股東平衡了。

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

雖然研究公司的機構持股可以增加您的研究價值,但研究分析師的建議以加深對股票預期表現的全面了解也是一個好習慣。雖然有部分分析師的覆蓋,但該公司可能沒有受到廣泛的關注。因此,在未來可能會受到更多關注。

Insider Ownership Of Suzhou Sunmun Technology

世名科技的內部持股情況

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

內部人員的定義在不同國家之間可能略有不同,但董事會成員始終計數。公司管理層回答董事會,在此應代表股東利益。值得注意的是,有時高級管理人員也在董事會上。

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

當內部人持股情況表明領導層思考和公司真正所有者一樣時,內部所有權是積極的。然而,高達內部人士所有權也可能爲公司內的小團體帶來巨大的權力。在某些情況下,這可能是負面的。

It seems insiders own a significant proportion of Suzhou Sunmun Technology Co., Ltd.. Insiders own CN¥1.1b worth of shares in the CN¥3.8b company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

看起來內部人擁有蘇州世名科技有限公司的大部分股份。內部人在這家38億元人民幣公司中擁有價值11億元人民幣的股份。這可能表明創始人仍然擁有很多股份。您可以點擊這裏查看他們是否一直在買入或賣出。

General Public Ownership

一般大衆所有權

The general public, who are usually individual investors, hold a 49% stake in Suzhou Sunmun Technology. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

一般公衆,通常是個人投資者,在蘇州世名科技持有49%的股份。儘管這一所有權規模相當可觀,但如果決定與其他大股東不同步,可能不足以改變公司政策。

Private Company Ownership

私有公司的所有權

It seems that Private Companies own 21%, of the Suzhou Sunmun Technology stock. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

世名科技股票的21%由私人公司持有。單憑這一事實很難得出任何結論,因此值得查明誰擁有這些私人公司。有時內部人員或其他相關方通過獨立的私人公司持有公共公司的股份。

Next Steps:

下一步:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

雖然考慮所有擁有一家公司的群體很重要,但還有其他更重要的因素。

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

我喜歡深入了解一家公司過去的表現。您可以免費訪問該互動圖表,了解其過去的盈利、營業收入和現金流。

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

最終,未來最重要。您可以在這份關於該公司分析師預測的免費報告中獲取有關信息。

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

注:本文中的數據是使用最後一個財務報表日期結束的爲期12個月的數據計算的。這可能與全年年度報告數據不一致。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.